In the world of sports betting, a quiet revolution has been happening for over two decades. While traditional bookmakers still dominate the landscape with their familiar fixed-odds model, a more dynamic, and for many, more profitable, alternative has taken root: the sports betting exchange. These platforms, acting as a virtual marketplace, allow bettors to bypass the bookie and bet directly against one another. The result is a system that is more transparent, offers better odds, and provides a level of control that traditional betting can’t match.

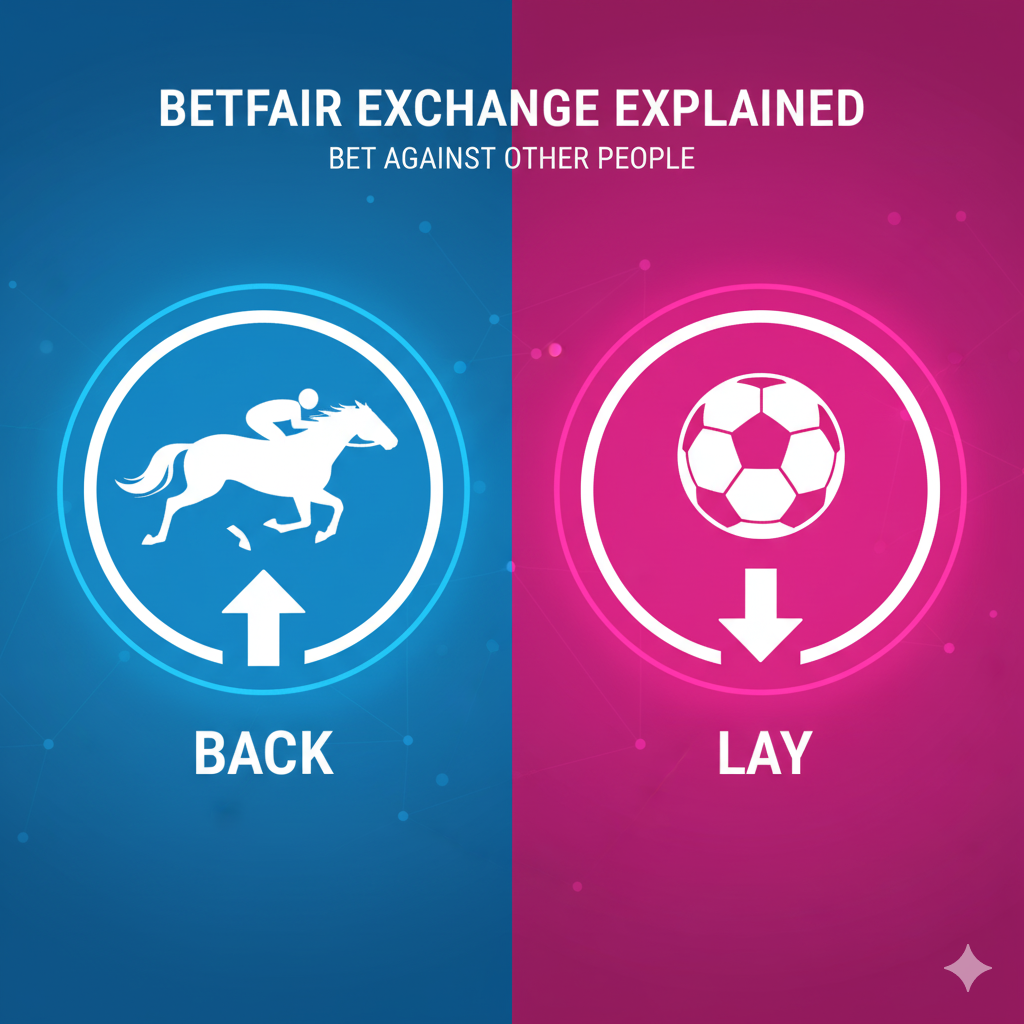

For those new to the concept, a betting exchange is akin to a stock market for sports. Instead of the house setting the odds, users do. You can either “back” an outcome (betting that it will happen, just like a traditional bet) or “lay” an outcome (betting that it won’t happen, effectively acting as the bookmaker). This simple but powerful distinction opens up a universe of possibilities, from simply getting a better price to sophisticated trading strategies that can lock in a profit before an event has even finished.

The rise of the sports exchange has given birth to a new kind of bettor—the “trader.” These individuals aren’t just placing a bet and hoping for the best; they are actively managing their positions, much like a financial trader would. They buy low and sell high, capitalizing on the constant flux of odds as a game unfolds. This article will serve as your guide to this exciting world, comparing the giants of the industry and highlighting what makes each platform unique.

The Pillars of the Exchange: Key Differentiators

Before we dive into the specific exchanges, it’s crucial to understand the metrics by which they are judged.

- Commission: This is how exchanges make their money. Unlike a traditional bookmaker that builds a margin into their odds, exchanges charge a small percentage on your net winnings on a market. The lower the commission, the more profit you keep. However, it’s not always as simple as a flat rate. Some exchanges have tiered structures or special promotions that can lower this cost.

- Liquidity: This is the lifeblood of an exchange. Liquidity refers to the amount of money available to be matched on a given market. High liquidity means you can get your bets matched quickly and at the odds you want. It also allows for larger stakes and more effective trading. A market with low liquidity, on the other hand, can be frustrating, as your bets may go unmatched or you may be forced to accept less favorable odds.

- Market Range: While a bookmaker might offer thousands of markets, exchanges often focus on the most popular ones where they can guarantee enough liquidity. The breadth and depth of markets—from major football leagues to obscure tennis matches—is a key point of comparison.

- Interface and Features: The user experience matters, especially for traders who need a fast, reliable, and intuitive platform. Features like live streaming, advanced charting, and API support for automated trading are significant advantages.

A Tale of Two Giants: Betfair vs. Matchbook

No discussion of sports exchanges is complete without starting with the undisputed leader and its most notable challenger.

Betfair: The Original and the Gold Standard

Betfair is to sports exchanges what Google is to search engines. It pioneered the concept and remains the largest and most liquid platform in the world.

- Liquidity: Betfair’s liquidity is its single greatest asset. For major events, millions of pounds can be matched on a single market, making it the ideal platform for professional traders and high-stakes bettors. This deep pool of money ensures you can almost always get your bets matched, which is critical for executing trading strategies.

- Market Coverage: The sheer volume of markets on Betfair is unmatched. They cover everything from the Premier League and horse racing to niche sports and even political events. This extensive range provides ample opportunities for traders to find value.

- Commission: Betfair’s commission structure is a tiered model, generally starting at 5% and decreasing based on how much you bet. While this can be higher than competitors, the superior liquidity often makes it worthwhile. For the most successful bettors, Betfair has a “Premium Charge,” a controversial fee levied on highly profitable accounts.

- Features: Betfair has a sophisticated platform with a wide array of tools, including live streaming, detailed form guides, and an advanced API that allows for the use of third-party trading software.

- Website: https://www.betfair.com

Matchbook: The Lean and Mean Competitor

Matchbook has positioned itself as a sleek, low-commission alternative to Betfair. It’s often favored by bettors and traders who are more sensitive to commission costs.

- Commission: Matchbook’s primary selling point is its commission structure, which is a flat 2% on net winnings for most users. This is a significant advantage over Betfair’s tiered model, especially for those who don’t bet at the highest volumes. They also have a unique commission model that charges different rates for “making” (placing an unmatched bet) and “taking” (accepting an existing bet).

- Liquidity: While Matchbook’s liquidity has grown considerably, it still can’t compete with Betfair on the largest markets. However, for major sports like football and US sports, its liquidity is often more than sufficient for the average user.

- Interface: Matchbook’s interface is known for its clean and modern design, which is more intuitive for beginners than Betfair’s sometimes-overwhelming layout. It is often praised for its usability on mobile devices.

- Promotions: Matchbook is known for its generous promotions, including 0% commission periods for new users, which can be a massive draw for those looking to try out an exchange without the initial cost.

- Website: https://www.matchbook.com

The Verdict: Betfair vs. Matchbook

Choosing between Betfair and Matchbook comes down to your personal betting style. If you are a high-volume trader or a matched bettor who needs unparalleled liquidity and a vast number of markets, Betfair is the clear choice. Its depth allows for complex strategies and larger stakes. However, if you are a more casual bettor or a trader who wants a simpler interface and a lower, more transparent commission rate, Matchbook is an excellent alternative. The money you save on commission can often outweigh the slightly lower liquidity.

The Next Tier: Other Contenders in the Exchange Market

While Betfair and Matchbook are the dominant forces, other exchanges have carved out their own niches and are well worth considering.

1. Smarkets

Smarkets has built a strong reputation as a user-friendly and highly competitive exchange.

- Commission: Smarkets is a major competitor on commission, offering a flat 2% on net winnings. This flat rate is a significant selling point, making it easy to calculate your potential returns. They also run promotions, including 0% commission for new customers for a set period.

- Interface: Smarkets is famous for its clean, minimalist interface, which is arguably the best in the business. It’s designed for efficiency and is highly responsive, especially on its mobile app.

- Liquidity: While not at Betfair’s level, Smarkets has strong liquidity in key markets, particularly football and politics. It’s a great option for those who primarily bet on these events.

- Website: https://smarkets.com

2. BETDAQ

Owned by Ladbrokes Coral, BETDAQ is the second-largest betting exchange and a reliable alternative.

- Commission: BETDAQ offers a flat 2% commission on net winnings for most users, making it a viable alternative to Betfair.

- Market Coverage: BETDAQ has a strong focus on horse racing, often providing competitive liquidity for UK and Irish races. It also covers a good range of football and other major sports.

- Unique Features: One of BETDAQ’s standout features is its “Exchange Multiples,” which allows users to combine multiple selections into a single bet, a feature not commonly found on other exchanges.

- Website: https://www.betdaq.com

3. The Rising Star: easyBet

easyBet is one of the newer players in the market.

- Commission: easyBet has a flat 2% commission on winning bets, which is in line with Smarkets and BETDAQ.

- Platform: As a new entrant, easyBet has a modern platform that is easy to navigate. It is quickly building its user base and liquidity.

- Website: https://www.easybet.net

A Comparative Look at Commission Structures

To provide a clear overview of how the various exchanges stack up on fees, here is a comparison table. It’s important to remember that these are general rates and can be subject to change, regional differences, or special promotions.

| Exchange | Standard Commission Rate | Key Fee Notes |

| Betfair | Tiered, starting at 5% | Commission rate can be reduced with “Betfair Points.” The controversial “Premium Charge” can be applied to highly profitable accounts. |

| Matchbook | Flat 2% on net winnings | A straightforward, flat rate that appeals to bettors seeking low costs. No “Premium Charge” like Betfair. |

| Smarkets | Flat 2% on net winnings | Simple and transparent commission structure. Has a “Select Tier” of 3% for a very small number of the most profitable users. |

| BETDAQ | Flat 2% on net winnings | A very competitive flat rate, making it a strong alternative to the bigger players. |

| easyBet | Flat 2% on winning bets | As a newer exchange, it’s positioning itself as a low-cost, easy-to-use platform. |

Conclusion: The Future of Betting is Peer-to-Peer

The comparison of sports exchanges reveals a vibrant and competitive landscape. Betfair, with its unmatched liquidity and extensive market coverage, remains the go-to for serious traders and professionals. Matchbook, Smarkets, and BETDAQ offer compelling alternatives, each with its own strengths—whether it’s lower commission, a superior user interface, or a focus on specific sports.

For the modern bettor, the choice between a traditional bookmaker and a betting exchange is clear. Exchanges offer superior odds, increased control, and the potential to truly “trade” your position. They eliminate the bookmaker’s margin and welcome winning players rather than restricting them.

As the industry continues to grow and more platforms emerge, the competition will only benefit the user. The power is shifting from the house to the individual, and in this new era of peer-to-peer betting, the informed and strategic bettor is the one who will win.

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Betfair Trading Strategies: The Ultimate 2026 Guide to Football Betting Automation

Executive Summary: The Era of the Algorithmic Trader The year 2026 marks a turning point for the Betfair Exchange. The…

Dutching Betting Strategy Guide (2026): Includes Free Excel Calculator & Automation Tools

We’ve all been there. You stare at the race card, torn between the 3/1 favourite who looks solid and the…

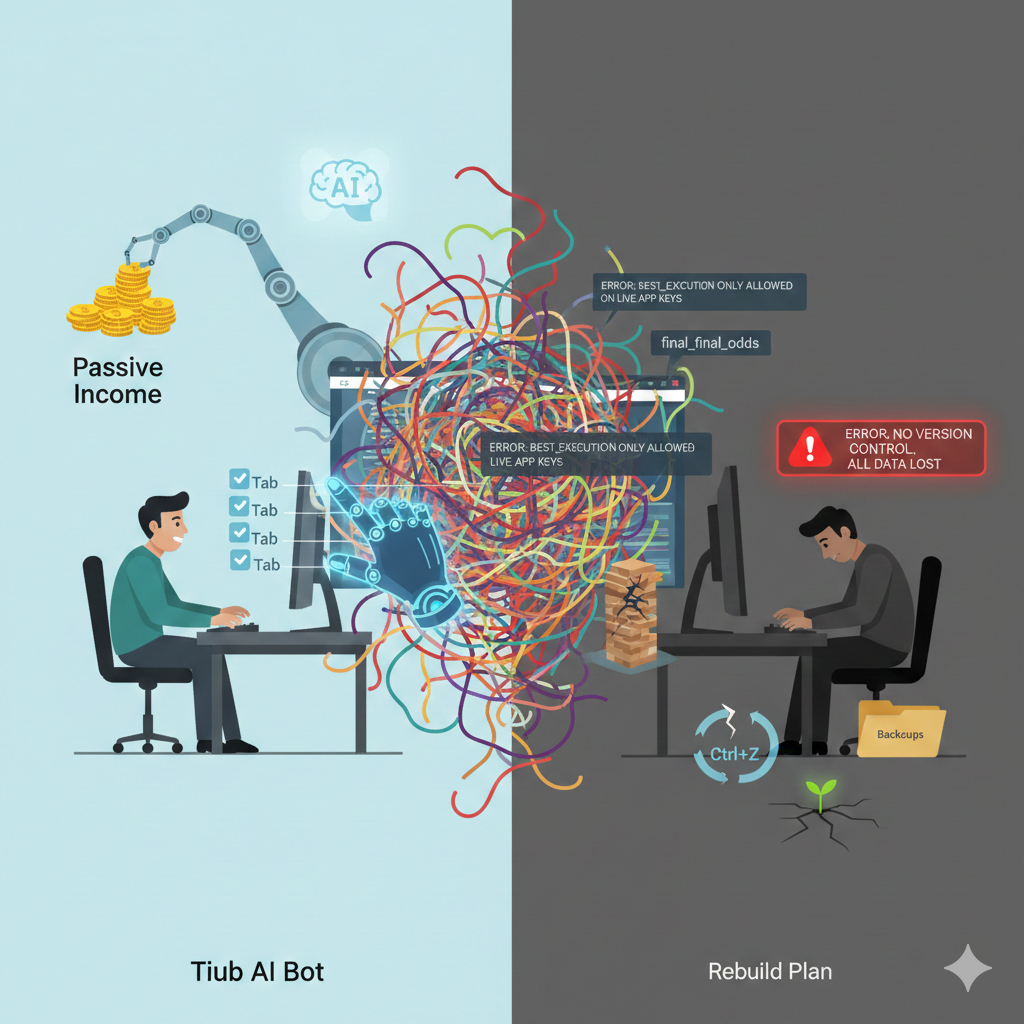

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

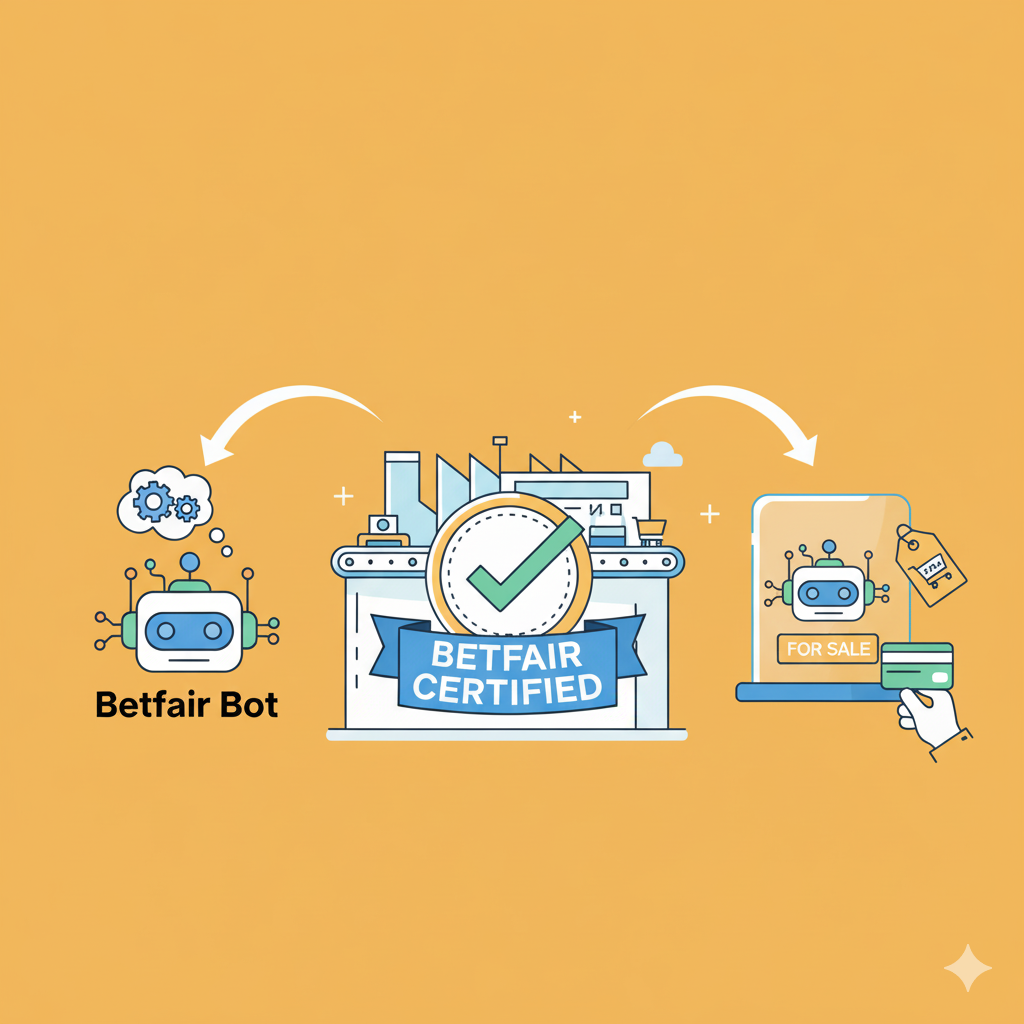

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of…

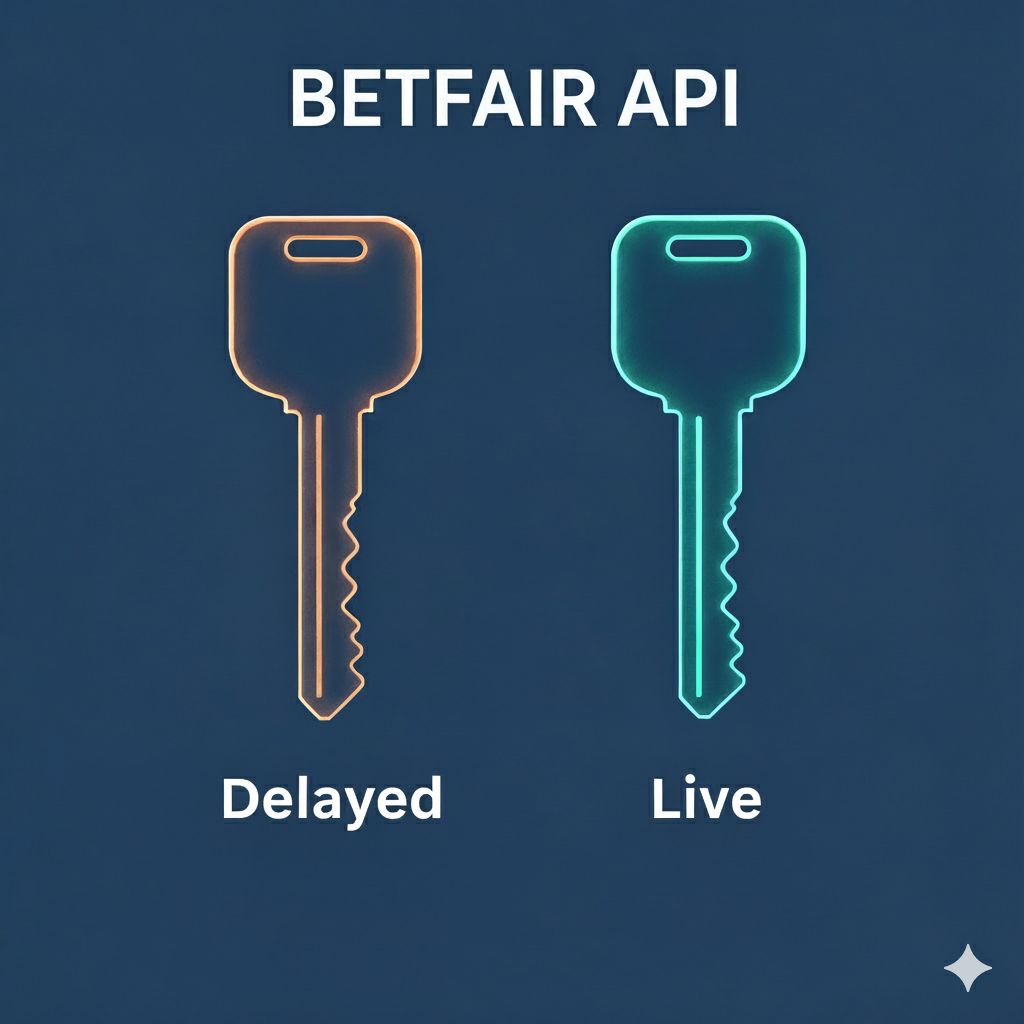

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge…