The crypto world is fast-paced and often overwhelming; staying ahead and executing timely trades can feel like a full-time job. Many traders find the solution in embracing innovation: automated trading bots. These tireless digital assistants work around the clock, executing strategies, managing risk, and spotting opportunities while you focus on… anything else!

Today, we’re diving deep into the ultimate Bitsgap review, comparing its specialized features with competitors like Coinrule and 3Commas to determine which platform offers the best value. This comprehensive Bitsgap review will help you decide if this multi-exchange automation tool is the one you need for 2026.

Bitsgap at a Glance (User Satisfaction Score)

| Metric | Rating | Source |

| Capterra Rating | 4.7 / 5 | Public User Reviews |

| Trustpilot Rating | 4.5 / 5 | Public User Reviews |

| Best For | Multi-Exchange Management & Arbitrage Trading | Expert Consensus |

Export to Sheets

1. The Core Offerings: A Critical Bitsgap Review with Expert Opinion

Bitsgap‘s core appeal rests on three pillars: automation, arbitrage, and multi-exchange aggregation. It functions as an all-in-one terminal where you easily connect over 15 major exchanges (Binance, Kraken, Coinbase, etc.), manage your portfolio, and deploy powerful bots.

- Quote on Automation: The core benefit of tools like Bitsgap is their tireless nature. As experts at Cryptohopper note: “Crypto bots enable automated trading for any beginner… a crypto bot ensures a certain degree of success in trades.” They operate 24/7, eliminating human error and emotional bias.

| Feature | Bitsgap (Focus: All-in-One & Arbitrage) | Coinrule (Focus: IFTTT Logic) | Pionex (Focus: Free Exchange Bots) |

| Primary Automation | Specialized Bots (GRID, DCA, Futures) | Customizable “IFTTT” Rules/Recipes | 16+ Free Built-in Bots (GRID, DCA) |

| Multi-Exchange | YES (15+ Exchanges) – Centralized Hub | Yes (10+ Exchanges) | NO (Exchange built-in, likely restricted in UK) |

| Arbitrage Scanner | YES (Advanced/Pro tiers) | No | Limited/No Cross-Exchange Arbitrage |

| Pricing Model | Subscription (∼$23−$119/mo) | Subscription or Free Tier | FREE (Exchange-based fee only) |

Export to Sheets

2. In-Depth Feature Comparison: Bitsgap’s Edge

Bitsgap differentiates itself through advanced features that combine the best aspects of specialized trading.

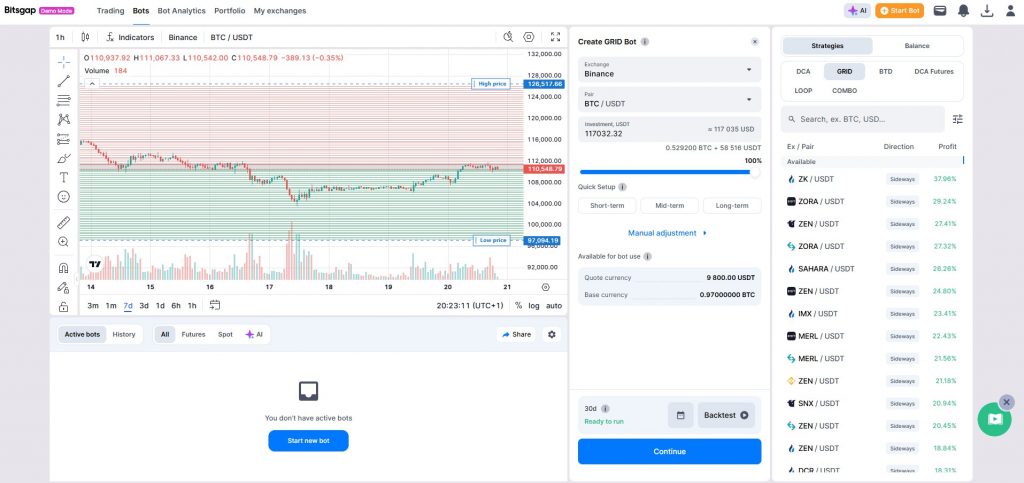

A. Bitsgap’s Flagship Bots & Strategy Example

- The GRID Bot + Trailing Up: This is the flagship bot, perfect for sideways or moderately trending markets. The bot sets a “grid” of buy and sell orders to profit from small price fluctuations.

- Advanced Example (GRID + Trailing Up): For a pair like BTC/USDT, you set an initial range ($25,000–$35,000). The bot executes orders within this grid. Furthermore, by enabling the Trailing Up feature (Advanced tier and above), the bot automatically shifts the entire trading range upwards as the price rises. This essential feature allows the bot to keep capturing gains beyond its initial price ceiling, addressing a major limitation of basic grid trading.

- The Arbitrage Advantage: Bitsgap’s scanner identifies price spreads across your multiple connected exchanges. While tempting, arbitrage trades have slim margins and are susceptible to fees and execution speed risk, meaning they often require large capital to be consistently profitable.

Quote on Ease of Use: HedgeWithCrypto specifically notes that Bitsgap’s interface is “intuitive, and virtually anyone can navigate the platform without hassles,” making the learning curve shallow despite the powerful features.

B. The Competition Context

- Vs. Pionex: Pionex offers free bots because it is the exchange itself. Conversely, Bitsgap’s paid model allows you to use your preferred, fully regulated exchange (like Coinbase or Kraken) and consolidate their activity into one sophisticated terminal. Crucially, Pionex is generally not available to UK residents or faces significant restriction barriers, making Bitsgap’s multi-exchange connectivity a safer alternative for British traders.

3. Bitsgap Pricing Tiers: Unlocking Key Features

Your choice of Bitsgap plan directly determines which key automation features you can access. Pricing is based on the annual subscription rate.

| Plan | Price (Approx. Annual/Month) | Active Bots (GRID / DCA) | Key Feature Unlocks |

| Basic | ∼$23/month | 3 GRID / 10 DCA | Unlimited Smart Orders, Portfolio Tracking |

| Advanced | ∼$55/month | 10 GRID / 50 DCA | Futures Bots, Arbitrage Scanner, Trailing Up/Down |

| Pro | ∼$119/month | 50 GRID / 250 DCA | AI Portfolio Mode, Max Backtesting (365 days) |

Export to Sheets

Comparison Insight: The Advanced plan offers the most comprehensive features, as it unlocks Arbitrage, Futures Bots, and Trailing features for the GRID Bot.

4. Pros and Cons of Bitsgap (Quick Look)

| 👍 Pros | 👎 Cons |

| Unified Multi-Exchange Terminal (Connects 15+ Exchanges) | Monthly Subscription Fee (Higher cost than free alternatives) |

| Arbitrage Scanner (Unique competitive feature) | No Social/Copy Trading (Unlike Cryptohopper/3Commas) |

| Advanced GRID Features (Trailing Up/Down, Futures Bots) | Subject to UK Regulatory Restrictions (see below) |

| High Security (Encrypted APIs, No Withdrawal Access) | Arbitrage profits are low-margin and sensitive to exchange fees |

Export to Sheets

5. The Regulatory View: UK Restrictions and Investor Protection (E-E-A-T)

Bitsgap is an overseas firm (Estonia) and is subject to evolving, restrictive UK regulations. UK residents must be aware of the following:

A. Ban on Crypto Derivatives and Leverage

The Financial Conduct Authority (FCA) currently bans the sale, marketing, and distribution of cryptoasset derivatives (such as Contracts for Difference (CFDs), futures, and options) to retail consumers in the UK.

- Impact on Bitsgap Users: If you are a UK retail investor, you cannot legally access Bitsgap’s Futures Bots (which use crypto derivatives/leverage) to execute trades, even if your underlying exchange supports them. The platform may still allow you to use spot trading bots (GRID, DCA).

B. Lack of Financial Protection

- No FCA Authorisation: Bitsgap is an overseas entity and is not fully licensed by the FCA for conducting regulated financial services. While some crypto firms register for Anti-Money Laundering (AML) purposes, this does not constitute consumer protection.

- No Safety Net: The FCA is clear on the high risk: “At present, consumers who buy cryptoassets do not have regulatory protections and should be prepared to lose all their money.” (FCA). You do not have access to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS).

C. Future Regulatory Scope

The UK government is drafting new legislation that intends to regulate certain crypto activities provided to UK clients, even by overseas firms. This means platforms like Bitsgap that arrange deals via API may be required to seek full FCA authorisation in the near future to continue serving the UK retail market.

Final Verdict: The Best Bitsgap Review for Your Trading Style

This ultimate Bitsgap review shows it excels as an all-in-one automation platform for the serious, multi-exchange trader.

- Choose Bitsgap if: You manage funds across multiple major exchanges and prioritize specialized bot types (GRID) combined with unique tools like the Arbitrage Scanner and Trailing features.

- Choose Coinrule if: You are an advanced trader who wants maximum flexibility to create complex, personalized trading strategies from scratch using IFTTT logic, or if you want to test the water permanently with a free live rule.

⚠️ Important Disclaimer

Cryptocurrency trading involves significant risk and is not suitable for all investors. This Bitsgap review is for informational purposes only and does not constitute financial or investment advice. You should not invest money you cannot afford to lose. Automated trading bots, including those offered by Bitsgap, carry the risk of loss, and past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial professional before making any investment decisions.

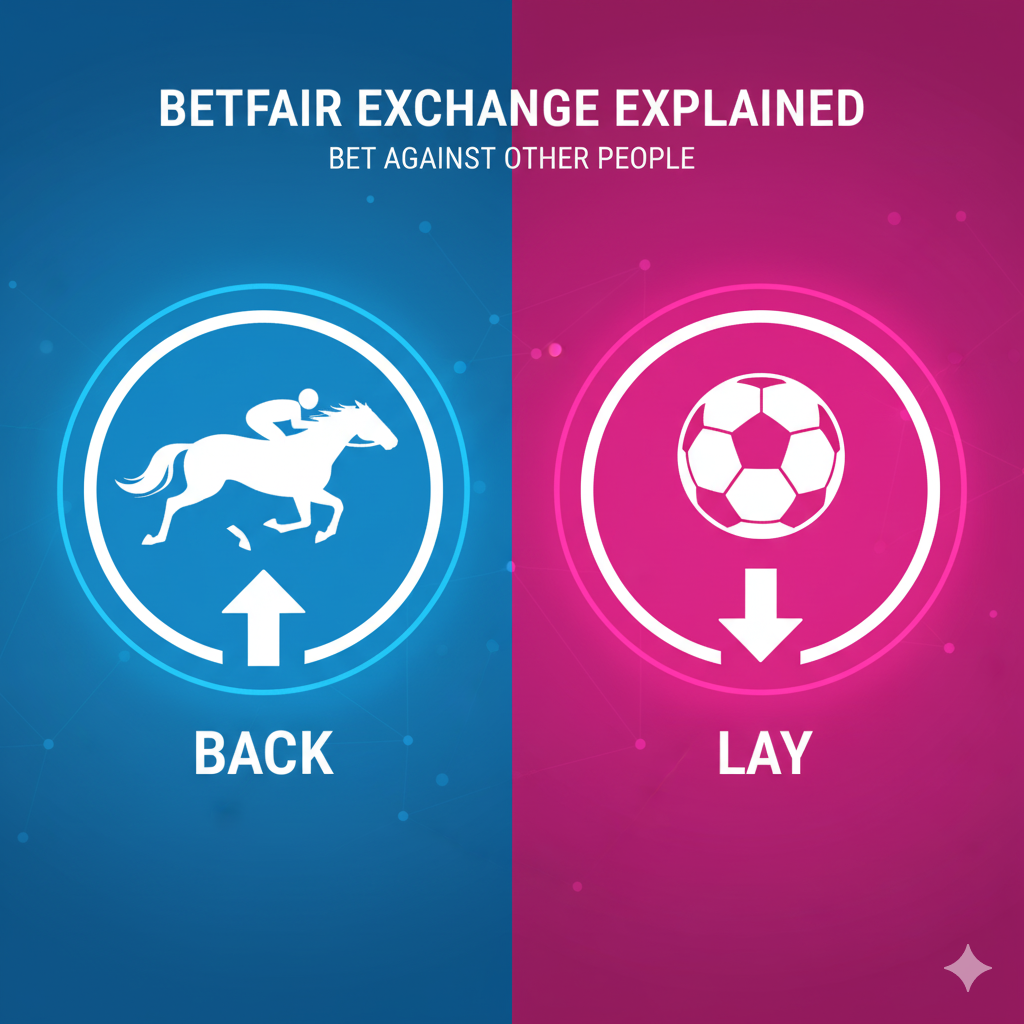

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

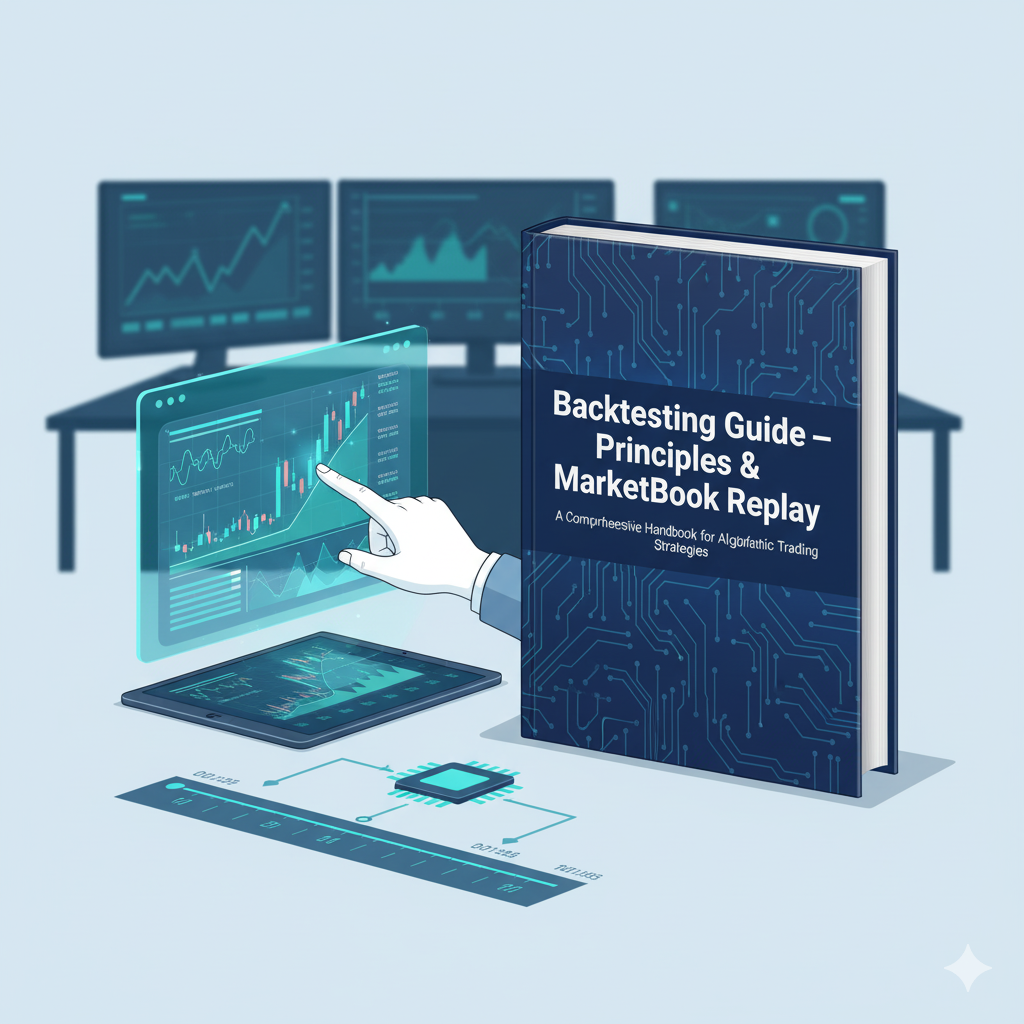

Backtesting Guides

Backtesting Guide — Principles & MarketBook Replay | BotBlog Backtesting guides Published: 2025-11-11 • BotBlog Backtesting Guide — Principles &…

Lesson 7 — Risk management & deployment

Skip to content Lesson 7 — Risk management, hedging & deployment Final crypto lesson: implement hedging/green‑up, enforce risk limits and…

Lesson 6 — Backtesting & simulation (Jupyter)

Skip to content Lesson 6 — Backtesting & simulation (Jupyter) Simulate strategies in Jupyter: load historical ticks/candles, replay data, simulate…

Lesson 5 — Webhooks & Pine alerts

Skip to content Lesson 5 — Webhooks & Pine alerts Build a secure webhook receiver for TradingView Pine alerts, validate…