If you’re looking for the best Betfair trading software in 2026, you’ve probably heard about the new Traderline. This isn’t just an update—it’s a massive, ground-up rebuild designed specifically for the modern cross-platform trading environment. For years, the legacy, desktop-focused version was a foundational tool for serious Betfair traders, but the new development team has retired it in favor of this faster, smarter app. This comprehensive Traderline Review will guide you through all the major changes.

This Traderline Review cuts through the confusion to tell you what the new platform is, what it isn’t, and why this major shift is ultimately a massive step forward for the modern sports trader.

The Verdict: A Necessary Revolution

The new Traderline sacrifices some of the old version’s deep, desktop-bound complexity in favor of blazing speed and true cross-platform functionality. This change is necessary and future-proof. It delivers a seamless experience across all devices and lays a powerful foundation for next-generation trading tools, including planned AI integration.

If you value mobility and a clean, responsive interface, the new Traderline is a must-try.

1. True Cross-Platform Trading: Desktop Power, Mobile Freedom

This is the biggest story here, and it’s a game-changer for anyone who doesn’t want to be chained to a multi-monitor setup.

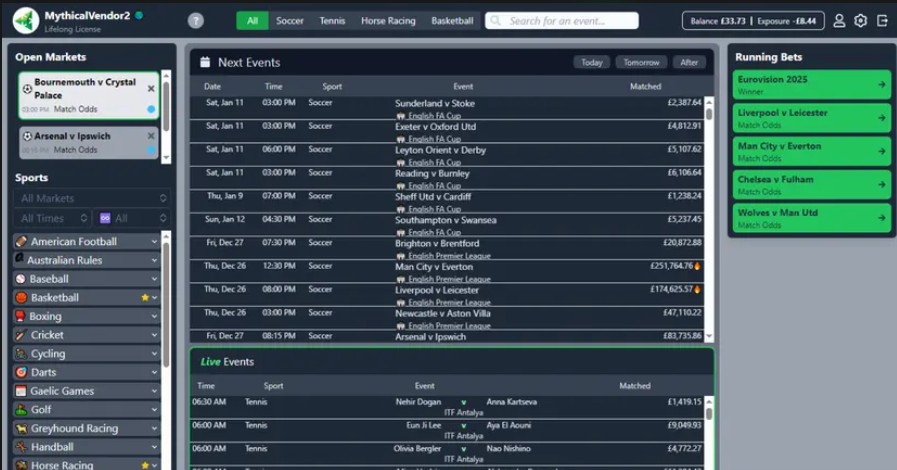

The previous versions felt very much like legacy desktop software. The new Traderline is a unified app accessible on Windows, macOS, iOS, and Android—all under a single license. This means whether you’re scalping pre-race markets on your desktop or monitoring an in-play football match on your tablet, the experience is designed to be consistent. While mobile trading always involves screen real estate limitations, Traderline has managed to keep the crucial Ladder View highly functional and responsive on smaller devices. The entire UI feels snappy, fast, and remarkably less prone to the lags that plagued the previous desktop application. This stability is a major focus point of our Traderline Review, proving the architecture is robust.

2. Core Features: Speed, Stability, and the Ladder

When a platform is rebuilt, users often fear losing their favorite power features. While some of the niche, older automations might be gone (or yet to be rebuilt), the new team has prioritized making the core experience as fast and stable as possible.

The core tools that define modern Betfair trading are all present and improved:

- Modern UI: The interface is clean, intuitive, and highly functional. It feels like a contemporary application, which is a welcome change from the clunky aesthetics of many legacy trading programs. The desktop interface is minimalist and feels focused.

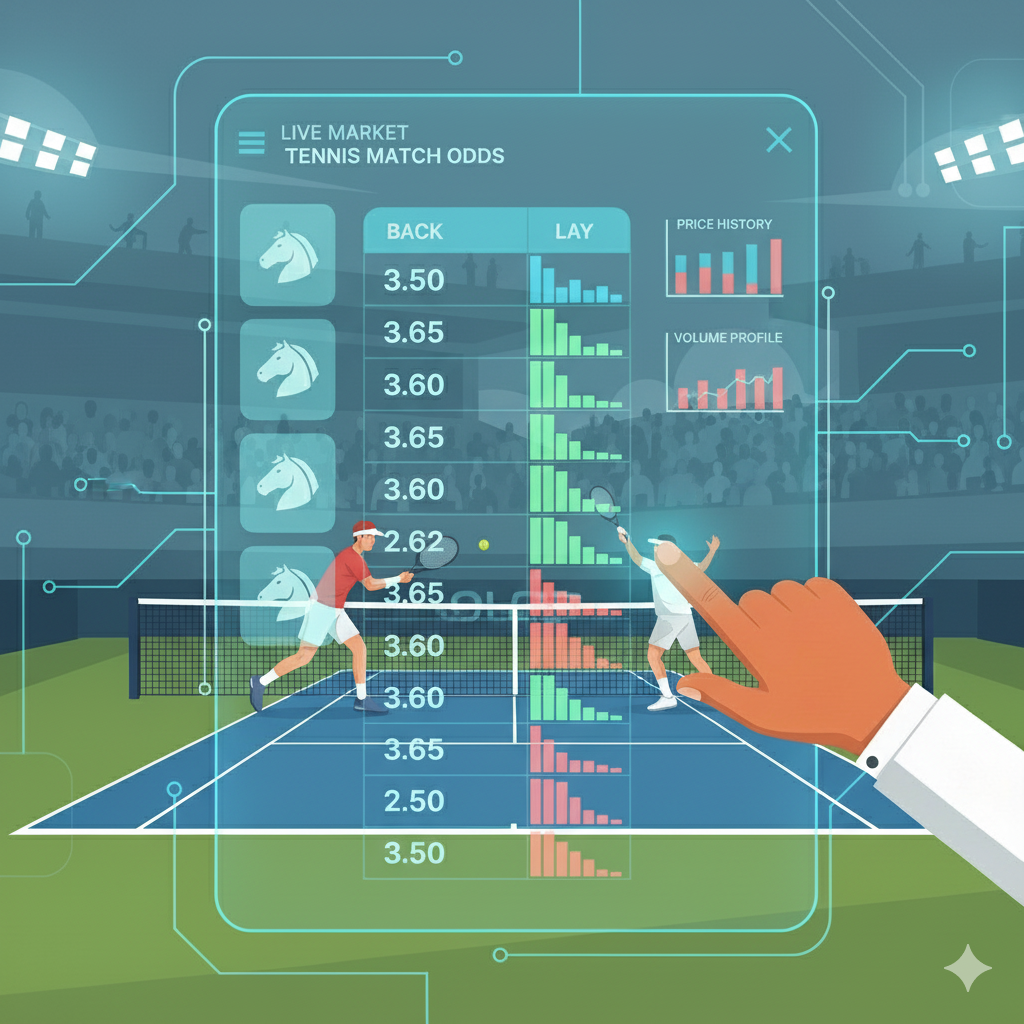

- Enhanced Ladder Trading: The ability to execute trades with a single click remains paramount. The new platform boasts improvements to real-time data visualization and “pressure graphs” to help visualize market liquidity and momentum. For scalpers, the tick-speed feels noticeably quicker than its predecessor.

- Stop Loss & Hedging: Critical risk management tools like Stop Loss and efficient hedging/cashout functionalities have been streamlined, ensuring you can manage your exposure quickly, which is non-negotiable for short-term trading.

- Support for Key Markets: While it supports all Betfair markets, the interface is clearly optimized for fast-paced events. It excels in Horse Racing, Greyhound Racing, and main Football markets where rapid order execution is essential.

- Compliance Ready: The application remains fully Betfair-certified, offering peace of mind regarding security. Furthermore, the new version is built to meet evolving global compliance standards, future-proofing your ability to trade.

- Crucial for Beginners: Training Mode: Like many professional tools, Traderline offers a Training Mode (often used during the free trial) which allows users to practice strategies using live market data without risking any real funds.

3. Pricing and the Lifetime License Policy (Critical Information)

The pricing structure for the new Traderline is straightforward, but the policy for existing lifetime license holders is crucial to understand due to the platform’s complete migration:

How much does Traderline cost compared to competitors?

| Plan | Price (One-Time) | Equivalent Monthly Cost (Annual) | Notes |

|---|---|---|---|

| Monthly | N/A | €5 / month (~£4.25) | Simple subscription for full access. |

| Lifelong | €99 (~£85) | N/A | New one-time purchase option for permanent access. |

Legacy Lifetime License Holders: The Migration Rule

This is the most important part for existing users. The developers have established a clear policy for those who purchased a “lifetime” license for the old, discontinued platform:

- Purchased in 2024: Users who bought a lifetime license in the year 2024 will receive lifetime access to the new Traderline.

- Purchased in 2023 or Before: Users who bought a lifetime license in 2023 or earlier will be granted a 1-year subscription to the new platform.

- Action Required: All legacy lifetime users must contact support with proof of purchase before a specified deadline (e.g., June 1, 2025) to claim their new license.

4. The Competitive Edge: Traderline vs. Geeks Toy and BF Bot Manager

When choosing a Betfair trading tool, the decision usually comes down to core feature sets, automation capabilities, and cost. The new Traderline clearly defines its Unique Selling Proposition (USP) by focusing on mobility and next-gen technology.

| Feature | Traderline (New) | Geeks Toy | BF Bot Manager |

|---|---|---|---|

| Cross-Platform Access (USP) | Unified Windows, macOS, iOS, Android | Primarily Windows-based | Windows Only (Automation Focus) |

| Automation Focus | Basic & Future AI Focus | Limited (Multi-Bet Tools) | Advanced Scripting & Bot Creation |

| Interface | Modern, Clean, Mobile-Optimized | Customizable, Fast, Lightweight | Feature-Dense, Automation UI |

| Equivalent Monthly Cost | €5/month (~£4.25) | £5 / month | £29.95 / month |

Traderline is the clear winner for traders requiring full mobile/Mac flexibility and those excited about the upcoming AI-driven market insights. For the lowest cost, Geeks Toy remains unbeatable, while BF Bot Manager is the preferred choice if your strategy requires complex, hands-off bot automation. This comprehensive Traderline Review gives you the data to make an informed choice.

You can also read our complete review of Geeks Toy and Bf Bot Manager in our Betfair bots section.

5. Future-Proofing Betfair Trading: A Look at the Upcoming Features

What truly sets the new Traderline apart from its competitors is the ambitious development roadmap focused on AI and predictive analytics. This is where the modern architecture really shines, and it’s why serious traders should be actively monitoring these developments:

- AI Integration: Future updates promise AI algorithms that analyze market trends to provide actionable data and personalized recommendations based on your trading style.

- Predictive Statistics: The platform aims to integrate highly enhanced live scores and predictive statistics to help you anticipate market movements, moving beyond just raw odds display.

- Dynamic Visualization: Look forward to revolutionary market views utilizing dynamic heatmaps and trend lines, making complex market sentiment easier to interpret at a glance.

This focus on the future suggests Traderline is trying to leapfrog its competition by leveraging modern data science, rather than just copying existing features.

6. Who is the New Traderline Best For?

Based on its feature set, price point, and unique advantages, the new Traderline is perfectly suited for three distinct groups of Betfair users: This segment of our Traderline Review explains who benefits most from the new platform.

A. The Mobile/Mac Trader

This is Traderline’s strongest unique selling point. If you use a macOS device, an iPad, or execute trades while away from your primary desktop, Traderline offers the most polished and fully-featured experience for mobile trading compared to its competitors, which are often strictly Windows-based or require virtualization.

B. The Newer, Manual Trader

While it’s feature-rich, the modern, clean interface is less overwhelming than the dense, customizable layouts of platforms like BF Bot Manager or even the Geeks Toy Grid. It provides the essential, fast tools (Ladder, Stop Loss) without immediately forcing the complexity of full-scale automation, making it an excellent bridge for those serious about trading but new to third-party software.

C. The Forward-Thinking Trader

If you believe that AI and predictive models will soon become an essential “edge” in sports trading, Traderline’s roadmap makes it the platform to commit to. Its architecture is built to support these complex data-driven features, appealing to those who want to integrate next-generation analytical power into their workflow.

7. Pros and Cons Summary

In summary, this Traderline Review provides a quick overview of the main advantages and potential drawbacks of the new platform:

| Pros | Cons |

|---|---|

| True Cross-Platform Access (PC, Mac, iOS, Android) | Limited Automation (Currently basic; AI integration is still future) |

| Modern, Clean UI (Less intimidating for new users) | Migration Hassle (For pre-2024 lifetime license holders) |

| Clear Roadmap (AI, Predictive Analytics) | Price is now extremely competitive with Geeks Toyricing (Similar to BF Bot Manager) |

| Training Mode for risk-free practice |

8. UK Tax Implications for Betfair Trading Profits

Disclaimer: This information is for general guidance only and does not constitute financial or tax advice. Always consult a qualified tax professional regarding your personal circumstances.

For UK residents, the profits earned from sports trading on the Betfair Exchange are generally tax-free. This is because, under current HMRC (His Majesty’s Revenue and Customs) guidance, spread betting and gambling activities are not classified as a trade.

Here are the key points to understand:

- No Income Tax or Capital Gains Tax (CGT): For the vast majority of traders, all profits made from betting and trading on the exchange are exempt from both Income Tax and CGT. This is because the UK places the tax burden on the gambling operators, not the individual punter.

- The “Professional” Distinction: HMRC’s position is that even professional, highly systematic gambling is typically not considered a “trade.” The fact that a trader uses sophisticated software (like Traderline) and earns a consistent income does not automatically make the winnings taxable.

- Losses are Not Offsettable: The flip side of tax-free profits is that you cannot offset any trading losses against other taxable income or capital gains.

- Keep Records: Despite the tax-free status, if you are trading consistently and generating large sums, it is highly advisable to keep clear records. This helps you demonstrate the source of your funds to HMRC if they ever inquire about your income or asset accumulation.

Final Thoughts: The New Era of Trading

The result of the major platform shift is clear: the new Traderline is a more robust, faster, and far more modern piece of software. While the management of legacy lifetime licenses was a necessary hurdle, the unified cross-platform experience is a major step forward.

The new application addresses the two biggest demands of today’s trader: mobility and speed. By prioritizing a unified cross-platform experience and laying the groundwork for AI-powered features, Traderline has positioned itself as a serious contender for the future of sports trading technology. Specifically, it is the best solution on the market for Mac users and traders who prioritize flexibility.

Ready to try the new speed advantage? If you’re looking for the flexibility to trade between your desktop and mobile devices, the 15-day free trial is highly recommended to experience the difference firsthand. Be sure to watch for in-app and official blog announcements as those revolutionary AI and predictive features go live! Share your thoughts and feedback on the new UI in the comments below!

Disclaimer: This review is based on information available regarding the new Traderline platform release. Pricing is based on best-value annual subscriptions and is approximate.

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

Backtesting Guides

Backtesting Guide — Principles & MarketBook Replay | BotBlog Backtesting guides Published: 2025-11-11 • BotBlog Backtesting Guide — Principles &…

Lesson 7 — Risk management & deployment

Skip to content Lesson 7 — Risk management, hedging & deployment Final crypto lesson: implement hedging/green‑up, enforce risk limits and…

Lesson 6 — Backtesting & simulation (Jupyter)

Skip to content Lesson 6 — Backtesting & simulation (Jupyter) Simulate strategies in Jupyter: load historical ticks/candles, replay data, simulate…

Lesson 5 — Webhooks & Pine alerts

Skip to content Lesson 5 — Webhooks & Pine alerts Build a secure webhook receiver for TradingView Pine alerts, validate…