The internet is saturated with advice on Betfair trading strategies, much of it promising rapid wealth with minimal effort. The reality, however, is far more nuanced. For the aspiring trader, the true goal isn’t a single spectacular win but the methodical pursuit of consistent, long-term profit. This requires a shift in mindset—from that of a gambler chasing a jackpot to that of a disciplined market operator executing a proven strategy. This article demystifies the process by focusing on what truly matters: sustainability. We will explain the basic rules of successful trading. Then, we will analyze proven strategies that have worked for a long time. This will help beginners and experienced traders build a profitable, long-term plan on the Betfair exchange.

Introduction: The Pursuit of Consistent Profit in Betfair Trading

Beyond Betting: Understanding Betfair Trading for Sustained Profit

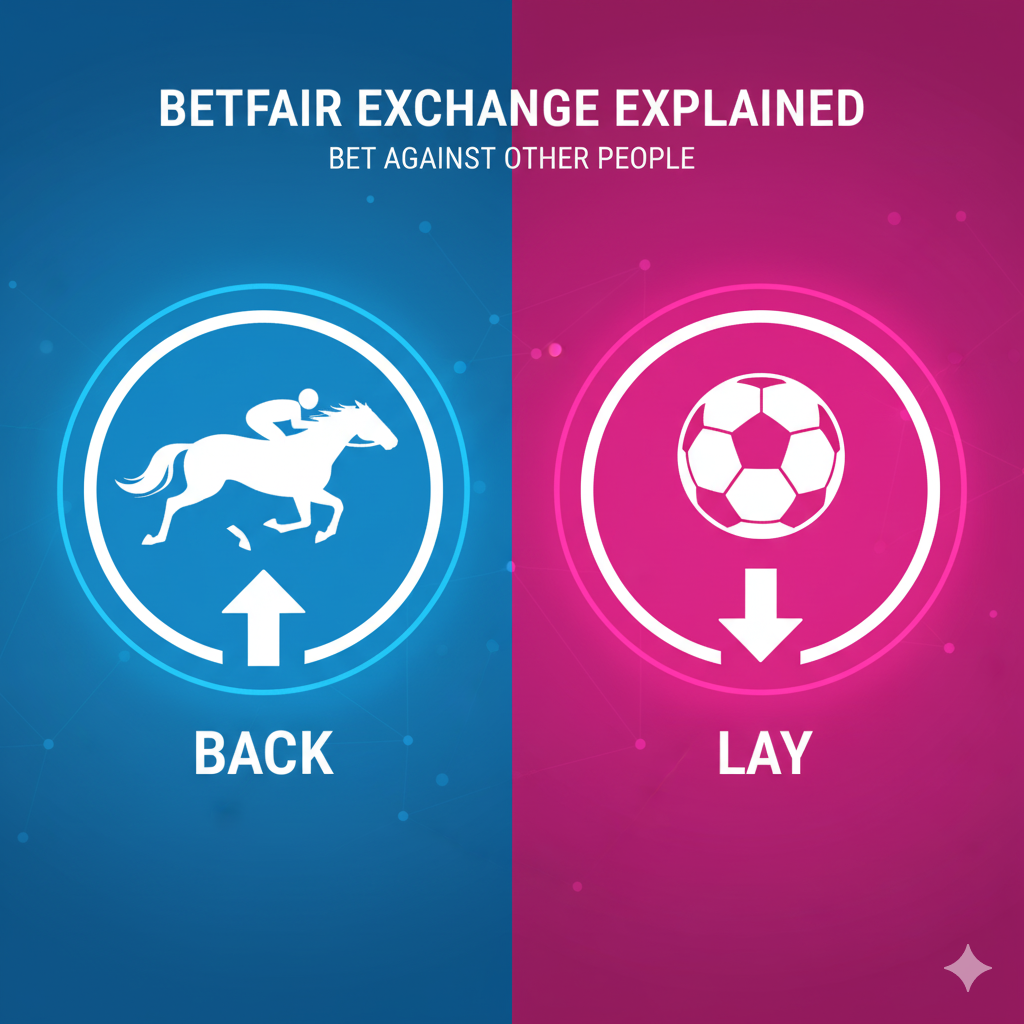

At its core, Betfair trading is fundamentally different from traditional betting. A bettor places a wager on an outcome and waits for the event to conclude, hoping their prediction is correct. A Betfair trader, by contrast, operates like a stock trader, buying (backing) and selling (laying) positions on outcomes within a market to secure a profit regardless of the final result. The aim is to capitalize on the fluctuation of odds, not to correctly predict the winner of a horse race or a football match.

This distinction is crucial for understanding the path to sustained profit. Trading removes much of the “all or nothing” risk associated with betting. By placing opposing bets on the same selection at different odds, a trader can lock in a small, guaranteed profit—a process often called “greening up.” This happens within a vast ecosystem; the global sports market reached a value of nearly $484 billion in 2023, providing immense liquidity and opportunity for traders. This method changes a risky bet into a planned business choice. The focus is on following a repeatable process to make small gains over time.

What Defines “Consistency” and “Long-Term Profit” in the Betfair Market?

In the context of Betfair trading, “consistency” does not mean winning every single trade. Losses are an unavoidable and integral part of the process. Instead, consistency refers to the reliable execution of a trading strategy that has a positive expected value over a large sample of trades. It is about the process, not the outcome of any individual trade. A consistent trader adheres to their plan, manages risk effectively, and maintains emotional discipline, whether a trade results in a profit or a loss.

“Long-term profit” is the natural result of this consistency. It isn’t about doubling your bankroll in a week. It’s about achieving a steady, upward-trending profit graph over months and years, built from hundreds or thousands of small, well-executed trades. This approach leverages the power of compounding, where small, consistent gains build upon each other to generate significant returns over the long term. It requires patience and the understanding that trading success is a marathon, not a sprint, within a rapidly expanding global online gambling market that is projected to grow substantially by 2030.

The Foundation: Why Strategy Alone Isn’t Enough – Discipline, Risk Management, and Market Insight

Many beginners believe that finding a “magic” strategy is the key to unlocking profit. While a sound strategy is essential, it is only one piece of a three-part puzzle. Without the other two components—discipline and risk management—even the best trading ideas are destined to fail.

Discipline is the trader’s ability to stick to their pre-defined plan without deviation. This means entering and exiting trades based on signals from your strategy, not on fear, greed, or gut instinct. It’s about accepting a small planned loss rather than hoping a losing position will turn around.

Risk management is the set of rules that protects your trading capital. This includes determining how much to stake on each trade (staking plan) and defining your maximum acceptable loss before you enter the market. A trader without strict risk management is, in effect, still just a gambler.

Finally, market insight involves a deep understanding of why odds move in your chosen sports. It’s about recognizing patterns, understanding the influence of liquidity, and knowing what factors—like team news in football or ground conditions in horse racing—will impact the odds. A successful trader combines a proven strategy with unwavering discipline and robust risk management, all informed by a solid understanding of their chosen market.

The Core Principles of Consistent Betfair Trading Success

Understanding Market Dynamics and Odds Fluctuation

The Betfair market is a dynamic environment where odds are in constant flux, representing the collective opinion of thousands of participants. To be a successful trader, one must move beyond simply seeing odds as a measure of probability and instead view them as a price that can be bought and sold. The key is understanding why these prices move.

Odds fluctuations are driven by two primary factors: the weight of money and new information. “Weight of money” refers to the balance of back and lay bets in the market. A large volume of money backing a selection will cause its odds to shorten (decrease), while a surge in lay bets will cause them to drift (increase). New information, such as a key player’s injury in a football match or a change in weather for a horse race, can cause dramatic and rapid re-evaluations of the market, leading to significant odds swings. A consistent trader learns to read these movements, anticipate them, and position themselves to profit from the volatility.

The Critical Role of Risk Management and Money Management

This is arguably the most important principle for long-term survival and profitability. Poor risk management is the single biggest reason why aspiring traders fail. The primary goal of a trader is not to maximize profit on any single trade, but to protect their trading capital so they can continue to trade. Shockingly, some analyses suggest that 95% of sport traders experience losses, a figure that highlights the dire need for a data-driven risk management approach.

Effective risk management involves several key components. First, only trade with money you can afford to lose. Second, implement a strict staking plan, such as risking only 1-2% of your total bankroll on any single trade. This ensures that a string of losses will not wipe out your account. Third, always define your exit point for a loss before entering a trade. This “stop-loss” removes emotion from the decision-making process and prevents a small, manageable loss from turning into a catastrophic one.

Developing a Robust Trading Plan and Staking Strategy

A trading plan is your business plan. It is a written document that outlines every aspect of your trading activity, removing guesswork and impulsive decision-making. A comprehensive plan should include:

- The Strategies You Will Use: Clearly define the entry and exit criteria for each strategy.

- The Markets You Will Trade: Specify which sports, events, and market types you will focus on. Specialization is often key.

- Your Staking Plan: Detail exactly how much you will risk per trade, whether it’s a percentage of your bankroll or a fixed liability.

- Your Trading Schedule: Define when you will trade to ensure you are focused and not over-trading.

- Record Keeping: Outline how you will log every trade to review performance and identify areas for improvement.

Trading without a plan is like navigating without a map. It invites emotional errors and leads to inconsistent results. A well-defined plan is the cornerstone of a professional approach to the market.

The Psychology of Trading: Mastering Your Mentality for Consistency

The mental game of trading is often more challenging than the technical aspects. The two most destructive emotions for a trader are greed and fear. Greed tempts you to stay in a winning position for too long, risking that the market will turn against you, or to over-stake after a few wins. Fear causes you to exit winning trades too early, cutting your profits short, or to hesitate on valid entry signals after a loss (“fear of pulling the trigger”).

To master your trading psychology, you need to develop discipline, patience, and objectivity. Accept that losses are a business expense and that you will not win every trade. Focus on flawless execution of your strategy, not on the monetary outcome of any single trade. Patience is required to wait for high-probability setups that meet your criteria, rather than forcing trades in suboptimal conditions. By detaching your emotions from your trading decisions, you can operate logically and consistently, which is the only way to achieve long-term success.

Strategy 1: Scalping – High-Frequency, Low-Risk Profit Accumulation

What is Scalping? Exploiting Micro Odds Movements

Scalping is a high-frequency Betfair trading strategy that involves placing a back bet and a lay bet on the same selection in quick succession to profit from very small odds movements. A scalper aims to secure a profit of just one or two “ticks” (the minimum odds increment on Betfair). For example, a trader might back a horse at odds of 3.0 for £100 and then, seconds later, lay the same horse at 2.98 for £100.50, locking in a small profit regardless of the race’s outcome. The goal is not to predict the winner but to exploit the market’s natural ebb and flow. This strategy thrives in the dynamic online sports betting market, which continues to show significant growth.

Why Scalping Delivers Consistent Profit Over the Long Term

The consistency of scalping comes from its high-volume, low-risk nature. Rather than seeking one large profit, a scalper accumulates dozens or even hundreds of tiny profits over a trading session. Each individual trade carries minimal risk, as the trader is only exposed to the market for a very brief period. The strategy relies on the law of large numbers; over many trades, the small, consistent wins will outweigh the small, managed losses. This method is careful and almost mechanical. It removes emotion and prediction. It focuses only on using short-term liquidity and price changes.

Practical Application: Identifying Entry and Exit Points for Scalping

Successful scalping requires the use of trading software that provides one-click betting and a real-time view of the market depth (the “ladder interface”). Entry points are typically identified by observing the weight of money. If a large amount of money is waiting to back a selection at a certain price, it creates a “wall” of support, suggesting the price is unlikely to move higher. A scalper might place a lay bet just above this price, expecting it to be matched as the odds shorten. Conversely, a wall of lay money suggests resistance, providing an opportunity to place a back bet just below it. Exits are executed as soon as the opposing bet can be placed for a one or two-tick profit. The key is speed and precision.

Risk Management and Staking in Scalping

Risk management in scalping is paramount. Because profits are small, losses must be kept equally small. The cardinal rule is to never let a small scalp turn into a large speculative position. If a trade moves one or two ticks against you, the disciplined approach is to exit immediately for a small loss (a “scratch” trade). Holding on in the hope the market will reverse is a recipe for disaster. Staking should be consistent and determined by your bankroll. A trader might use level stakes or a fixed liability on each scalp, ensuring no single loss can significantly impact their capital.

Ideal Market Conditions: Fast-Moving Pre-Match and In-Play Markets

Scalping is most effective in highly liquid and volatile markets. Liquidity ensures that your bets can be matched quickly at your desired odds, while volatility provides the price movements necessary to create scalping opportunities. The final 10-15 minutes before a major horse race are a classic scalping environment, as are liquid pre-match football markets like Match Odds or Over/Under 2.5 Goals. You can also scalp in in-play markets, especially during breaks in play. Live betting had a 54.04% market share in 2024, showing it has a lot of money and interest.

Strategy 2: The Calculated Lay The Draw (LTD) – Leveraging Football Market Dynamics

Understanding the Lay The Draw Strategy (LTD)

Lay The Draw (LTD) is one of the most popular and well-known Betfair trading strategies for football markets. The core premise is simple: you place a lay bet against the draw before the match begins. Your position is profitable as long as one of the two teams is winning. If a goal is scored, the odds on the draw will increase significantly, allowing you to trade out by placing a back bet on the draw at the higher price to lock in a profit. Your primary risk is the match remaining 0-0 or the score becoming level again, which would cause the draw odds to fall, resulting in a loss.

The Consistency Mechanism: Time Decay and Market Psychology

The LTD strategy is consistent because it has a powerful natural advantage: time decay. As a football match progresses without a goal, the probability of a draw naturally increases, causing the odds on the draw to decrease. However, the moment a goal is scored, this trend is violently reversed. The odds on the draw shoot up because a draw is now less likely. This predictable market reaction is the engine of the strategy. The trader is effectively betting that a goal will be scored, which is a statistically probable event in most football matches. The strategy leverages the market’s overreaction to a goal to create a profitable exit opportunity.

Executing the LTD: Entry and Exit Rules for Consistent Profit

Executing LTD requires clear rules. Entry involves carefully selecting matches where a goal is likely and where the draw odds are not excessively low (typically below 4.5 offers a good risk/reward profile). Look for matches with a clear favorite who is strong offensively.

The primary exit rule is to trade out for a profit immediately after the first goal is scored. The size of the profit will depend on when the goal is scored—the earlier the goal, the greater the increase in the draw odds and the larger the profit. It is crucial to resist the temptation to let the trade run in hopes of a second goal, as this turns a trade into a gamble. You must also have a pre-defined exit plan for a loss.

Managing Risk and Losses in LTD

Loss management is critical for the long-term success of LTD. The main risk is the game remaining 0-0 for an extended period. A trader must set a stop-loss point. This could be a specific price target (e.g., trade out if the draw odds drop to 2.0) or a time-based stop (e.g., trade out at 70 minutes if still 0-0). This ensures you take a controlled, partial loss rather than risking your full liability if the match ends in a draw. Another risk is the underdog scoring first. In this scenario, the draw odds might not rise as much as expected. A disciplined trader will still exit for a smaller profit or a minimal loss rather than holding on.

Adaptability and Market Selection for LTD Consistency

Not all football matches are suitable for LTD. The key to consistency is meticulous match selection. An expert trader develops a strict set of criteria. This might include:

- A strong favorite: Look for teams with a high probability of scoring.

- Good liquidity: Ensure the market has enough money to get your bets matched easily.

- Avoid notoriously defensive teams: Teams known for 0-0 draws should be avoided.

- Consider recent form: Analyze how often teams score first and keep clean sheets.

By making a “shortlist” of good matches using statistics and deep knowledge of the teams, a trader greatly raises the chance of long-term success. This systematic approach is what separates a professional trader from a casual punter.

Strategy 3: Pre-Match Odds Fluctuation – Capitalizing on Information and Market Re-evaluation

What is Pre-Match Trading? Backing and Laying Before the Event Begins

Pre-match trading involves opening and closing a position on Betfair before an event—be it a horse race, football match, or tennis game—has even started. The objective is to profit from the movement of odds in the hours or even days leading up to the event. In-play trading is based on live action. Pre-match trading depends on information flow, market feelings, and how people change their odds as more money enters the market. A trader might back a team early in the week at high odds and then lay them at shorter odds closer to kick-off once positive team news is announced.

Why Pre-Match Trading Offers Consistent Opportunities

Consistency in pre-match trading stems from predictable market reactions to certain types of news. The most significant driver of odds movement is team news in sports like football. When a star player is announced as starting, their team’s odds will almost invariably shorten. Conversely, an unexpected injury to a key player will cause their team’s odds to drift. These are not random fluctuations; they are logical market adjustments. By anticipating or reacting quickly to this information, a trader can consistently place themselves on the right side of these price movements. Other factors, like significant weather changes or even just the “weight of money” as casual bettors pile on a popular favorite, can also create predictable trading opportunities.

Key Techniques: Back-to-Lay and Lay-to-Back Across Sports

The two primary techniques are Back-to-Lay (B2L) and Lay-to-Back (L2B).

- Back-to-Lay (B2L): This involves backing a selection with the expectation that its odds will shorten (decrease). Once the odds have dropped, you lay the same selection to lock in a profit. This is used when you anticipate positive news or a surge of market support for a selection. For example, backing a horse that is being heavily tipped in the morning press, expecting its odds to fall throughout the day.

- Lay-to-Back (L2B): This is the opposite. You lay a selection, anticipating that its odds will drift (increase). When the odds have risen, you back it at the higher price to secure your profit. This is common when negative news is expected, such as a doubtful star player being confirmed as absent from the starting lineup.

Risk Management for Pre-Match Trading

The main risk in pre-match trading is that the anticipated odds movement does not occur, or worse, moves in the opposite direction. Effective risk management requires setting a clear stop-loss. If you back a team at 2.5 expecting the odds to drop to 2.3, you should also have a plan to exit if they drift to 2.7. This caps your potential loss. It’s also vital not to be “all in” on one piece of information. Sometimes the market has already “priced in” the news, and its release has little effect. Diversifying your approach and sticking to your staking plan is crucial for protecting your bankroll from unexpected market behavior.

Optimal Sports and Events for Pre-Match Consistency

Horse racing is a prime market for pre-match trading due to the high volume of daily events and the sensitivity of odds to jockey information, ground conditions, and tips from influential pundits. Football is another excellent market, especially in the 60-90 minutes before kick-off when official team lineups are announced. This single piece of information can cause the most significant and predictable odds movements of the pre-match period. Tennis markets can also offer opportunities as news of a player’s fitness or withdrawal can create large swings. The key is to specialize in sports where information flow is reliable and its impact on the market is relatively predictable.

Strategy 4: In-Play ‘Under Goals’ Trading – Profiting from Time Decay and Game Flow

Understanding In-Play Trading on Under 2.5 Goals (or similar markets)

This football trading strategy is, in many ways, the inverse of Lay The Draw. It focuses on profiting from periods of a match where no goals are scored. The most common market is ‘Under 2.5 Goals’. A trader will back this selection at the start of a match or during a quiet period of play. As time passes without a goal being scored, the probability of the match ending with fewer than three goals increases. This causes the odds on ‘Under 2.5 Goals’ to steadily decrease. The trader’s goal is to exit the trade by laying ‘Under 2.5 Goals’ at lower odds after a certain period, securing a profit from this “time decay.” The primary risk is, of course, a goal being scored, which would cause the odds to shoot up dramatically.

Key Elements for Long-Term Betfair Profit

The pursuit of long-term profit on Betfair is not about discovering a flawless, secret system, but about embracing a disciplined, professional approach. Success depends on three things. First, having strong and well-understood trading strategies. Second, a firm commitment to managing risk. Third, a strong trading mindset. We have looked at several steady strategies: Scalping, Lay The Draw, Pre-Match Trading, and Under Goals Trading. Each uses a specific, repeated market weakness instead of just guessing.

The common thread among them is their foundation in logic and probability, not luck. Scalping earns money from small price changes. Lay The Draw uses the market’s reaction to a goal. Pre-match or ‘Under Goals’ trading takes advantage of odds dropping predictably based on information and time. However, simply knowing these strategies is not enough. Your journey to consistent profitability begins now, with the commitment to implement these ideas methodically.

Your next steps should be to choose one strategy that resonates with you, study it deeply, and then practice it with very small stakes. Create a detailed trading plan, define your entry, exit, and risk management rules, and log every trade. Analyze your results, learn from your losses, and refine your approach. Remember, consistency is built trade by trade, day by day. By treating Betfair trading as a business and mastering your chosen craft, you can move away from the uncertainty of gambling and towards the rewarding path of sustained, long-term profit.

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

Backtesting Guides

Backtesting Guide — Principles & MarketBook Replay | BotBlog Backtesting guides Published: 2025-11-11 • BotBlog Backtesting Guide — Principles &…

Lesson 7 — Risk management & deployment

Skip to content Lesson 7 — Risk management, hedging & deployment Final crypto lesson: implement hedging/green‑up, enforce risk limits and…

Lesson 6 — Backtesting & simulation (Jupyter)

Skip to content Lesson 6 — Backtesting & simulation (Jupyter) Simulate strategies in Jupyter: load historical ticks/candles, replay data, simulate…

Lesson 5 — Webhooks & Pine alerts

Skip to content Lesson 5 — Webhooks & Pine alerts Build a secure webhook receiver for TradingView Pine alerts, validate…