Thinking of using automated crypto trading bots? This comprehensive 3Commas review for 2026 breaks down everything traders need to know. We’ll cover features, pricing, safety, general regulations, and whether it’s the right tool for you in this in-depth 3Commas review.

What is 3Commas and How Does it Work for Traders?

First, it’s important to understand that 3Commas is not a cryptocurrency exchange where you buy and sell crypto directly. Instead, it operates as a powerful software platform that connects to your existing exchange accounts (like Binance, Kraken, or Coinbase Pro) using API keys. Consequently, this allows you to manage all your crypto portfolios and execute advanced, automated trading strategies from a single interface, without giving 3Commas withdrawal access to your funds.

For traders globally, this means you can automate your trading activity 24/7 across multiple exchanges, thereby taking advantage of market movements even while you sleep.

Key Features: A Deep Dive for This 3Commas Review

3Commas offers a wide array of tools designed to enhance your trading. Here’s a closer look at the most important features we’ll explore in this 3Commas review.

Automated Trading Bots: Your 24/7 Crypto Assistant

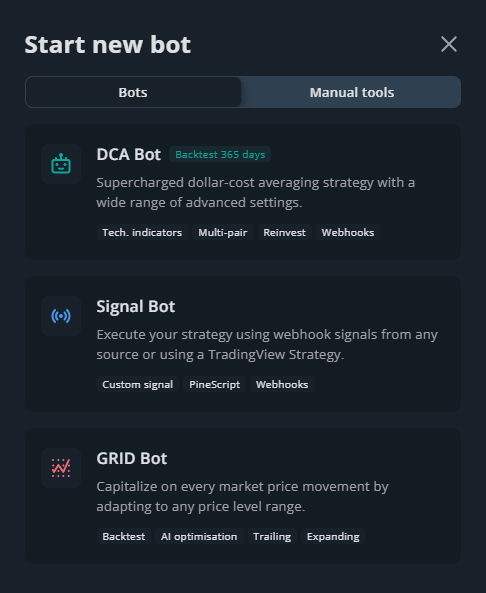

This is the core of the 3Commas platform. These bots actively trade on your behalf based on pre-set rules, which removes emotion and saves you valuable time.

- DCA Bots (Dollar-Cost Averaging): A favourite for long-term investors. These bots help you build a position over time by buying a fixed amount of a cryptocurrency at regular intervals. This, in turn, averages out your entry price and reduces the impact of volatility.

- Grid Bots: These are perfect for sideways or ranging crypto markets. A Grid Bot places a series of buy and sell orders at different price levels, automatically profiting from small price fluctuations.

- Options Bots: Furthermore, for advanced traders, 3Commas provides bots that can hedge positions or speculate with more complex strategies on exchanges that support options.

- Signal Bots: You can also configure a bot to automatically execute trades based on signals from professional analysts or your own custom alerts from TradingView.

SmartTrade Terminal: Go Beyond Basic Exchange Orders

The SmartTrade terminal provides a significant upgrade over the standard trading interfaces on most exchanges. Specifically, it allows you to set up a complete trade with an entry point, take-profit targets, and a stop-loss all in one go. You can also use trailing stops to maximise profits during a strong trend.

Portfolio Management: A Unified View of Your Crypto

If you hold crypto on multiple exchanges, 3Commas offers a single, clean dashboard to track your entire portfolio’s performance. This makes it much easier to get a clear overview of your holdings and growth.

Bot Marketplace: Copy Expert Traders

For beginners, the marketplace is an excellent starting point. Here, you can browse and copy the exact bot configurations that other successful traders use on the platform, seeing their real-world performance data.

Validate Before You Automate: The Power of Backtesting

Before you even risk simulated money with Paper Trading, 3Commas offers a powerful tool for data-driven traders: Backtesting. This feature lets you test your DCA bot configurations against historical market data. In minutes, you can see how your proposed strategy would have performed over the last week, month, or year. This is a crucial step for building confidence in a strategy and identifying potential flaws before you commit any capital.

Beyond the Bots: The 3Commas Academy & Community

One of the biggest hurdles for new users is feeling overwhelmed. 3Commas addresses this with a strong support ecosystem that shows you’re not alone on your trading journey.

- 3Commas Academy: A free resource packed with video tutorials, articles, and step-by-step guides that cover everything from basic concepts to advanced bot configurations.

- Community Forums & Discord: Connect with thousands of other 3Commas users. These channels are invaluable for asking questions, sharing strategies, and learning from the collective experience of the community.

- Help Center: A detailed knowledge base that provides answers to almost any technical question you might have about the platform’s features.

Managing Risk with 3Commas Smart Tools

While bots are designed to capture profit, their most powerful function is arguably risk management. This is where 3Commas truly shines for serious traders. Instead of just placing a buy order and hoping for the best, you can build a safety net directly into every trade.

- Set-and-Forget Stop Loss: Before your bot even starts a deal, you can define an exact price at which it will sell to prevent significant losses if the market turns against you.

- Trailing Take Profit: This is a brilliant feature for maximising gains. Instead of selling at a fixed target, a trailing stop follows the price up, only selling after it drops by a certain percentage from its peak. This lets you ride a winning trend for longer without giving back all your profits.

- Concurrent Take Profit and Stop Loss: The SmartTrade terminal allows you to have both your profit target and your safety net active at the same time. Whichever is hit first is executed, ensuring you never leave a trade unprotected. By focusing on these tools, you shift from pure speculation to strategic, risk-managed trading.

User Experience and Interface: A Deeper Look

While listing features is useful, this 3Commas review aims to explain what it feels like to use the platform.

- The Main Dashboard: Your command center is surprisingly clean. Upon logging in, you get a high-level overview of your total portfolio balance, broken down by exchange. It effectively consolidates everything, showing your active bots, recent trade history, and overall profit/loss. It strikes a good balance between providing rich data without feeling cluttered.

- The Bot Creation Process: Setting up a bot is guided and intuitive. For both DCA and Grid bots, you are offered a choice between a simplified “Wizard” setup and an “Advanced” mode. The Wizard is perfect for newer users, asking simple questions to configure a basic strategy. The Advanced mode, however, unlocks the full potential, allowing you to fine-tune every parameter, from deal start conditions based on complex TradingView signals to specific safety order scaling.

- Executing Trades with SmartTrade: This is where 3Commas truly outshines a standard exchange. Instead of just placing a limit order, you can plan an entire trade from start to finish. For example, you can set up a trade to buy a coin at a specific price, then automatically set three separate take-profit targets (e.g., sell 25% at +2%, 50% at +4%, and the rest at +5%). Simultaneously, you can add a trailing stop-loss that moves up as the price rises, protecting your profits. This level of control in a single, easy-to-use interface is a significant advantage for active traders.

- Mobile App for On-the-Go Management: The 3Commas mobile app is well-designed for monitoring. You can check your portfolio, view active bot performance, and receive real-time notifications about completed trades. You can also start or stop bots and make basic adjustments. While creating a complex new bot strategy is still best done on the desktop version, the app is excellent for managing your automated systems when you’re away from your computer.

Who is 3Commas Best For (And Who Should Avoid It)?

To provide a balanced 3Commas review, it’s crucial to identify the ideal user.

3Commas is an excellent choice for:

- Intermediate to Advanced Traders: Individuals who understand market dynamics and want to automate their strategies will find the tools incredibly powerful.

- Multi-Exchange Traders: If you’re tired of logging into several exchanges, the unified dashboard is a game-changer.

- Data-Driven Investors: Those who enjoy backtesting and refining strategies based on historical data will appreciate the platform’s analytical tools.

- Busy Professionals: People who don’t have time to watch the charts all day can benefit immensely from 24/7 automation.

3Commas may not be the best fit for:

- Absolute Beginners: While the marketplace helps, a complete novice might be overwhelmed. It’s best to first learn the basics of crypto trading.

- Long-Term “Buy and Hold” Investors: If your strategy is simply to buy and hold a few major coins without active trading, a subscription fee is likely not worth it.

- Traders on a Very Tight Budget: If the subscription fee represents a significant portion of your trading capital, it can be a psychological and financial hurdle.

Making the Subscription Pay for Itself: A Realistic Scenario

A common question is: “Is the subscription fee worth it?” The goal of using 3Commas is to generate profits that comfortably exceed the monthly cost. Let’s look at a hypothetical case study.

Meet Trader Alex, a Pro Plan Subscriber ($37/month).

Alex notices that a popular altcoin has been trading in a predictable range between $90 and $110 for the past few weeks. Alex decides to deploy a Grid Bot with a total investment of $1,000.

- The bot places buy orders every time the price drops within the range and sell orders as it rises.

- Each successful buy-low-sell-high trade generates a small profit of around 0.5% after exchange fees.

- In a volatile week, the bot successfully completes 30 of these small trades.

Even with modest profits of around $5 per trade (0.5% of a $1000 position), those 30 trades would generate $150 in profit for the week. This not only covers the $37 monthly subscription but also results in a net profit of over $100, all achieved automatically by exploiting market volatility that Alex would have been too busy to trade manually. This scenario illustrates how, with the right strategy, the platform can become a profitable investment.

3Commas Alternatives: A Head-to-Head Comparison for UK Users

No 3Commas review would be complete without looking at the competition. Here’s how 3Commas stacks up against other popular platforms available in the UK.

| Feature | 3Commas | Cryptohopper | Coinrule |

|---|---|---|---|

| Primary Model | Subscription-based software | Subscription-based software | Subscription-based software |

| Pricing | Monthly/Annual Fee | Monthly/Annual Fee | Monthly/Annual Fee |

| Ease of Use | Moderate learning curve | Steeper learning curve | Very beginner-friendly |

| Best Feature | SmartTrade Terminal & powerful DCA/Grid bots | Advanced strategy designer & signals marketplace | “If-This-Then-That” logic and template strategies |

| Supported Exchanges | 15+ major exchanges | 15+ major exchanges | 10+ major exchanges |

| Paper Trading | Yes, on paid plans | Yes, on all plans | Yes, with Demo Exchange |

Why Start with 3Commas Today? Stop Missing Opportunities.

Reading a 3Commas review is the first step, but taking action is how you gain an edge. Here’s why you should consider starting today:

- The Crypto Market Never Sleeps: Opportunities appear at all hours. While you’re asleep, at work, or away from your screen, a well-configured bot can execute your strategy flawlessly, securing profits or buying dips you would have otherwise missed.

- Remove Emotion from Your Trading: The biggest enemy of a trader is often fear and greed (FUD and FOMO). Bots are logical. They execute your pre-planned strategy without hesitation, helping you avoid costly emotional decisions.

- Start Learning with Zero Financial Risk: The best part is that you don’t need to commit any real money to begin. By signing up for a free account, you can immediately start using the Paper Trading feature to test bots, learn the interface, and build your confidence.

What Real Traders Are Saying (User Testimonials)

“As a busy professional, I can’t watch the charts all day. My 3Commas DCA bot lets me consistently invest and catches dips I would have missed. It’s completely changed my long-term strategy.” — Sarah K., Part-Time Investor

“I used to make so many panic sells and FOMO buys. Using Grid Bots has forced me to be disciplined and trade my strategy, not my emotions. The consistency has been a game-changer for my portfolio.” — Tom L., Active Trader

Common Mistakes New 3Commas Users Make (And How to Avoid Them)

To help you succeed from day one, here are three common pitfalls that new traders fall into. By being aware of them, you can start your automated trading journey on the right foot.

- The “Set and Forget” Mentality. It’s tempting to launch a bot and assume it will print money forever. This is the biggest mistake. Markets are dynamic; a strategy that works perfectly in a bull market can quickly fail in a downturn.

- How to Avoid It: Schedule a weekly check-in. Review your bots’ performance, analyze their closed deals, and assess if the current market conditions still suit your strategy. Don’t be afraid to pause or adjust a bot that is underperforming.

- Underestimating Exchange Fees. Many bots, especially Grid Bots, perform dozens of small trades. A bot might report a 0.5% profit on a trade, but if your exchange charges a 0.1% fee on both the buy and sell, your actual profit is only 0.3%. These small amounts add up and can erode your gains.

- How to Avoid It: Know your exchange’s fee structure. When setting your “Take Profit” percentage, ensure it’s high enough to comfortably cover both transaction fees and still leave you with a meaningful gain.

- Going All-In on an Unproven Strategy. The excitement of a powerful new tool can lead traders to allocate too much capital to their first bots. A backtest can look promising, but live market conditions are always unpredictable.

- How to Avoid It: Scale up gradually. Start your first real-money bot with a small amount of capital you are completely comfortable losing. Let it run for a week, validate its performance in a live environment, and only then consider increasing its allocated funds.

Three Pro-Tips Before You Start (My Advice)

As a final piece of advice, here are three essential tips I give to anyone starting with 3Commas to help them succeed.

- Start Small and Simple: Don’t try to automate everything at once. Begin with a single DCA bot on a major, well-known pair like BTC/USDT. Use a small amount of capital you are comfortable with. The goal of your first bot is to learn the mechanics and understand the process, not to make huge profits immediately.

- Factor in Exchange Fees: Remember that every trade your bot makes incurs a fee from your connected exchange (e.g., Binance, Kraken). For strategies that trade frequently, like Grid Bots, these small fees can add up. Ensure your “Take Profit” percentage is high enough to cover these fees and still leave a profit.

- Review and Adapt Regularly: Automation is a tool, not a magic box that prints money. Market conditions change. A strategy that works well in a bull market may fail in a bearish or sideways market. Set aside time once a week to review your bots’ performance, check the logs, and decide if you need to adjust your settings or pause a bot.

Your Final Checklist Before You Start

If you can answer “yes” to the following questions, you are ready to take the next step.

- Do you have an account on a supported crypto exchange? (e.g., Binance, Kraken, Coinbase Pro)

- Do you understand the fundamental risks of cryptocurrency trading?

- Are you ready to start with Paper Trading to learn the platform without financial risk?

- Are you excited to take emotion out of your trading and save time with automation?

If you ticked all the boxes, then you are perfectly positioned to benefit from 3Commas.

Your 3-Step Plan to Get Started (Risk-Free)

Ready to see what automated trading can do for you? Follow these simple steps to begin your journey without any financial commitment.

- Create Your Free Account: Use this link to sign up for 3Commas. The process is quick and only requires an email address.

- Connect an Exchange for Paper Trading: Instead of linking your main account, start by connecting your exchange using a Paper Trading account. This gives you full access to the platform’s features with simulated funds.

- Test a Strategy: Go to the DCA or Grid Bot section and try setting up one of the example strategies from this review. Let it run in the simulated environment and watch how it works in real-time.

By following these steps, you can become comfortable with the platform and prove your strategies work before you ever decide to trade with real money.

3Commas Pricing: Costs & Plans Explained

3Commas uses a tiered subscription model. The company officially quotes prices in US dollars, so the cost in your local currency will fluctuate with the exchange rate.

For the most accurate and up-to-date costs, you should always visit the official 3Commas pricing page.

Pricing Guide

| Plan | Official Price (USD/month) | Key Features |

|---|---|---|

| Free | $0 | Limited to demo trading, 1 of each bot type. Ideal for testing. |

| Pro | $37 | Unlocks real trading, more bots, and advanced SmartTrade features. |

| Expert | $59 | Higher bot limits, full features, and priority support for serious traders. |

Disclaimer: Prices are subject to change. Annual plans often provide a significant discount.

Is 3Commas Safe to Use? A Look at Security

A critical part of any 3Commas review is looking at security. 3Commas employs several measures to protect your assets:

- API Keys with No Withdrawal Rights: You connect your exchange accounts via API keys. It is crucial that you disable withdrawal permissions when creating these keys. This means 3Commas can place trades for you, but cannot move your funds out of your exchange wallet.

- Two-Factor Authentication (2FA): You should always enable 2FA on your 3Commas account. This adds a vital extra layer of security against unauthorized access.

- Past Incidents: For a transparent 3Commas review, it’s important to note that the platform has faced security incidents in the past. The company has since strengthened its security protocols, but this serves as a reminder for users to always create unique, securely generated API keys and practice good security hygiene.

What the Experts Say: 3Commas Review Highlights

“Built with crypto beginners in mind, the 3Commas user interface is intuitive, with built-in tutorials to help with every aspect of the platform.” — Moneywise

“3Commas is a cryptocurrency trading bot that helps improve the trade quality by giving the trader the right control and features they need to maximize their cryptocurrency trading profits.” — CoinSutra

“Its range of educational resources, dashboard to track your different exchanges and library of bots and algorithms can give you a major edge.” — Benzinga

“For those looking for hands-free trading solutions, 3Commas offers an extensive bot marketplace. Users can either copy top-performing bots or create their own using customizable settings tailored to their trading strategies.” — G2

Example Bot Strategies: Settings & Steps

Disclaimer: The following strategies are for educational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile, and you should always do your own research (DYOR) and test strategies thoroughly in Paper Trading mode before risking real capital. Past performance is not indicative of future results.

Here are two detailed strategies you can adapt, one conservative and one more aggressive. Always test these in Paper Trading mode first.

Strategy 1: Conservative DCA Bot for Bitcoin Accumulation

- Goal: To steadily accumulate Bitcoin (BTC) over the long term, buying more when the price dips to lower the average cost.

- Best For: Long-term investors who believe in BTC and want to automate their buying strategy in any market condition.

Example Settings:

| Setting | Value | Purpose |

|---|---|---|

| Pair | BTC/USDT (or your preferred stablecoin) | Defines the trading pair. |

| Strategy | Long | The bot will profit from the price of BTC increasing. |

| Base Order Size | $20 | The initial amount for starting a new deal. |

| Safety Order Size | $30 | The amount for subsequent orders placed when the price drops. |

| Deal Start Condition | RSI-7, 15min, < 30 | Starts a new deal only when BTC is potentially oversold on the 15m chart. |

| Take Profit | 3% | Closes the deal after the position is 3% in profit. |

| Max Safety Orders | 5 | The bot will place a maximum of 5 safety orders. |

| Price Deviation | 2% | Places a new safety order every time the price drops by another 2%. |

| Safety Order Volume Scale | 1.2 | Each safety order will be 1.2x larger than the previous one. |

Step-by-Step Setup:

- Navigate to the DCA Bot section in your 3Commas dashboard.

- Click “Create Bot” and select the “Advanced” option.

- Choose your exchange, select the BTC/USDT pair, and set the Strategy to “Long”.

- Enter your Base and Safety Order sizes.

- Set your Take Profit percentage. For this conservative strategy, 3% is a reasonable target.

- Under “Deal Start Condition”, select RSI-7, set the timeframe to 15 minutes, and the value to “less than 30”.

- Configure your Safety Orders section with the settings from the table above.

- Give your bot a name (e.g., “BTC Accumulator”), review all settings, and click “Create Bot”.

- Start the bot, but monitor its first few deals closely to ensure it’s behaving as expected.

Strategy 2: Aggressive Grid Bot for a Volatile Altcoin

- Goal: To generate frequent, small profits from the high volatility of an altcoin within a defined price range.

- Best For: Sideways or ranging markets where an asset’s price is fluctuating between clear support and resistance levels.

Example Settings:

| Setting | Value | Purpose |

|---|---|---|

| Pair | SOL/USDT (or another volatile altcoin) | Select a pair known for significant price swings. |

| Upper Price Limit | $180 | The highest price at which the bot will operate and sell. |

| Lower Price Limit | $130 | The lowest price at which the bot will operate and buy. |

| Number of Grids | 40 | Creates 40 buy/sell levels within the defined price range. |

| Quantity per Grid | $$ Amount based on total investment $$ | The bot will calculate this based on your total allocated funds. |

| Stop Loss | $125 | If the price drops below the grid, the bot closes all positions to limit loss. |

Step-by-Step Setup:

- Navigate to the Grid Bot section in your 3Commas dashboard.

- Click “Create Bot”.

- Select your exchange and the volatile pair you want to trade (e.g., SOL/USDT).

- In the settings, you can use the “Auto” function to let 3Commas suggest a range, but for this strategy, we will set it manually.

- Enter your Upper Price Limit based on a recent resistance level you’ve identified.

- Enter your Lower Price Limit based on a recent support level.

- Set the Number of Grids. More grids mean smaller, more frequent trades but require more capital. 40 is a good starting point for an aggressive strategy.

- Allocate the total amount of USDT you want the bot to use for this strategy.

- Crucially, set a Stop Loss just below your lower grid limit to protect against a market crash.

- Name your bot (e.g., “SOL Range Trader”), review the grid visualization, and click “Create Bot”.

Navigating the Global Regulatory Landscape with 3Commas

The global approach to crypto is constantly evolving. As a trader, it’s vital to be aware of the rules in your jurisdiction.

A Focus on UK Regulation

The United Kingdom has been actively developing a comprehensive framework for crypto-assets, led by the Financial Conduct Authority (FCA) and HM Treasury.

- Is 3Commas Regulated by the FCA? 3Commas itself is not directly regulated by the FCA because it is considered a software provider, not a financial services firm that holds customer funds. However, the crypto exchanges you connect to 3Commas are subject to UK regulation if they operate in or serve UK customers. You must use an exchange that is registered with the FCA for anti-money laundering (AML) purposes.

- The UK’s Financial Promotions Regime The FCA has implemented strict rules for the marketing and promotion of crypto-assets to UK consumers. Any firm promoting crypto, including overseas firms, must comply with this regime. This aims to ensure promotions are fair, clear, and not misleading, and that consumers are aware of the high risks involved.

- Tax on 3Commas Profits in the UK Any profits you make from crypto trading using 3Commas bots are subject to UK tax. For individuals, this is typically Capital Gains Tax. You have an annual tax-free allowance, but any gains above that must be reported to HMRC via a self-assessment tax return. It is your legal responsibility to keep detailed records of all your trades (date, asset, quantity, price in GBP at the time of transaction) to calculate your gains correctly.

- The Future of UK Crypto Regulation The UK government aims to position the country as a global crypto-asset hub. Legislation like the Financial Services and Markets Act 2023 is bringing more crypto activities, including the operation of trading venues and custody services, into the scope of financial services regulation. This means UK traders can expect a more robust and clearly defined regulatory environment in the coming years.

Regulatory Comparison: UK vs. Global Context

| Aspect | UK Specifics (FCA & HMRC) | General Global Context |

|---|---|---|

| Platform Regulation | 3Commas is not directly regulated. Connected exchanges must be registered with the FCA for AML purposes. | 3Commas is typically viewed as a software provider. Regulation applies to the connected crypto exchanges. |

| Marketing & Promotions | A strict, legally-binding Financial Promotions Regime is enforced by the FCA, targeting all firms serving UK customers. | Varies widely by country, but many are introducing stronger consumer protection rules around crypto advertising. |

| Taxation of Profits | Profits are subject to Capital Gains Tax, reported to HMRC. Detailed records in GBP are a legal requirement. | Profits are generally taxable under local capital gains or income tax laws. Record-keeping is the user’s responsibility. |

Pros and Cons of Using 3Commas

Pros:

- Powerful 24/7 Automation: Saves an enormous amount of time and removes emotional decision-making from trading.

- Wide Exchange Support: Connects to most major exchanges available to global customers.

- Intuitive Interface: The platform is well-designed and relatively easy to learn.

- Risk-Free Paper Trading: An essential feature for testing and learning.

- Helpful Community & Marketplace: A large user base provides access to shared strategies and support.

Cons:

- Monthly Subscription Cost: The fees can eat into profits, especially for those with smaller portfolios.

- Steep Learning Curve: Mastering advanced bot configurations and strategies takes time and effort.

- Losses are Possible: Automation does not guarantee profits. A poorly set up bot in a bad market will lose money.

- Historical Security Concerns: Requires users to be diligent with their own security practices.

Author’s Verdict: My Personal Take on 3Commas

After spending significant time testing the platform for this 3Commas review, my conclusion is this: 3Commas is a professional-grade tool that can genuinely transform your trading workflow. The SmartTrade terminal alone is worth the price of admission for an active trader, and the bots, once mastered, are incredibly powerful. I personally recommend it for anyone who is serious about moving beyond basic buy/sell orders and wants to implement a disciplined, automated, and strategic approach to their crypto investing. But for me, the biggest win has been the non-financial one: the time it frees up. I no longer feel chained to the charts, which has significantly reduced my trading-related stress.

The Final Verdict: Is 3Commas Worth it for Crypto Traders?

To conclude this 3Commas review, for any crypto trader looking to level up their strategy, 3Commas is a feature-rich and powerful tool. The ability to automate trading 24/7 with sophisticated bots and manage everything from one dashboard is a significant advantage.

However, it is not a “set and forget” path to riches. Success with 3Commas requires a solid understanding of trading principles and a willingness to learn and adapt your strategies. The subscription costs mean it is best suited for traders who are serious about their craft and have sufficient capital to make the fees worthwhile.

Frequently Asked Questions (FAQ)

Is 3Commas legal to use? Yes, in most countries, it is legal to use software like 3Commas to manage your crypto trading on legally operating exchanges. However, you should always check your local regulations.

Can you actually make money with 3Commas? Yes, many traders make money using 3Commas. However, it is not guaranteed. Profitability depends entirely on your trading strategy, bot configuration, and market conditions. You can also lose money.

Which exchanges does 3Commas support? 3Commas supports a wide range of popular global exchanges, including Binance, Kraken, Coinbase Pro, Bybit, and many more.

Do I need experience to use 3Commas? While beginners can start with the marketplace and copy-trading features, we recommend a basic understanding of cryptocurrency and trading concepts to use the platform effectively and safely.

What is the customer support like? 3Commas offers support through a help center with detailed guides and a ticketing system. Users on higher-tier plans like the Expert plan receive priority support, which is a key consideration for serious traders who may need faster assistance.