In the dynamic world of sports betting, traders constantly pursue a strategic edge. Ladder trading is one of the most sophisticated and effective methods seasoned traders use today. When you execute this technique with an automated bot connected to a sports exchange, you transform the chaotic betting landscape. This comprehensive guide will explore ladder trading’s intricacies. We’ll explain exactly how and when to place back and lay bets. We’ll focus on the critical metric: the volume of money available for matching. Furthermore, we’ll thoroughly explain the critical importance of reaching the front of the betting queue and the methods to achieve this.

Understanding the Sports Exchange Ecosystem

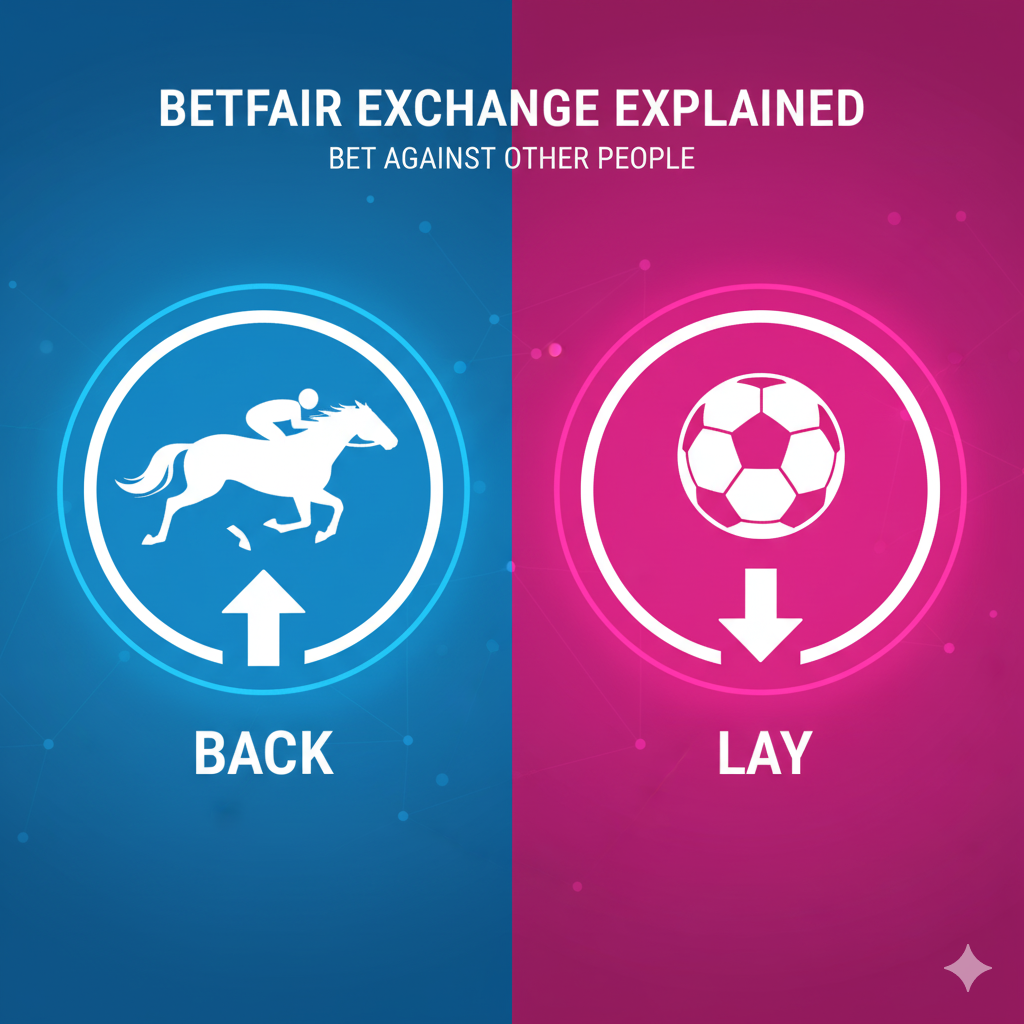

Before we unravel the mechanics of ladder trading, you must understand the arena where it operates. This is the sports exchange. Unlike traditional bookmakers, exchanges like Betfair or Betdaq operate as peer-to-peer marketplaces. Here, users can both back an outcome (bet for it to happen) and lay an outcome (bet against it). This effectively lets them act as the bookmaker.

This dual-function marketplace creates a continuous flow of supply and demand. Odds fluctuate based on the weight of money and incoming information. Crucially, the exchanges match bets on a first-come, first-served basis at any given price. The ladder trading strategy finds its opportunity within these price movements and the queue-based matching system.

What is Ladder Trading?

Ladder trading is a strategy. It involves placing opposing back and lay bets on the same selection. You place these at different points on the odds “ladder.” The primary goal is to secure a green book. This means a profit regardless of the event’s outcome. This is a form of financial trading applied to sporting events, distinct from pure gambling. It focuses on price movements rather than solely on predicting winners and losers.

The strategy heavily depends on analyzing the order book or market depth. This displays the amount of money waiting to be matched at various odds. The execution of this strategy requires speed and constant market monitoring. An automated, dedicated trading bot performs it much better.

The Indispensable Role of Trading Bots

Manual ladder trading is theoretically possible, but in practice, it’s almost impossible to execute effectively. The markets move with incredible speed. This is especially true in-play during a live sporting event. A trading bot is software that connects to a sports exchange via an API. Programmed to follow specific rules, it can react to market changes in milliseconds. It places bets without human intervention.

Bots like Geeks Toy are designed specifically for this environment. They provide a visual interface, often a ladder interface. This shows the available money at each price point. It also allows for the automation of complex trading strategies. Most importantly, they are configured to manage order placement to maximize your chance of being at the front of the queue.

The Core Principle: Reading Market Depth

Your entire decision-making process in ladder trading revolves around interpreting the volume of money available at different prices. People often call this the “wall” of money.

A large volume of money at a particular price point acts as a barrier. This makes it difficult for the odds to move beyond that point. For example, if £50,000 is waiting to lay a horse at odds of 5.0, the odds will likely struggle to shorten below that price. This is true until the market consumes that money.

Conversely, a thin volume of money means little resistance. The odds can move through that price quickly. This happens with a relatively small amount of matched money.

This dynamic is the cornerstone of deciding when to place your back and lay bets.

The Critical Advantage: Getting to the Front of the Queue

On a sports exchange, each price point has a queue. When you place a bet at a specific odds, you go to the back of the queue for that price. The exchange only matches your bet when it has matched all the money in front of you. This money comes from bettors taking the opposite view.

Why is this so important for ladder trading?

Speed is everything. Your trading bot might identify a fleeting opportunity based on market depth. But if your order goes to the back of a long queue, the opportunity will likely vanish. This will happen before the exchange matches your bet. You might try to back at 2.10. But if £10,000 is already in the queue ahead of you, a sudden price move will see that 2.10 price disappear. Your order will go unmatched. This causes a missed opportunity or a worse entry price.

Therefore, your objective is not just to place a bet at the right price. You also need to place it ahead of others at that same price.

How to Get to the Front of the Queue

To achieve queue priority, you must be the first to place an order at a new price. You can also use a specific order type. You primarily accomplish this through two methods:

1. Placing Orders at New Prices (Picking Off Prices)

The most effective way to get to the front of the queue is to be the very first person to place a bet at a new price point. This happens as the market moves. For example, if the current best available lay price is 2.12 and the market is moving up, a new back price of 2.14 might become available. The first trader to place a back bet at 2.14 will be at the very front of the queue for that price. As the market continues to move, others will want to back at 2.14. They will queue behind this initial bet.

Trading bots excel at this. You can set them to monitor price movements. They can instantly place an order the millisecond a new price becomes available. People often call this “price picking” or “stepping ahead of the market.”

2. Using ‘Cancel and Replace’ or ‘Place and Modify’

This is a vital functionality within all advanced trading bots. Instead of placing a new, separate bet, this technique involves a few steps.

- You initially place an order at a desired price (e.g., a lay at 2.00).

- If the market moves away from this price, the exchange will unlikely match the order.

- The bot will then cancel the existing unmatched order. It will immediately replace it with a new order at a more relevant price (e.g., a lay at 1.98).

The key advantage is that the bot executes this cancel-and-replace action as a single, near-instantaneous instruction. The new price (1.98) has just become available. This rapid action ensures the bot’s order is one of the first at that price. This secures a prime position in the new queue. Manual traders cannot compete with the speed of a bot. Bots can execute hundreds of these commands per minute.

When to Place the Back Bet

A back bet in a ladder trading strategy is typically triggered by two things. One is identifying strong support at a higher price point. The other is the ability to gain queue priority.

Scenario: Backing at a Higher Price with Large Lay Volume Below

You often place a back bet when you detect a significant volume of lay money. This money is at a price below the current odds. This large volume creates a strong support level. It suggests the price is unlikely to fall further in the immediate term. The trader, anticipating a potential price rise or at least stability at the current price, will seek to place a back bet at the best available higher odds.

Execution and Queue Priority: The trading bot will be programmed not just to place a back bet at, for example, 2.10. It will do so in a way that secures its queue position. If 2.10 is already a crowded price, the bot might instead place an order at 2.12. This is if it anticipates that price is about to become available. The goal is to be the first to get an order matched at a favorable price before the market moves away.

Why? The large wall of lay money provides a buffer. If the price does decrease, you expect that support to halt and potentially reverse it. This protects the back bet from significant immediate loss. By being at the front of the queue, the trader ensures their back bet is matched while the price is still favorable. This maximizes potential profit on the subsequent lay bet.

When to Place the Lay Bet

Conversely, you usually base the decision to place a lay bet on two things. One is identifying strong resistance at a lower price point. The other is securing a queue advantage.

Scenario: Laying at a Lower Price with Large Back Volume Above

You often place a lay bet when you identify a significant volume of back money. This money is at a price above the current odds. This large volume creates a strong resistance level. It suggests the price is unlikely to rise above that point. The trader, anticipating a price fall, will seek to place a lay bet at the best available lower odds.

Execution and Queue Priority: The bot will attempt to place a lay order at the most advantageous price point. For instance, if the market is drifting downward and a new low price of 1.96 is forming, the bot will use a cancel-and-replace command. It will quickly move its unmatched lay order from 1.98 to 1.96. The aim is to be the first order in the queue at this new price. This ensures the exchange matches it quickly as the market falls into this new price level.

Why? The large wall of back money above acts as a ceiling. By laying at the current lower price and being first in the queue, the trader “sells” an asset they anticipate will decrease in value. This means the odds will shorten further. When the price drops, the trader can later close out the lay bet. They do this by backing at even lower odds for a profit.

The Art of Securing the Profit: Closing the Trade

The ultimate goal is not just to place these bets. It’s to close the position for a guaranteed profit. You achieve this by placing the opposing bet once a favorable price movement has occurred. Again, you must pay attention to queue position.

- If the price rises after a back bet: After you place a back bet at higher odds (e.g., 2.10) and the price subsequently rises due to market forces (e.g., a player breaks serve), you then place a lay bet at the new, lower odds (e.g., 1.80). To ensure the exchange instantly matches this profit-securing lay bet, you may place it a tick above the current best available price. This is if the market is moving fast. You sacrifice a tiny amount of potential profit for the certainty of closing the trade.

- If the price falls after a lay bet: After you place a lay bet at lower odds (e.g., 2.00) and the price falls further (e.g., to 1.70), you then place a back bet at the new, even lower odds. The bot will use its speed to get this back bet matched quickly. This locks in the profit.

The key determinant for when the bot executes this closing bet is the volume of money. The bot will be programmed to attempt to get the closing bet matched at the most favorable price. It does this by assessing the available liquidity and its potential position in the queue.

Advanced Considerations: Staking and Risk Management

Furthermore, a bot’s sophistication allows for dynamic staking. This is based on the volume of money.

- You can deploy larger stake sizes when the walls of money are exceptionally large. This indicates a higher conviction level in the market’s direction. It also provides more safety due to the stronger support/resistance. A good queue position is even more critical here. Larger stakes require more liquidity for a full match.

- We advise smaller stake sizes or even abstaining from a trade when the market depth is thin and volatile. The predicted support and resistance levels can be easily broken. This leads to potential losses. In thin markets, queue position is less critical as fewer participants exist. However, the risks are higher.

Risk management rules, such as stop-loss orders, are also a critical component. They automatically close a trade after a certain deficit. You must also manage these stop orders with queue priority in mind. This ensures the exchange matches them when you need them.

Conclusion: The Symbiosis of Strategy and Technology

Ladder trading represents the convergence of financial trading principles and sports betting markets. Success doesn’t come from a mystic prediction. It comes from a calculated analysis of supply and demand. You visualize this through the volume of money in the market order book. You make the decision to place a back bet when you identify strong lay support below the current price. Strong back resistance above triggers a lay bet.

However, this strategic insight is useless without the technological ability to act upon it. The human mind is simply not equipped to monitor dozens of markets simultaneously. It can’t interpret market depth. It can’t execute trades with millisecond precision. Most importantly, it can’t master the queue-based matching system through constant cancel-and-replace commands. Consequently, using a robust trading bot from providers like Geeks Toy is an absolute necessity for implementing this strategy effectively. By automating the process with a focus on queue priority, traders can systematically identify opportunities. They can execute trades at optimal prices. They can manage risk. Ultimately, they strive for consistent profits in the exhilarating world of sports exchange trading.

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Betfair Trading Strategies: The Ultimate 2026 Guide to Football Betting Automation

Executive Summary: The Era of the Algorithmic Trader The year 2026 marks a turning point for the Betfair Exchange. The…

Dutching Betting Strategy Guide (2026): Includes Free Excel Calculator & Automation Tools

We’ve all been there. You stare at the race card, torn between the 3/1 favourite who looks solid and the…

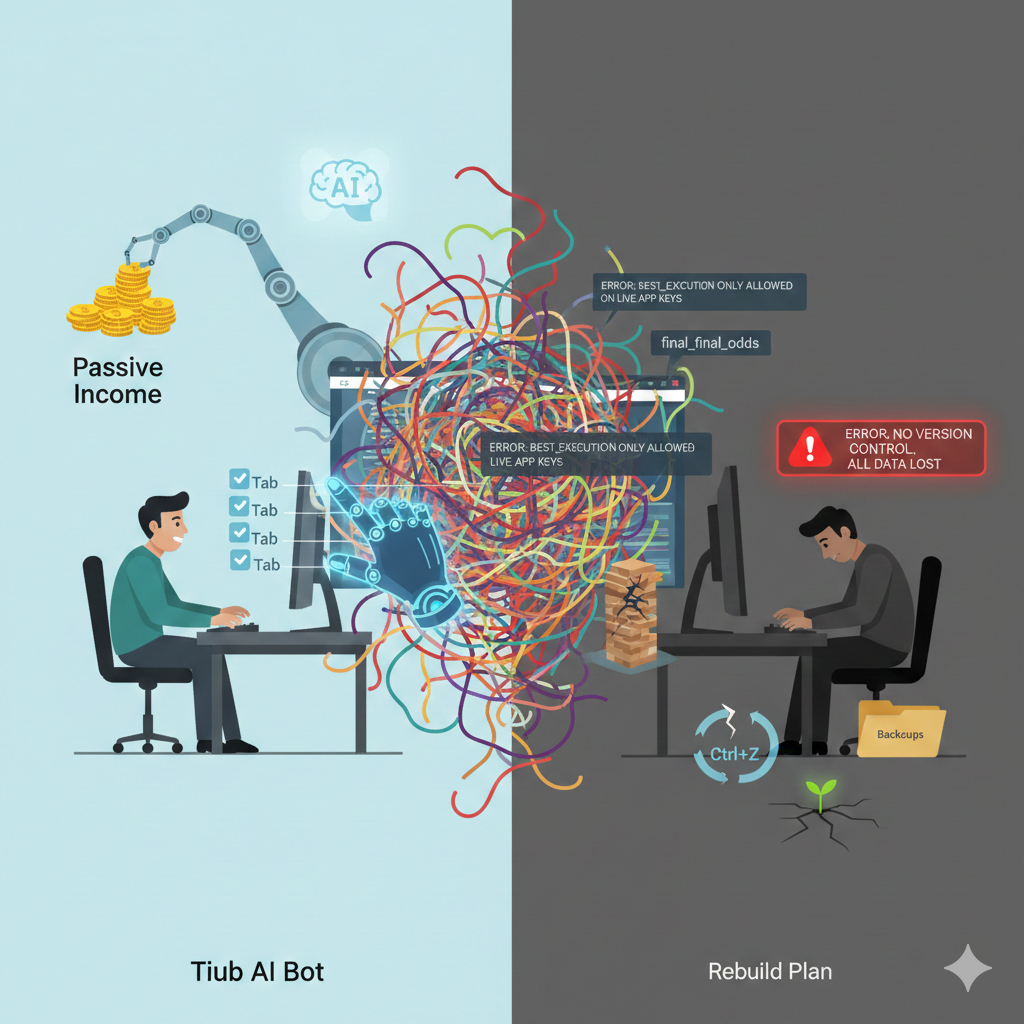

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

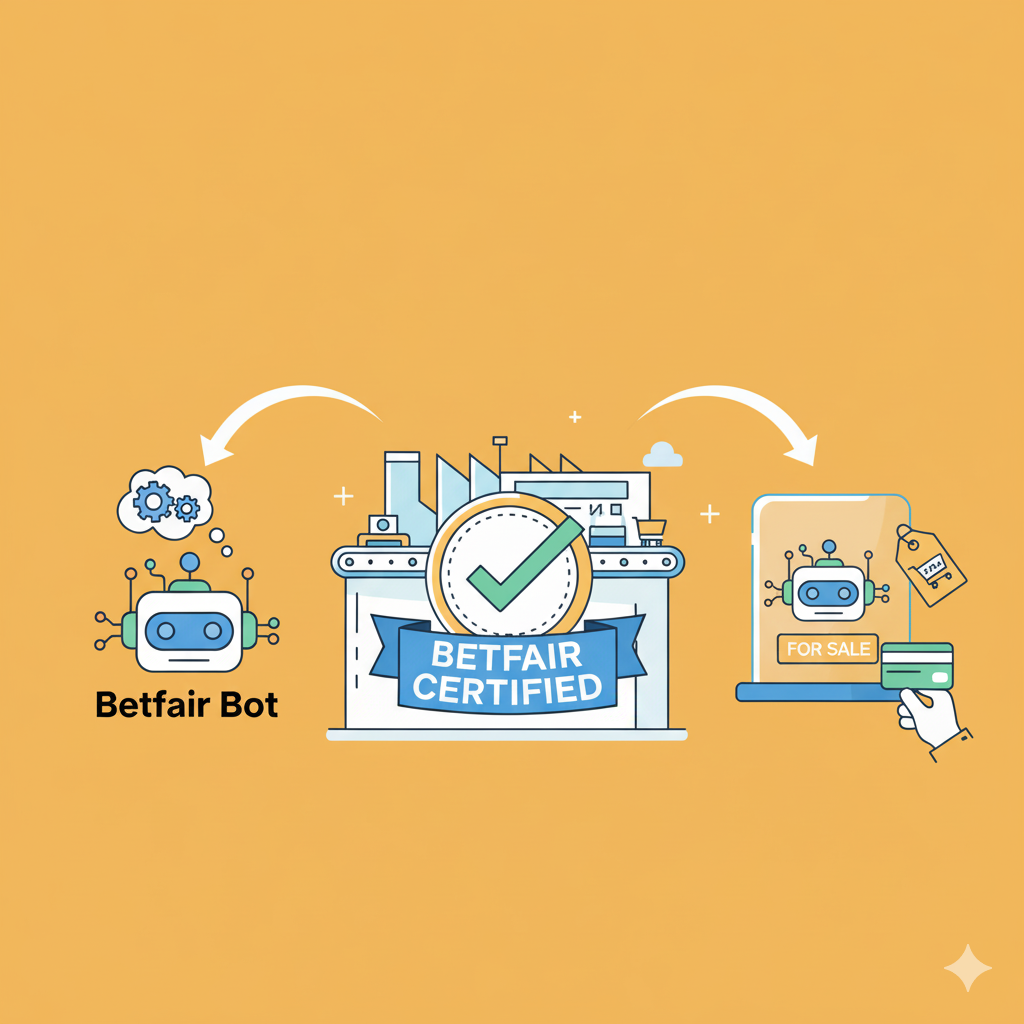

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of…

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge…