Introduction

The cryptocurrency market offers a new frontier of financial opportunity, but its notorious volatility can be daunting for investors. Navigating this landscape successfully requires more than just luck; it demands a well-defined strategy tailored to your goals, risk tolerance, and time commitment. Whether you’re a long-term believer in blockchain technology or interested in more active approaches, understanding the core methodologies is the first step.

This guide breaks down five of the most popular cryptocurrency investment strategies, explaining their concepts, steps, and inherent risks to help you make more informed decisions in your investing journey.

1. HODLing (Buy and Hold)

Concept: HODLing is a long-term, passive investment strategy where you buy a cryptocurrency and hold onto it for an extended period, ignoring short-term market fluctuations. The core belief is that quality assets will appreciate significantly over time.

Steps (General):

- Research: Identify cryptocurrencies with strong fundamentals, robust technology, and a clear, valuable use case.

- Purchase: Buy your chosen asset on a reputable cryptocurrency exchange like Kraken or Coinbase.

- Secure Storage: Withdraw your coins from the exchange to a secure private wallet like a Ledger (hardware) or a trusted software wallet.

- Monitor (Occasionally): Keep an eye on major project developments and news, but avoid making impulsive decisions based on daily price swings.

Risk Management:

- Diversification: Avoid concentrating all your capital into a single cryptocurrency.

- Invest What You Can Afford to Lose: Only use disposable income that you can afford to lose entirely.

- Long-Term Mindset: Be psychologically prepared for significant price drops (drawdowns) without panicking.

2. Day Trading

Concept: Day trading involves buying and selling cryptocurrencies within the same day to profit from small, short-term price movements. It is a highly active strategy that requires constant market monitoring and quick execution.

Steps (General):

- Technical Analysis: Use advanced charting tools and indicators on platforms like TradingView to identify potential entry and exit points.

- Market Monitoring: Stay glued to live market news, order books, and social media sentiment.

- Execute Trades: Place rapid buy and sell orders on exchanges with advanced trading features like Binance or Kraken Pro.

- Profit Taking/Stop Loss: Set strict pre-defined targets for taking profits and stop-loss orders to automatically limit losses.

Risk Management:

- Strict Risk Rules: Use stop-loss orders on every single trade without exception.

- Small Position Sizes: Never over-leverage or risk a large portion of your capital on one trade.

- Emotional Control: Avoid impulsive decisions driven by fear (FUD) or greed (FOMO).

- High Learning Curve: Acknowledge that this requires significant knowledge, practice, and time.

3. Swing Trading

Concept: Swing trading aims to capture gains over a period of days or weeks by capitalizing on predictable “swings” or price momentum within a trend. It sits between day trading and HODLing in terms of time commitment.

Steps (General):

- Trend Identification: Find assets that are in a clear upward or downward trend and look for temporary pullbacks using tools like TradingView.

- Technical Analysis: Use indicators to confirm the strength of a trend and spot potential reversal points.

- Entry and Exit: Enter a trade when a counter-trend swing is likely ending and exit once the main trend resumes and your target is neared.

- Patience: Hold positions for several days or weeks to realise gains.

Risk Management:

- Clear Plan: Define your profit targets and stop-loss levels before entering any trade.

- Position Sizing: Allocate capital wisely to each trade to manage overall portfolio risk.

- Market Awareness: Be aware that overnight or weekend news events can significantly impact your open positions.

4. Staking and Yield Farming

Concept: These are “passive income” strategies. Staking involves locking up cryptocurrencies to help secure a Proof-of-Stake (PoS) blockchain network in return for rewards. Yield farming involves lending your crypto or providing it as liquidity to Decentralized Finance (DeFi) protocols to earn interest or fees.

Steps (General):

- For Staking:

- Research promising PoS coins (e.g., Ethereum, Cardano, Solana).

- Choose a staking method: directly via a wallet, through your exchange (Coinbase offers easy staking), or via a staking pool.

- Commit (lock) your assets to the network.

- For Yield Farming:

- Research reputable DeFi protocols on networks like Ethereum or Binance Smart Chain.

- Provide liquidity by depositing pairs of tokens into a liquidity pool.

- Earn rewards in the form of trading fees and/or the protocol’s native token.

Risk Management:

- Smart Contract Risk: The code powering DeFi protocols can have vulnerabilities leading to hacks.

- Impermanent Loss: A unique risk to liquidity providers where the value of deposited assets changes unfavourably compared to simply holding them.

- Platform Risk: The exchange or platform you use for staking could be hacked or become insolvent.

- Regulatory Uncertainty: The regulatory environment for DeFi and staking is still evolving, especially in the UK.

5. Dollar-Cost Averaging (DCA)

Concept: DCA is a risk-management strategy where you invest a fixed amount of money at regular intervals (e.g., £50 every week), regardless of the asset’s current price. This averages out your purchase cost over time and removes the emotion and difficulty of trying to “time the market.”

Steps (General):

- Choose an Asset: Select a cryptocurrency you believe in for the long term.

- Set a Budget: Decide on a fixed, affordable amount to invest regularly.

- Schedule Purchases: Set up a recurring buy schedule on an exchange like Coinbase or Binance.

- Automate: Use exchange features to automate your purchases and build your holdings consistently.

Risk Management:

- Long-Term Focus: DCA is designed for a multi-year horizon, smoothing over volatility.

- Consistency: The key is to stick to the plan religiously, especially during market downturns when prices are low.

- Affordability: Only invest an amount you can sustain over the long term.

Useful Tools for UK Crypto Investors

(For illustrative purposes – not financial advice)

- UK-Friendly Exchanges: Kraken, Coinbase, Binance (ensure you use the UK-compliant platform), eToro.

- Hardware Wallets (Cold Storage): Ledger Nano S/X, Trezor Model T/One.

- Charting & Analysis: TradingView.

Conclusion

Choosing the right cryptocurrency strategy is a personal decision that hinges on your investment goals, risk appetite, and available time. A long-term believer might find a combination of HODLing and DCA most effective, while a more active, experienced individual might explore swing trading. Those seeking passive income can research staking, but must be acutely aware of the associated smart contract risks.

No single strategy is foolproof, and the volatile nature of crypto means risk is ever-present. The most successful investors are those who educate themselves, manage their risks meticulously, and never invest more than they are willing to lose.

Important Disclaimer: Cryptocurrency investments are highly volatile and speculative. You could lose all or a substantial portion of your investment. The information provided here is for general educational purposes only and does not constitute financial advice. Always conduct your own thorough research (DYOR) and consider seeking advice from a qualified financial advisor before making any investment decisions. Regulations and available services can change, so always verify current information.

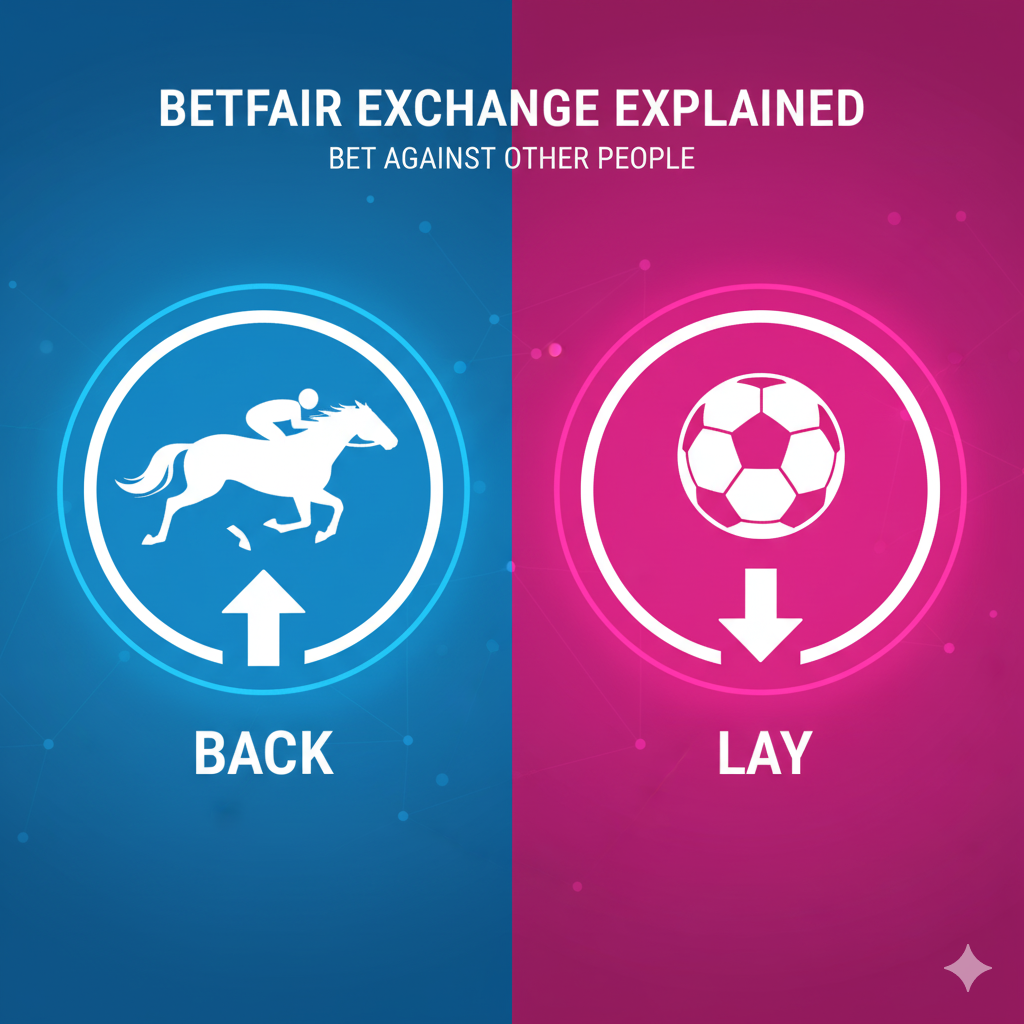

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Betfair Trading Strategies: The Ultimate 2026 Guide to Football Betting Automation

Executive Summary: The Era of the Algorithmic Trader The year 2026 marks a turning point for the Betfair Exchange. The…

Dutching Betting Strategy Guide (2026): Includes Free Excel Calculator & Automation Tools

We’ve all been there. You stare at the race card, torn between the 3/1 favourite who looks solid and the…

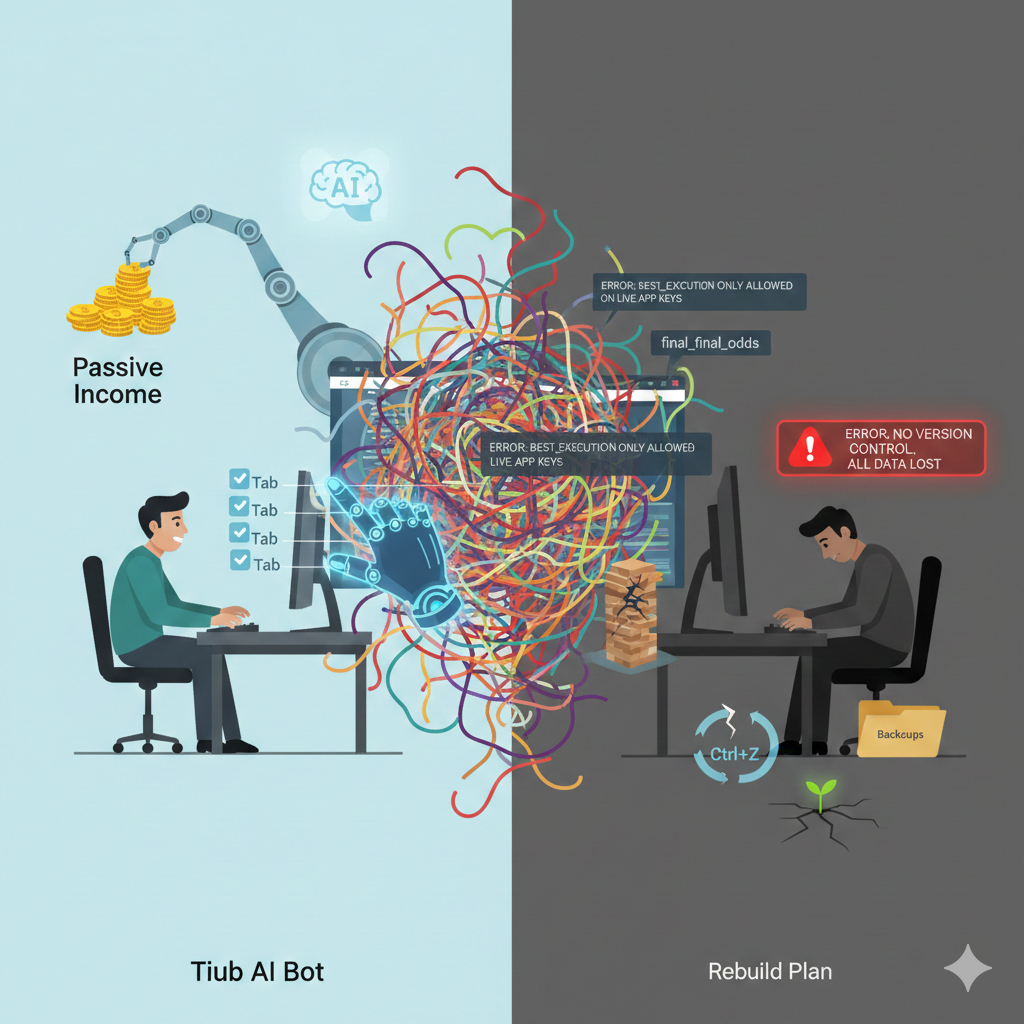

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

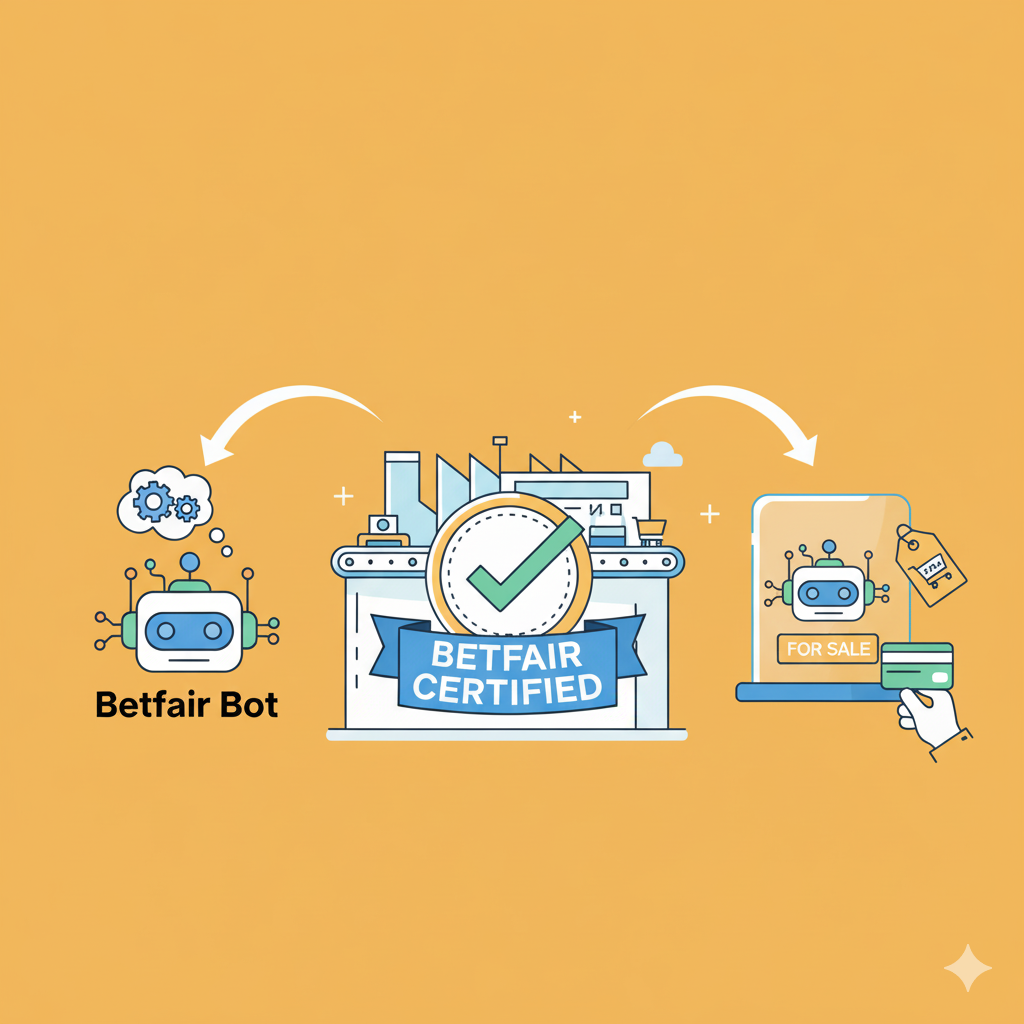

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of…

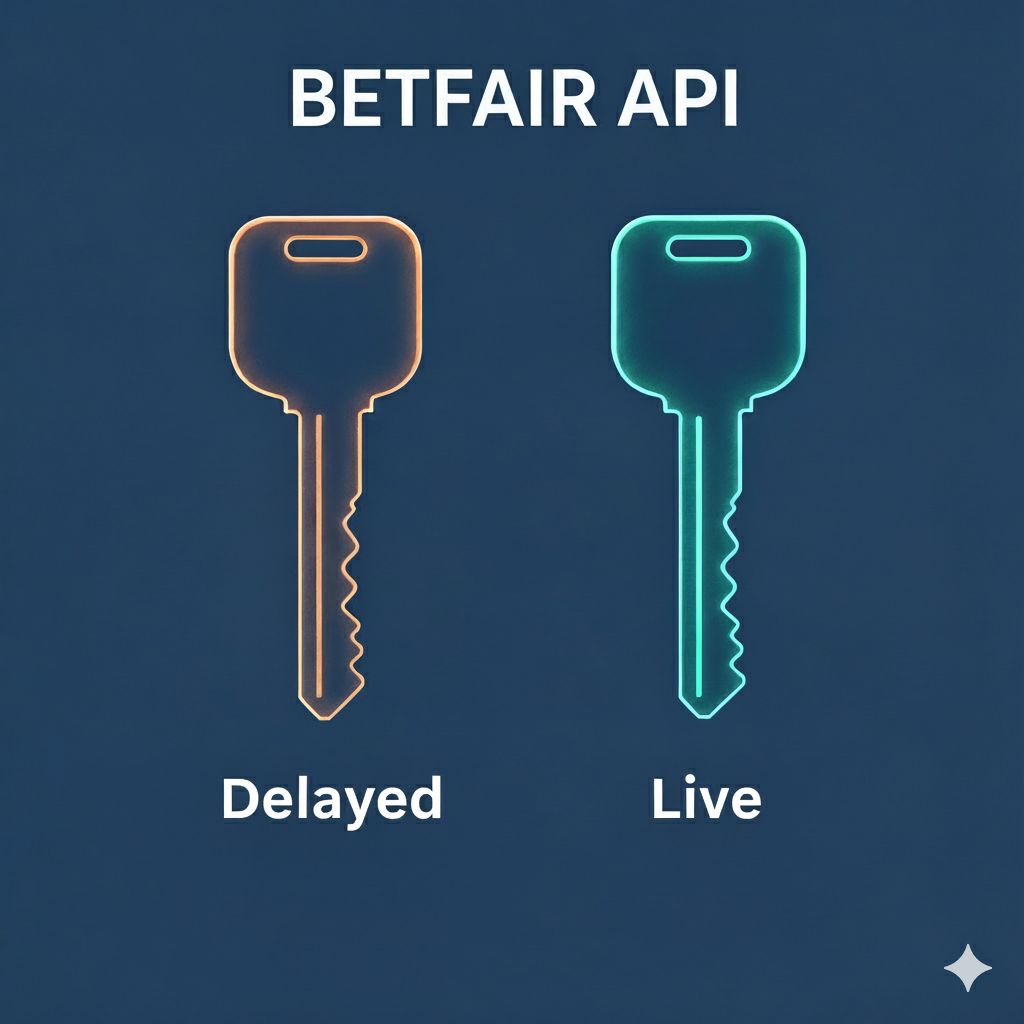

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge…