Looking for an easy way to start with automated crypto trading? This comprehensive Coinrule review for 2026 explores how its “no-code” strategy builder makes automation accessible to everyone. In this guide, we’ll cover features, pricing, safety, and ultimately determine if this is the right tool for your trading journey.

Coinrule Review: Key Takeaways

- Best For: Absolute beginners and non-coders.

- Core Feature: An intuitive “if-this-then-that” rule builder that makes creating automated trading rules simple.

- Pricing: Offers a generous Free Forever plan, making it risk-free to start.

- Top Benefit: Removes the technical barrier to automated trading, allowing anyone to build custom strategies.

- Verdict: The best platform on the market for those new to crypto trading bots or for creative traders who want to build unique rules without code.

What is Coinrule and How Does it Work for Traders?

Coinrule is a smart trading platform that makes automated crypto trading accessible to everyone, regardless of their coding knowledge. Unlike more complex platforms, Coinrule’s core feature is its intuitive “if-this-then-that” (IFTTT) logic. Consequently, this allows you to build sophisticated trading rules using plain language and simple building blocks.

Similar to other trading tools, it connects to your existing exchange accounts (like Binance, Kraken, or Coinbase Pro) via secure API keys. This means it can execute trades on your behalf, but importantly, it never has withdrawal access to your funds. For traders, therefore, Coinrule acts as a powerful and user-friendly layer on top of your exchange, allowing you to build and automate your own strategies 24/7.

A Deep Dive into Coinrule’s Key Features

Coinrule’s features all centre around ease of use and customisation. Here’s a closer look at what makes the platform stand out in this Coinrule review.

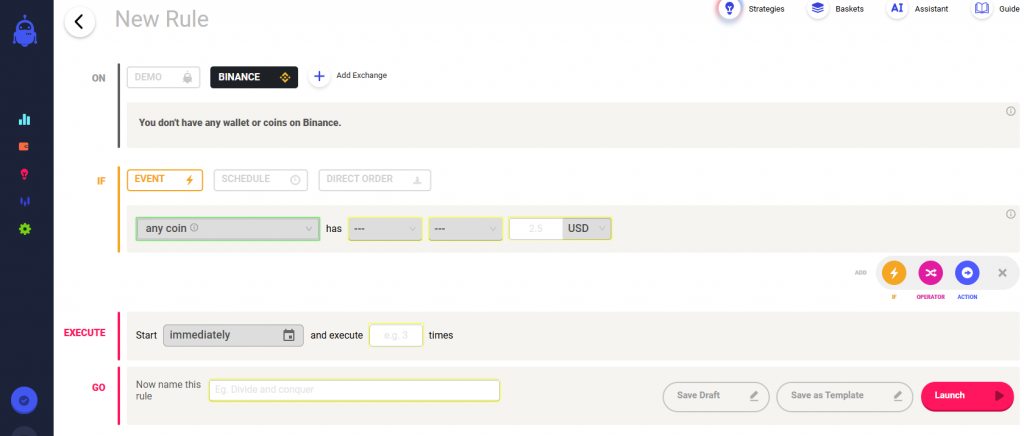

The “If-This-Then-That” Rule Builder

This is the heart of Coinrule. Here, you can create trading rules by combining simple conditions and actions. For example, you could build a rule that says: “IF the price of Bitcoin drops by 5% in 6 hours, THEN buy $100 worth of Bitcoin with my USDT wallet.” Moreover, you can stack multiple conditions and actions to create incredibly detailed strategies without writing a single line of code.

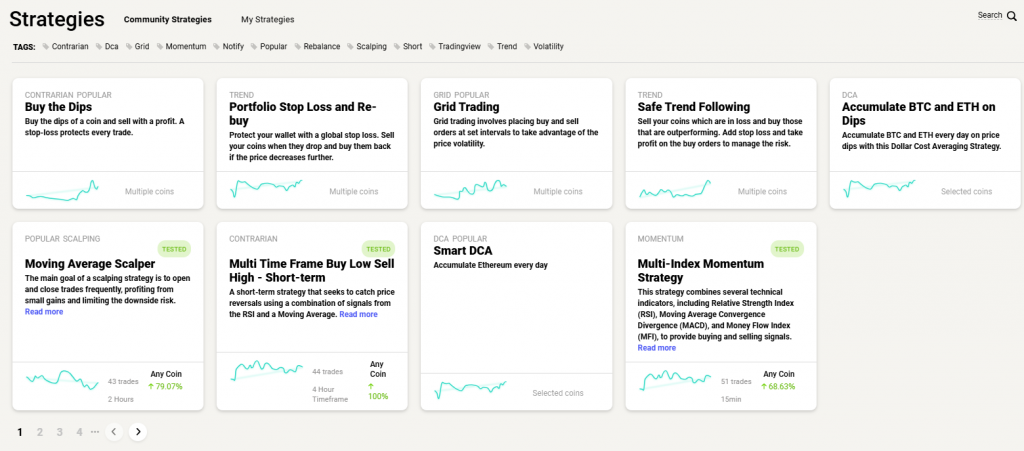

The Template Library

For those who don’t want to start from scratch, Coinrule offers a vast library of over 200 pre-built trading strategy templates. These range from simple trend-following rules to more advanced accumulation strategies for specific market conditions. As a result, this serves as an excellent starting point for beginners to learn from and adapt.

The Demo Exchange (Paper Trading)

Additionally, Coinrule provides a risk-free Demo Exchange that allows you to test your newly created rules in a simulated market environment. You can see how your strategies perform with zero financial risk, making it an essential tool for learning and building confidence before you deploy real capital.

Wide Range of Triggers and Actions

The power of the rule builder comes from its versatility. You can use a huge variety of triggers, including:

- Price Movements: (e.g., price increase/decrease, moving average crosses)

- Technical Indicators: (e.g., RSI, Bollinger Bands, MACD)

- Time-Based Triggers: (e.g., every day at 9 AM)

This flexibility allows for a level of customisation that can suit almost any trading style.

User Experience in this Coinrule Review: Is it Truly Beginner-Friendly?

While many platforms claim to be easy to use, this Coinrule review confirms that beginner-friendliness is its greatest strength.

- The Rule Builder Interface: Creating a rule feels like building with LEGO blocks. The platform presents you with dropdown menus and simple text boxes, guiding you through each step, from selecting your trigger (“IF”) to defining your action (“THEN”). This visual, step-by-step process effectively removes the intimidation factor often associated with trading bots.

- The Template Library: This is a game-changer for new users. Instead of facing a blank slate, you can browse templates with clear titles like “Trend Following” or “Catch the Dips.” Clicking on a template pre-fills the rule builder, allowing you to see exactly how a professional strategy is constructed. You can then use it as is or tweak it to fit your own risk tolerance.

- Learning as You Go: The platform’s design teaches you about automated trading organically. By experimenting with different triggers and actions in the Demo Exchange, you naturally learn about technical indicators and strategy construction without having to read dense technical manuals.

Who is Coinrule Best For (And Who Should Look Elsewhere)?

To provide a balanced Coinrule review, it’s important to match the tool to the trader.

Coinrule is an excellent choice for:

- Absolute Beginners: It is arguably the best platform on the market for someone starting their journey with automated trading.

- Hobbyist Traders and Investors: Individuals who want to automate simple, long-term strategies (like buying the dip) without a steep learning curve.

- Creative Traders: People who have unique strategy ideas but lack the coding skills to implement them on other platforms.

- Visual Learners: The “if-this-then-that” interface is perfect for those who prefer a visual approach to building strategies.

In contrast, Coinrule may not be the best fit for:

- High-Frequency Traders: The platform is not designed for ultra-fast scalping strategies that require millisecond execution speeds.

- Advanced Quants and Coders: Traders who are comfortable with programming languages like Python may find the building block approach more restrictive than writing their own custom scripts.

- Users Needing Advanced Grid Bots: While you can build grid-like strategies, it lacks the dedicated, highly optimised Grid Bot terminals found on platforms like 3Commas.

How Does Coinrule Compare to the Competition?

The clearest way to understand Coinrule’s value is to see it next to a more complex competitor. This comparison effectively highlights its unique position in the market.

| Feature | Coinrule | 3Commas |

|---|---|---|

| Target Audience | Beginners & Non-Coders | Intermediate to Advanced Traders |

| Core Strength | Unmatched ease of use with “if-this-then-that” logic | Powerful, pre-built DCA and Grid bots |

| Learning Curve | Very low; intuitive from the start | Moderate; requires learning specific bot settings |

| Flexibility | Extremely high for custom logic | High for optimising pre-built bot types |

| Best For | Building your own unique strategies easily | Deploying proven, complex strategies quickly |

Beyond the Builder: Coinrule’s Learning & Support Ecosystem

A major concern for new users is being left alone with a new tool. Fortunately, Coinrule excels at providing a supportive environment to help you learn and grow.

- Knowledge Base: An extensive library of articles and guides explains every feature on the platform, from connecting an exchange to understanding technical indicators.

- Video Tutorials: For visual learners, Coinrule offers a range of video guides that walk you through the process of creating and launching rules.

- Responsive Customer Support: Furthermore, should you run into any issues, their support team is known for being helpful and responsive, ensuring you’re never stuck for long.

What Do the Experts Say About Coinrule?

“Coinrule’s IFTTT (If This Then That) logic is a godsend for non-technical traders who want to create their own automated trading strategies without having to learn how to code.” — HackerNoon

“Coinrule is a great platform for beginners and intermediate traders who want to automate their trading strategies. The platform’s ‘if-this-then-that’ rule builder is incredibly intuitive and makes it easy to create complex strategies without any coding knowledge.” — Coin Bureau

“The platform stands out for its user-friendly interface that allows traders to create custom automated trading rules based on the ‘If-This-Then-That’ principle. This approach democratizes algorithmic trading, making it accessible even to those without a programming background.” — BeInCrypto

Two Example Coinrule Strategies to Get You Started

Disclaimer: The following strategies are for educational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile. Therefore, you should always do your own research (DYOR) and test strategies thoroughly in the Demo Exchange before risking real capital. Past performance is not indicative of future results.

Strategy 1: The “Buy the Dip” Accumulator

- Goal: To automatically buy a set amount of a chosen cryptocurrency when its price drops significantly, allowing for steady accumulation at a lower average cost.

- Best For: Long-term investors who want to build their holdings in major coins like Bitcoin or Ethereum without having to time the market manually.

| Section | Condition / Action |

|---|---|

| IF | The price of BTC has a percentage decrease of 5% within 1 day |

| THEN | Buy $50 of BTC with my USDT wallet |

| AND THEN | Wait 1 week before this rule can trigger again |

Strategy 2: The “RSI Trend Rider”

- Goal: To enter a trade when a coin is potentially oversold and exit automatically after a modest price increase, aiming for consistent small gains.

- Best For: More active traders who want to capitalise on short-term trend reversals.

| Section | Condition / Action |

|---|---|

| IF | The RSI on ETH is below 30 on a 4-hour timeframe |

| AND | The price of ETH is above its 50-period Moving Average |

| THEN | Buy $100 of ETH with my USDT wallet |

| AND THEN | Take Profit at 3% |

Setting Realistic Expectations: An Honest Look for this Coinrule Review

It’s crucial in any honest Coinrule review to talk about profitability. While Coinrule is an incredibly powerful tool for executing your strategy, it does not guarantee profits. Automation is a tool for consistency and efficiency, not a “get rich quick” scheme. Ultimately, success requires patience, a willingness to learn from your tests on the Demo Exchange, and an understanding that not every rule will be a winner. Your goal should be to build a portfolio of sensible, well-tested rules that can perform consistently over the long term.

Common Mistakes New Coinrule Users Make (And How to Avoid Them)

- Making Rules Too Complex at First. The temptation is to stack dozens of conditions, thinking a more complex rule is a better one. However, this often leads to a rule that never triggers or behaves unexpectedly.

- How to Avoid It: Start with a simple, single condition and action. Test it on the Demo Exchange to ensure it works as you expect. Then, you can gradually add more layers of complexity.

- Not Using the Demo Exchange. Jumping straight to live trading with an untested rule is the fastest way to lose money.

- How to Avoid It: Every single new rule should run on the Demo Exchange for at least a few days. This is non-negotiable. Treat your demo trading as seriously as you would your live trading.

- Setting Unrealistic Profit Targets. New users might set a “Take Profit” action at 20% for a rule that trades frequently. In most market conditions, this target will rarely be hit, and consequently, the rule will underperform.

- How to Avoid It: Look at the asset’s recent volatility. For a day-trading rule, a profit target of 1-3% is often far more realistic and will result in more consistent performance.

Is a Coinrule Paid Plan Worth It? A Look at the ROI

For many users, the free “Hobbyist” plan is an amazing starting point. However, you should view upgrading to a paid plan as an investment, not an expense. Here’s why:

- More Rules = More Opportunities: The primary limitation of the free plan is the number of active rules. With a paid plan, you can run multiple strategies across different coins simultaneously. Indeed, one successful trade captured by an extra rule can easily pay for a month’s subscription.

- Access to Advanced Templates & Indicators: In addition, paid plans unlock the full template library and more advanced technical indicators, giving you a wider range of tools to build more robust strategies.

- Time is Money: A well-built rule saves you hours of chart-watching. The value of your time, combined with the potential for your rules to execute profitable trades 24/7, makes a paid plan a logical step for any serious trader.

A Quick Scenario: Making the Subscription Pay for Itself

Imagine you’re on the “Trader” plan (£29.99/month). You create a simple rule to buy £150 of a volatile altcoin if its RSI drops below 30, with an automatic take-profit at 4%. If that rule successfully executes just once a month, it generates a £6 profit. If you have five similar rules running, and just a few of them execute successfully, you have easily covered your subscription cost—with the rest being pure profit.

Why You Should Start with Coinrule Today

Reading a Coinrule review is one thing, but taking action is how you gain an edge. The crypto market operates 24/7, and every hour you spend manually watching charts is an hour you could have a rule working for you. By starting today, you can:

- Stop Missing Dips: Automate your accumulation strategy so you never miss a buying opportunity again.

- Trade Without Emotion: Let your pre-defined rules make logical decisions, protecting you from fear and greed.

- Start Learning Risk-Free: Best of all, the free plan and demo exchange allow you to build your confidence and test every feature without committing any real money.

Your Final Checklist Before You Start

- [ ] Do you have an account on a supported crypto exchange?

- [ ] Are you looking for a user-friendly way to automate your trading?

- [ ] Are you ready to use the Demo Exchange to learn and test your strategies first?

- [ ] Are you excited to build your own trading rules without needing to code?

If you answered “yes” to these questions, then Coinrule is likely the perfect platform for you.

Your 3-Step Plan to Get Started (Risk-Free)

Ready to stop watching the charts and start automating your strategy? Here’s what you gain by starting today:

- Automate Your Strategy: Let your rules work for you, 24/7.

- Trade Without Emotion: Execute your plan with logic, not fear or greed.

- Learn Without Risk: Test every idea on the Demo Exchange before spending a penny.

The best part about Coinrule is that you can get started and learn the entire platform without any financial commitment.

- Create Your Free Account: Use this link to sign up for Coinrule’s free “Hobbyist” plan. No credit card is required.

- Connect an Exchange to the Demo Environment: Follow the simple on-screen instructions to link your exchange account for paper trading. This is completely safe and only takes a minute.

- Launch Your First Rule from a Template: Go to the Template Library, choose a simple strategy like “Buy the Dip on Major Coins,” and launch it on the Demo Exchange. Watch how it works and start your journey into automated trading!

Coinrule Pricing: Costs & Plans Explained

Coinrule offers a tiered subscription model with a fantastic free forever plan, making it highly accessible.

| Plan | Official Price (GBP/month) | Key Features |

|---|---|---|

| Hobbyist | £0 (Free Forever) | 2 Live Rules, 2 Demo Rules, 1 Connected Exchange. Perfect for starting. |

| Trader | £29.99 | 7 Live Rules, 7 Demo Rules, 3 Connected Exchanges, access to more templates. |

| Pro | £59.99 | 15 Live Rules, 15 Demo Rules, 5 Connected Exchanges, fastest execution speeds. |

Disclaimer: Prices are subject to change. Annual plans offer a discount.

Is Coinrule Safe to Use? A Look at Security

- API Keys with No Withdrawal Rights: Just like other reputable platforms, you connect your exchange via API keys and must disable withdrawal permissions. This ensures Coinrule can trade for you but cannot access your funds.

- Two-Factor Authentication (2FA): It is essential to enable 2FA on your Coinrule account for an extra layer of security.

- UK-Based Company: As a UK-registered company, Coinrule operates within a strong regulatory and data protection framework, which can provide extra peace of mind for users.

Author’s Verdict: My Personal Take on this Coinrule Review

After thoroughly testing the platform for this Coinrule review, my conclusion is clear: Coinrule is the most accessible and intuitive trading bot platform on the market. It successfully demystifies automated trading and empowers non-technical users to build strategies that were once the exclusive domain of coders. For me, its greatest strength is its ability to serve as both a powerful tool and an excellent educational platform where you learn by doing in a creative and risk-free environment. The biggest personal win has been the creativity it unlocks; I can finally test out all the “what if” trading ideas I’ve had without needing to code. For these reasons, I highly recommend it for anyone who has been curious about trading bots but felt intimidated by the complexity of other platforms.

Frequently Asked Questions (FAQ)

Is Coinrule good for beginners? Yes, it is the best platform for beginners due to its “if-this-then-that” logic and extensive template library. This Coinrule review confirms it is a top choice for new users.

Can you actually make money with Coinrule? Yes, but profitability depends entirely on your strategy, risk management, and market conditions. The platform is a tool; it does not guarantee profits.

What is the best feature of Coinrule? The visual, no-code Rule Builder is its standout feature, making automated strategy creation accessible to everyone.

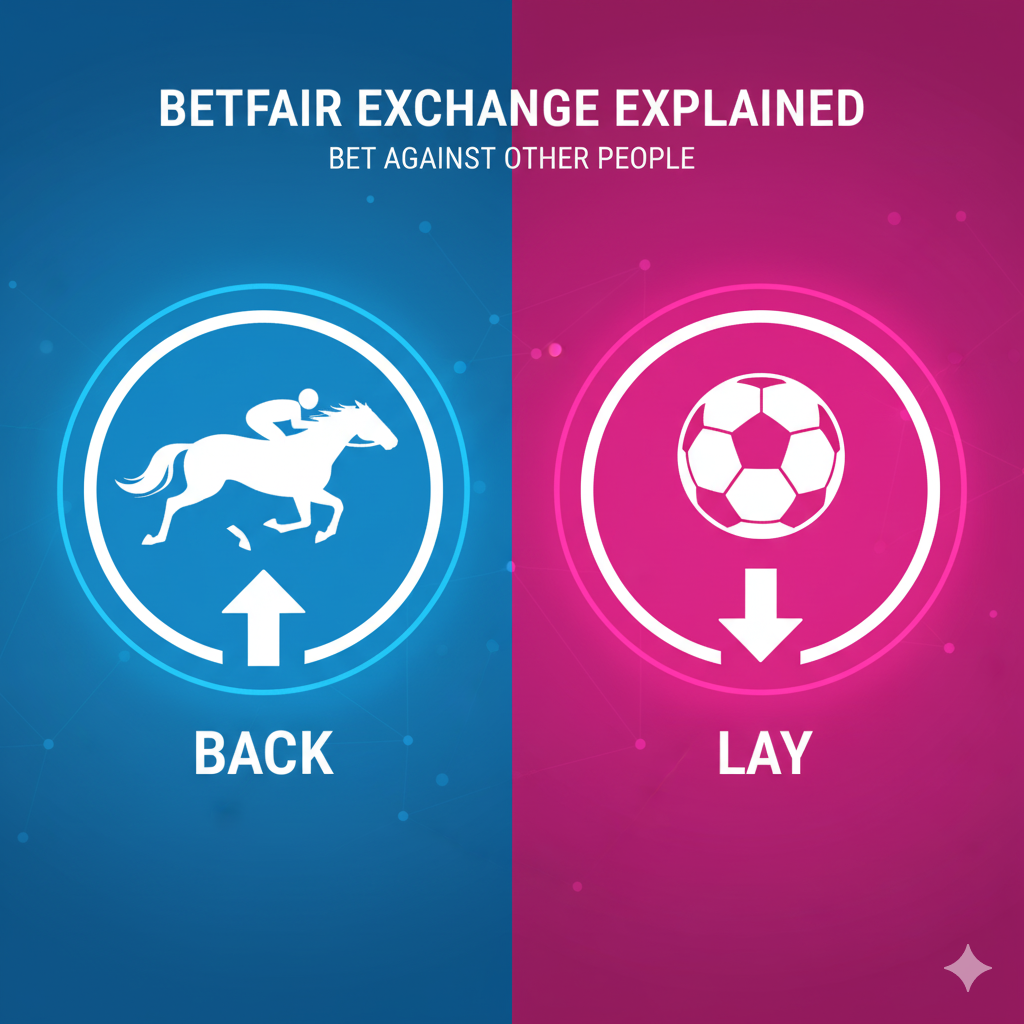

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Betfair Trading Strategies: The Ultimate 2026 Guide to Football Betting Automation

Executive Summary: The Era of the Algorithmic Trader The year 2026 marks a turning point for the Betfair Exchange. The…

Dutching Betting Strategy Guide (2026): Includes Free Excel Calculator & Automation Tools

We’ve all been there. You stare at the race card, torn between the 3/1 favourite who looks solid and the…

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of…

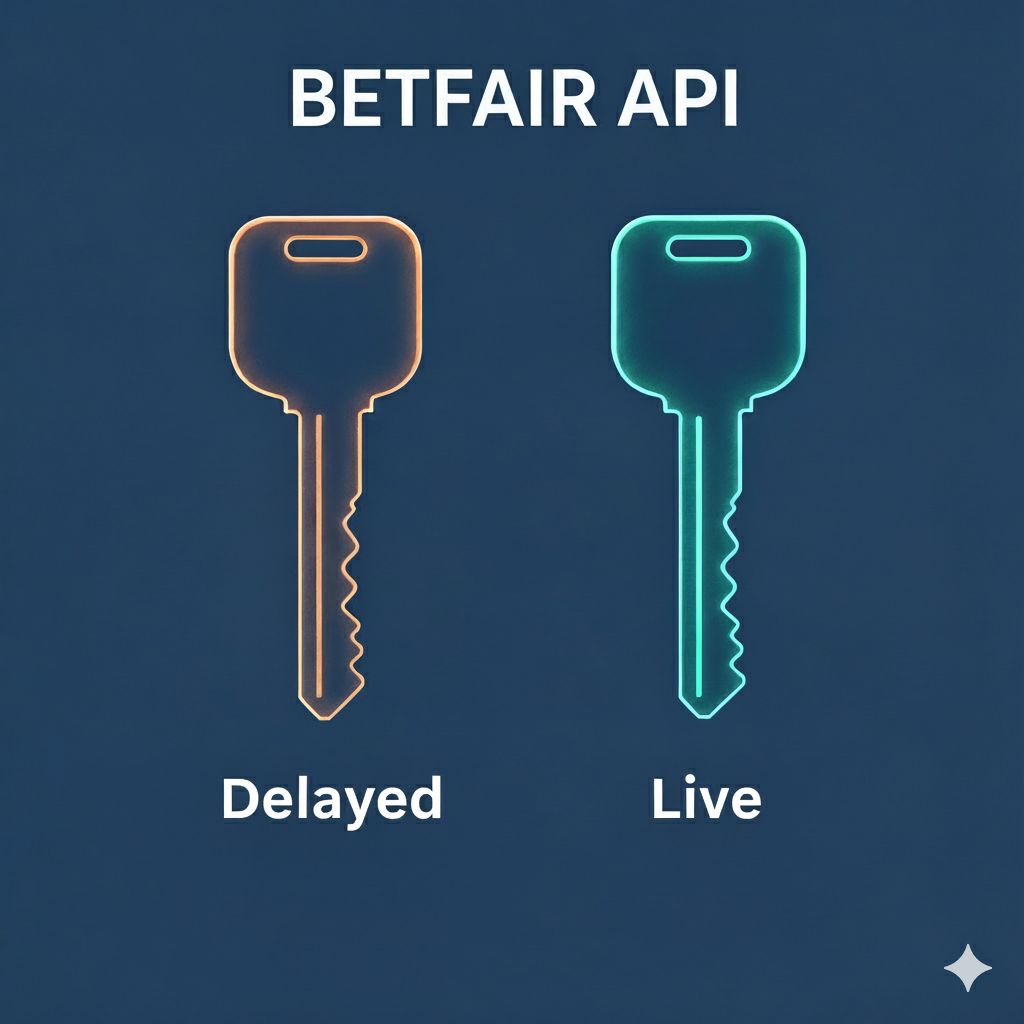

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge…