The UK’s cryptocurrency market is dynamic and, while facing increasing regulation, still offers a solid range of options for both new and experienced investors. The Financial Conduct Authority (FCA) has been tightening its oversight, which means that platforms operating in the UK must adhere to strict standards. This ensures a safer and more transparent environment for investors.

Here is an updated look at some of the most prominent crypto exchanges available to users in the UK, with details on their offerings and suitability.

1. Crypto.com

Crypto.com is a popular choice for UK investors, known for its user-friendly mobile app and a wide variety of supported cryptocurrencies. It is registered with the FCA, which allows it to provide reliable GBP services through bank transfers and other payment methods. The platform also offers an “Exchange” for more advanced users, which features lower fees for active traders. Its main draw is the combination of a broad asset range with flexible GBP payment options.

- Trading Bots: Crypto.com offers its own built-in trading bots, specifically Dollar-Cost Averaging (DCA) and Grid Trading Bots. These are available to all verified UK users on the Crypto.com Exchange. The cost of using these bots is included in the standard trading fees, meaning there are no additional subscription or per-bot fees.

2. Kraken

As one of the oldest and most trusted exchanges, Kraken has been serving UK investors since 2014. It is highly regarded for its robust security measures and a wide selection of over 300 cryptocurrencies. Kraken caters to both beginners and more experienced traders with features like spot trading, staking, and futures trading. It is FCA-registered and provides a reliable, compliant, and secure platform for UK users.

- Trading Bots: While Kraken does not have a native, built-in trading bot service, it is a highly popular exchange for third-party bot providers like Bitsgap, 3Commas, and others. These services connect to your Kraken account via API keys. The pricing for these bots is external to Kraken and is typically subscription-based, ranging from around £15 to over £100 per month depending on the features and number of bots you wish to run. These third-party services are generally available to UK users.

3. Coinbase

Coinbase is often the go-to platform for beginners in the UK due to its intuitive interface and strong brand recognition. It has been operating in the UK since 2015 and is FCA-registered. While its fees can be higher for instant purchases, its “Coinbase Advanced” platform offers lower fees for more active traders. Coinbase is known for its deep GBP liquidity and extensive range of cryptocurrencies.

- Trading Bots: Similar to Kraken, Coinbase does not offer its own trading bots but allows UK users to connect with a variety of external bot services through its API. The cost is determined by the third-party provider, and you will need to research the pricing plans of services like Bitsgap, 3Commas, or others to find one that suits your needs.

4. Uphold

Uphold is a multi-asset platform that allows users to trade not only cryptocurrencies but also traditional assets like stocks and precious metals. It is available to UK users and provides access to over 250 crypto assets with major GBP pairs. Uphold is known for its straightforward platform and is a good option for those looking to diversify their portfolio beyond just crypto.

- Trading Bots: At present, Uphold does not have a native trading bot feature. You would need to use a third-party service that supports Uphold’s API to run automated strategies. The availability of these services for UK users may vary.

5. Revolut

While primarily a digital banking app, Revolut has expanded its services to include cryptocurrency trading. Its crypto offering is integrated directly into its main app, making it incredibly convenient for existing users. Revolut also has a dedicated “Revolut X” platform for more advanced crypto trading, which offers lower fees and more analytical tools. It is FCA-registered and provides a seamless experience for those who want to manage both their fiat and crypto finances in one place.

- Trading Bots: Revolut does not currently offer a trading bot feature within its platform.

6. Nexo

Nexo is a platform focused on crypto-backed loans and interest-earning accounts. It allows users to earn interest on their crypto holdings and borrow against them without selling. It supports a selection of over 100 cryptocurrencies and is a good option for those looking to use their crypto as a financial tool rather than just a speculative asset.

- Trading Bots: Nexo does not provide a native trading bot function.

7. eToro

eToro is a popular platform in the UK that is well-known for its social trading features, such as “CopyTrader,” which allows users to automatically copy the trades of top-performing investors. It offers a user-friendly interface and is FCA-regulated, making it a safe choice for beginners. eToro’s platform includes not just crypto but also stocks and ETFs, providing a versatile trading experience.

- Trading Bots: While eToro does not have a traditional trading bot, its “CopyTrader” and “Smart Portfolios” features function in a similar way by allowing you to automate your investments by copying the strategies of others or investing in pre-built portfolios. These features are fully available to UK users. There are no additional fees for using these features, beyond the standard trading fees and spreads.

8. Bitstamp

Bitstamp is a Luxembourg-based exchange with a long-standing reputation for security and reliability. It offers a professional trading platform with competitive fees and a solid selection of cryptocurrencies. It is a good choice for both beginners and experienced traders who are looking for a reliable and transparent exchange.

- Trading Bots: Like many of the platforms listed, Bitstamp supports a range of third-party trading bot services. UK users can connect services like Bitsgap and others via API, and the cost will be based on the pricing model of the specific bot provider.

9. Gemini

Gemini is another highly-regarded exchange that places a strong emphasis on security and compliance. It is one of the few platforms to be authorized by the FCA as both an Electronic Money Institution and a registered crypto-asset firm. While its fees can be higher than some competitors, its commitment to security and regulation makes it a trusted option for UK investors.

- Trading Bots: Gemini allows for API connectivity, which means UK users can use third-party trading bot services with the platform. The cost will be determined by the provider you choose.

10. CoinJar

CoinJar is an Australian exchange that has a strong presence in the UK market. It is registered with the FCA and offers a simple and accessible platform for buying and selling cryptocurrencies. It provides a straightforward user experience and is a good option for those who are new to crypto trading.

- Trading Bots: CoinJar does not have its own integrated trading bot service. UK users would need to use a third-party bot provider that supports the CoinJar API.

Fee Comparison Table

When choosing a crypto exchange, fees are a crucial factor to consider. They can vary widely based on the platform, the type of transaction (e.g., instant buy vs. trading), and your trading volume.

| Platform | Trading Fees (Standard/Instant Buy) | Trading Fees (Advanced/Pro) | Deposit Fees (GBP) | Withdrawal Fees (GBP) | Other Key Fees |

| Crypto.com | 0.40% (Tiered) | Lower, tiered based on volume | Free (via FPS) | £1.90 | Debit/Credit Card: 1% |

| Kraken | Varies, up to 1.5% | Maker/Taker fees, tiered based on volume (e.g., 0.25% maker / 0.40% taker for low volume) | Free (via FPS) | Free (via FPS) | Spread on instant buys |

| Coinbase | Varies, up to 3.99% for card purchases | Maker/Taker fees, tiered based on volume (e.g., 0.60% taker for low volume) | Free (via FPS) | Free (via FPS) | Spread on instant buys |

| Uphold | 0.20% for major currencies | N/A | Free (via FPS) | Free (via FPS) | Debit/Credit Card: 3.99% |

| Revolut | Tiered based on subscription plan & volume (e.g., Standard: 1.49%) | Lower fees for “Revolut X” | Free (Bank Transfer) | Free (Bank Transfer) | Monthly subscription fee may apply |

| Nexo | “No trading fees” on their platform. | N/A | Free | Free withdrawals (tiered) | Interest rates on loans & crypto-backed credit lines |

| eToro | 1% (Buy/Sell fee for crypto) | N/A | Free (Bank Transfer) | $5 (£3.90 approx.) | $10 monthly inactivity fee after 12 months |

| Bitstamp | 0.40% (Taker) / 0.30% (Maker) for low volume | Tiered based on trading volume | Free (via FPS) | £2.00 (via FPS) | Varies based on trading volume |

| Gemini | High, fixed fees on basic app (e.g., £2.99 on a £100 trade) | Maker/Taker fees, tiered (e.g., up to 0.40% taker) | Free (via FPS) | Free (up to 10 withdrawals per month) | High fees on mobile app vs. “ActiveTrader” platform |

| CoinJar | 1% for Instant Buy/Sell | Maker/Taker fees, tiered based on volume (e.g., 0.10% maker/taker) | Free (via FPS) | Free (via FPS) | 2% for card purchases |

Export to Sheets

Trading Bot Comparison

The availability and features of trading bots vary significantly. Some exchanges offer native bots, while others require third-party integration. The type of bot (e.g., Grid, DCA) and the pricing model are key differentiators.

| Platform | Bot Availability | Types of Bots | Pricing | Available to UK Users? |

| Crypto.com | Native, built-in bots | Grid, DCA (Dollar-Cost Averaging) | Included in standard trading fees | Yes |

| Kraken | Third-party only (API) | Varies by provider (e.g., Grid, DCA, Arbitrage) | External, subscription-based (e.g., £15-£100+/month) | Yes |

| Coinbase | Third-party only (API) | Varies by provider (e.g., Grid, DCA, Arbitrage) | External, subscription-based (e.g., £15-£100+/month) | Yes |

| Uphold | Third-party only (API) | Varies by provider | External, subscription-based | Yes (varies by provider) |

| Revolut | None | N/A | N/A | No |

| Nexo | None | N/A | N/A | No |

| eToro | Native social features | CopyTrader, Smart Portfolios | Included in standard trading fees and spreads | Yes |

| Bitstamp | Third-party only (API) | Varies by provider (e.g., Grid, DCA) | External, subscription-based | Yes |

| Gemini | Third-party only (API) | Varies by provider | External, subscription-based | Yes |

| CoinJar | Third-party only (API) | Varies by provider | External, subscription-based | Yes |

Export to Sheets

Disclaimer: Cryptocurrency investments are high-risk and volatile. You should be prepared to lose all the money you invest. This is not financial advice. Always conduct your own research and consider your own financial situation before making any investment decisions. Fees and bot availability are subject to change and may vary based on specific transactions and user status.

-

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You bet…

-

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of software,…

-

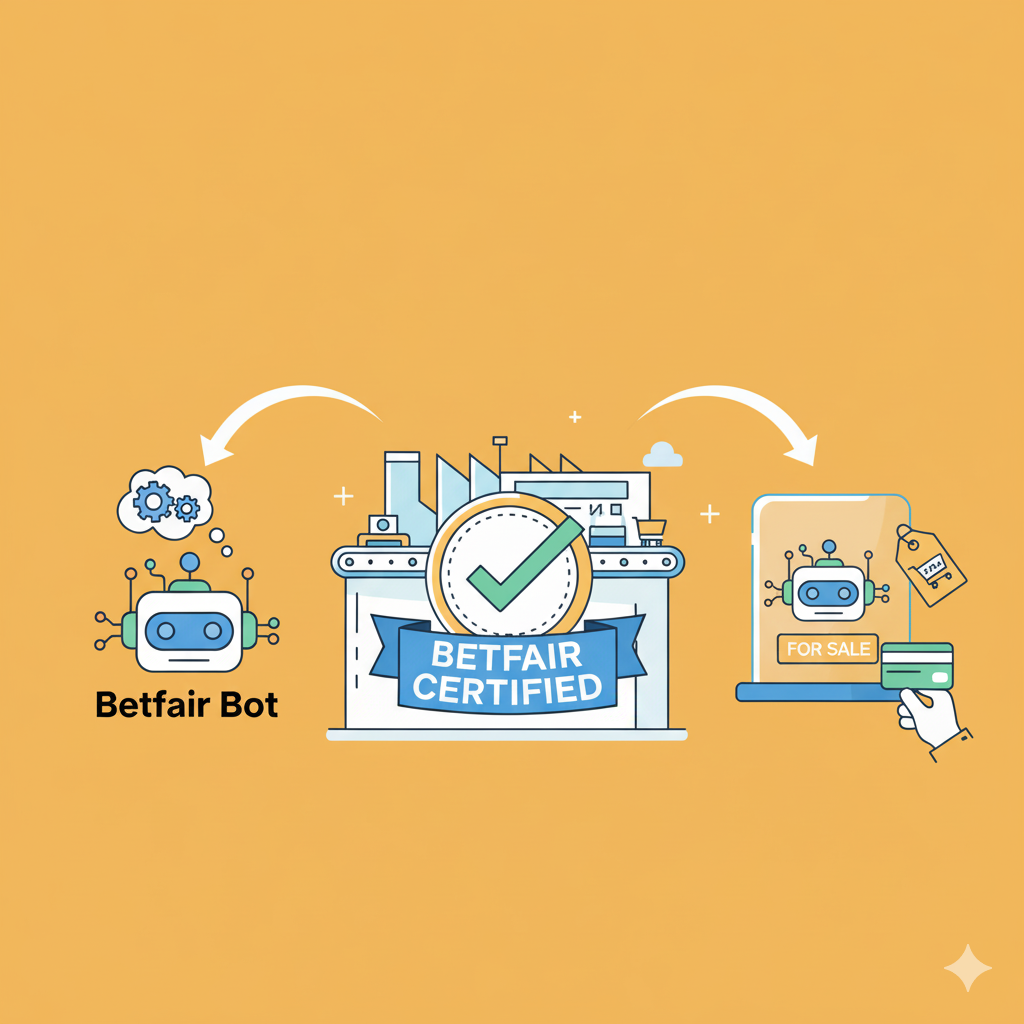

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge is…

-

Build Your First Betfair Bot Web App with Python & Flask (Free Local Tutorial)

Ever wanted to build a Betfair bot? This Betfair bot tutorial actively guides you through creating a basic web application using…

-

Bitsgap Review 2026: Is This Crypto Trading Bot Worth It?

The crypto world is fast-paced and often overwhelming; staying ahead and executing timely trades can feel like a full-time job. Many…

-

Traderline Review 2026: Is the New Betfair Trading Software Worth It?

If you’re looking for the best Betfair trading software in 2026, you’ve probably heard about the new Traderline. This isn’t just…