Welcome to the world of Pine Script, where trading strategies meet coding creativity! If you’re a beginner looking to build your skills in scripting for financial markets, you’ve arrived at the perfect starting point. Pine Script, developed by TradingView, is a powerful tool that combines technical analysis with the ease of programming, allowing traders to craft custom indicators and strategies tailored to their unique trading styles.

In this comprehensive tutorial, we’ll walk you through the foundational concepts of Pine Script, from basic syntax to advanced functions. By the end of this journey, you’ll not only grasp the essentials but also gain the confidence to analyze markets like never before. Whether you dream of developing your own trading bots or simply wish to enhance your analysis, mastering Pine Script will place you on a path to trading success. Let’s dive in and unlock the potential of your trading ambitions! 🚀

Understanding the Basics of Trading and Technical Analysis

Before diving into Pine Script, it’s essential to grasp the foundational concepts of trading and technical analysis. Trading involves buying and selling assets like stocks or currencies to make a profit. To predict future price movements, many traders use technical analysis, which involves studying historical price data and volume to identify patterns and trends. It relies on the belief that price movements are not random but follow identifiable patterns that repeat over time.

Technical analysts use a variety of tools, with the price chart being the most fundamental. It visually represents an asset’s price movements over a specific period.

Common chart types include:

- Line charts: Connect closing prices to show the general price trend.

- Bar charts: Show the open, high, low, and close prices for each period.

- Candlestick charts: Also show the open, high, low, and close, but do so in a more visual format that is highly favored by traders for identifying patterns.

Here’s an example of what a typical candlestick chart looks like:

In addition to charts, analysts use indicators—mathematical calculations based on price and volume. Popular indicators include Moving Averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). These tools help traders identify trends, momentum, and potential reversal points. Understanding these basics is crucial as they form the foundation upon which Pine Script builds its powerful capabilities.

Setting Up Your TradingView Account

To begin your journey, you’ll need a TradingView account. TradingView is a leading charting platform and provides the integrated environment where you will write and test your Pine Scripts. Setting up an account is straightforward and free.

Simply visit the TradingView website and sign up. While premium plans offer advanced features, the free account provides all the functionality you need to learn and build powerful scripts.

Once your account is created, take a moment to explore the interface. You can create chart layouts, add assets to your watchlist, and access a wide range of drawing tools and indicators. Familiarizing yourself with the platform will make your scripting journey much smoother.

Here’s a glimpse of the TradingView charting interface:

Exploring the Pine Script Environment

Now that you have your TradingView account, it’s time to get started with Pine Script. The great news is that there’s no installation required—Pine Script is built directly into the TradingView platform.

To access it, open a chart for any asset and click on the “Pine Editor” tab at the bottom of the screen. This will open the editor where you can write, edit, and test your scripts.

This is what the Pine Editor looks like within TradingView:

The Pine Editor is a user-friendly environment with features like syntax highlighting and auto-completion. It also includes a comprehensive documentation and reference guide, which is an invaluable resource for understanding the various functions available.

Key Features of Pine Script: Functions, Variables, and Data Types

Pine Script is a lightweight language designed specifically for trading. Its syntax is straightforward, revolving around three core components: functions, variables, and data types.

- Functions are the building blocks of Pine Script, used to perform specific calculations. Pine Script has many built-in functions, like

ta.sma()to calculate a Simple Moving Average orplot()to display data on the chart. - Variables are used to store and manage data. You define a variable that recalculates on every bar simply by assigning it a value, like

myPrice = close. Pine Script also has a specialvarkeyword, which is used to declare a variable that should be initialized only once (on the first bar) and maintain its state between bars. This is a more advanced concept you’ll encounter later. - Data Types define the kind of values a variable can hold, such as

intfor integers,floatfor decimal numbers,boolfor true/false values, andstringfor text.

Mastering these three components is essential for writing powerful and flexible Pine Script code.

Writing Your First Pine Script: A Step-by-Step Guide

Let’s create a simple moving average crossover strategy. This strategy uses two moving averages (a fast one and a slow one) and generates signals when they cross.

Step 1: Open the Pine Editor in TradingView and click “Open” -> “New indicator”. This will create a new script with some default code, which you can delete.

Step 2: Copy and paste the code below into the editor. The comments in the code explain what each line does.

Pine Script

//@version=5

indicator("My First Moving Average Crossover", overlay=true)

// Step 1: Define user inputs for the moving average lengths.

// This allows us to easily change the settings from the chart.

shortMaLength = input.int(9, title="Short MA Length")

longMaLength = input.int(21, title="Long MA Length")

// Step 2: Calculate the moving averages using the 'close' price.

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Step 3: Plot the moving averages on the chart.

plot(shortMa, color=color.new(color.blue, 0), title="Short MA")

plot(longMa, color=color.new(color.red, 0), title="Long MA")

// Step 4: Define the crossover conditions.

// ta.crossover() returns true on the bar where the first series crosses above the second.

buySignal = ta.crossover(shortMa, longMa)

// ta.crossunder() returns true on the bar where the first series crosses below the second.

sellSignal = ta.crossunder(shortMa, longMa)

// Step 5: Plot shapes on the chart to mark the signals.

plotshape(series=buySignal, location=location.belowbar, color=color.new(color.green, 0), style=shape.labelup, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, title="Sell Signal")

Step 3: Click the “Save” button, give your script a name, and then click “Add to Chart.”

Congratulations! You should now see the moving averages and the buy/sell signals on your chart. This script is a fantastic foundation for exploring more complex ideas.

Common Pine Script Strategies for Beginners

As a beginner, it’s helpful to start with common strategies that are widely used in trading. These serve as excellent learning tools.

- The Moving Average Crossover: The strategy we just built. It’s a simple trend-following system that works well in markets with clear directional movement.

- The RSI Strategy: This uses the Relative Strength Index (RSI) to identify overbought (often above 70) and oversold (often below 30) conditions. A common strategy generates buy signals when the RSI moves out of oversold territory and sell signals when it moves out of overbought territory.

- The MACD Strategy: The Moving Average Convergence Divergence (MACD) strategy uses two lines—the MACD line and the signal line—to identify momentum. A buy signal is often generated when the MACD line crosses above the signal line, and a sell signal is generated when it crosses below.

By studying and building these strategies, you can gain a deeper understanding of how indicators and signals work in Pine Script.

Debugging and Testing Your Pine Scripts

Debugging and testing are crucial steps to ensure your scripts are accurate and reliable.

- Visual Debugging: The

plot()function is your best friend. You can plot any variable at any stage of your calculation to visually confirm on the chart that it’s behaving as you expect. - Logging: To see the exact value of a variable on each bar, use the

log.info()function. This will print messages and variable values to the “Pine Logs” tab in the editor, which is invaluable for tracing complex logic. - Backtesting: This involves running your script on historical data to evaluate its past performance. Pine Script has a built-in Strategy Tester that allows you to simulate trades and review metrics like net profit, win rate, and drawdown. This helps you understand how a strategy might have performed historically.

- Forward Testing: This involves applying your script to live market data to see how it performs in real-time. TradingView’s paper trading feature is perfect for this, allowing you to simulate trades without risking real capital.

Following these practices will help you develop robust and reliable scripts, giving you confidence in your trading tools.

Advanced Pine Script Techniques: Custom Indicators and Alerts

Once you’ve mastered the basics, you can create fully custom indicators and alerts.

Custom indicators allow you to develop your own analytical tools. You can combine existing indicators, apply complex mathematical formulas, and create unique visualizations tailored to your trading style.

Alerts are notifications that trigger when specific conditions are met. Using the alertcondition() function, you can create an alert for any event, such as a moving average crossover or an RSI level being breached. These alerts can be sent to your phone or email, ensuring you never miss a potential trading opportunity.

Here’s an example of a simple custom indicator that plots three moving averages and colors them based on whether the trend is bullish or bearish.

Pine Script

//@version=5

indicator("Custom Multi-MA Trend Indicator", overlay=true)

// Define input parameters for the moving averages

shortMaLength = input.int(9, title="Short MA Length")

mediumMaLength = input.int(21, title="Medium MA Length")

longMaLength = input.int(50, title="Long MA Length")

// Calculate the moving averages

shortMa = ta.sma(close, shortMaLength)

mediumMa = ta.sma(close, mediumMaLength)

longMa = ta.sma(close, longMaLength)

// Determine the color based on the trend.

// We check if MAs are stacked bullishly (short > medium > long).

isBullish = shortMa > mediumMa and mediumMa > longMa

isBearish = shortMa < mediumMa and mediumMa < longMa

maColor = isBullish ? color.green : isBearish ? color.red : color.gray

// Plot the moving averages with the dynamic color

plot(shortMa, color=maColor, title="Short MA", linewidth=2)

plot(mediumMa, color=maColor, title="Medium MA", linewidth=2)

plot(longMa, color=maColor, title="Long MA", linewidth=2)

Conclusion: Your Journey Forward

You’ve now walked through the entire process of creating trading tools with Pine Script—from understanding the basics to writing, testing, and even creating advanced custom indicators. You have a solid foundation to build upon.

The key to success is continuous learning and practice. Don’t be afraid to experiment. Modify the scripts in this tutorial, try combining different indicators, and explore the extensive Pine Script documentation. The TradingView community scripts are also a fantastic resource for learning from other developers.

Happy scripting, and may your trading journey be a successful one!

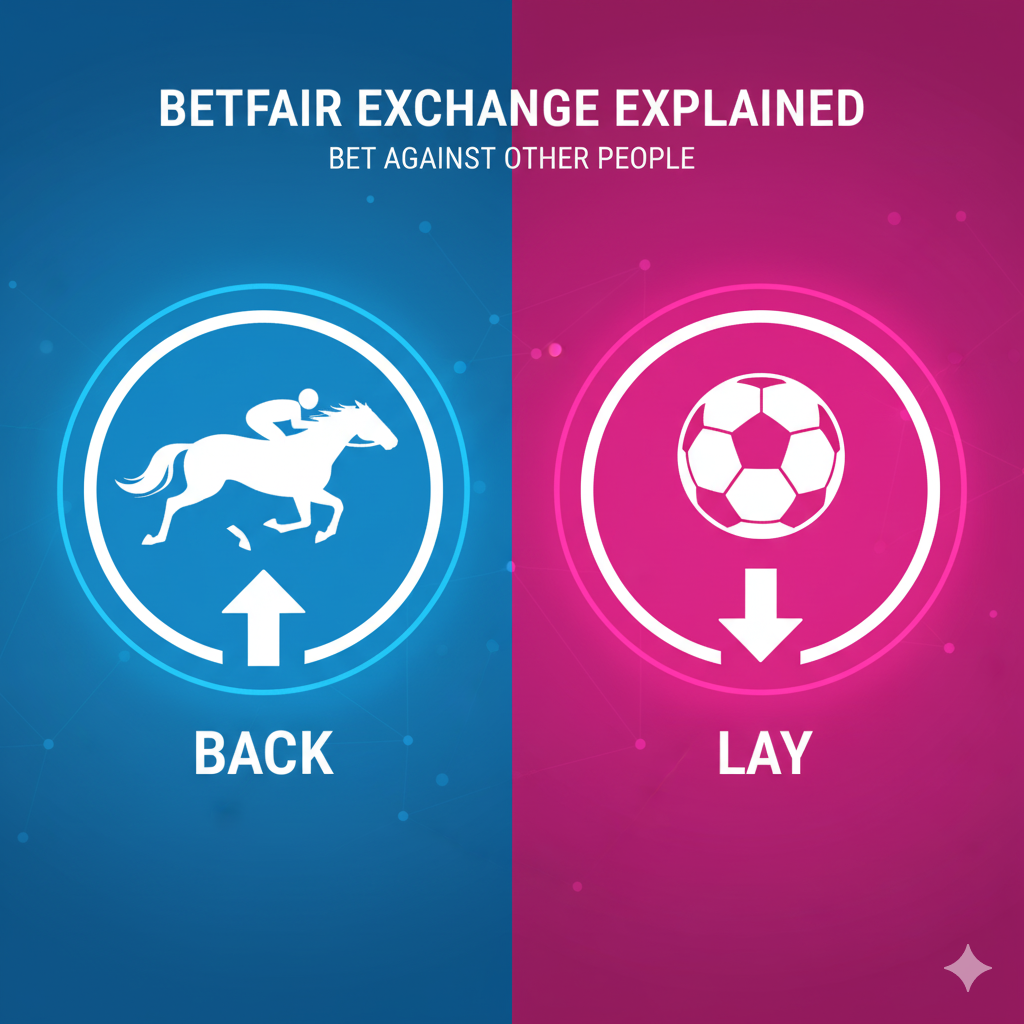

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Betfair Trading Strategies: The Ultimate 2026 Guide to Football Betting Automation

Executive Summary: The Era of the Algorithmic Trader The year 2026 marks a turning point for the Betfair Exchange. The…

Dutching Betting Strategy Guide (2026): Includes Free Excel Calculator & Automation Tools

We’ve all been there. You stare at the race card, torn between the 3/1 favourite who looks solid and the…

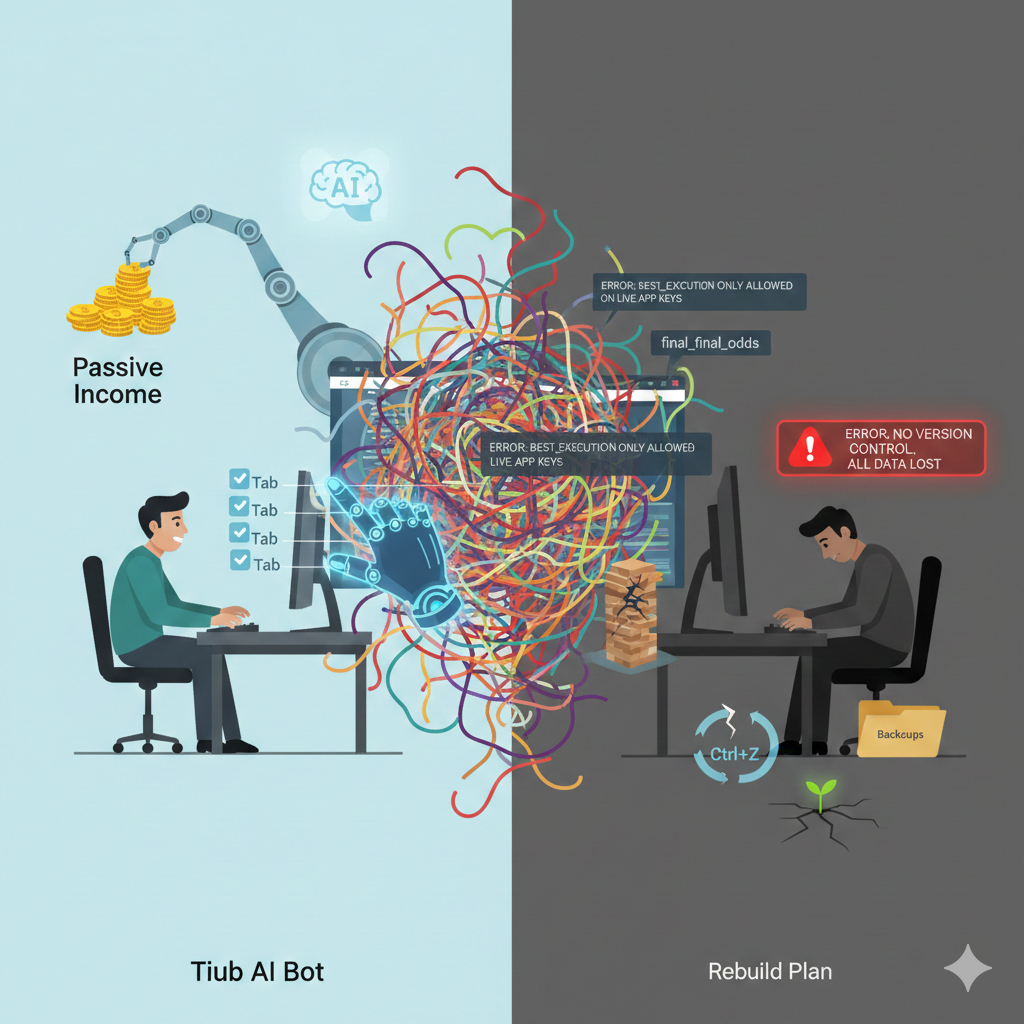

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

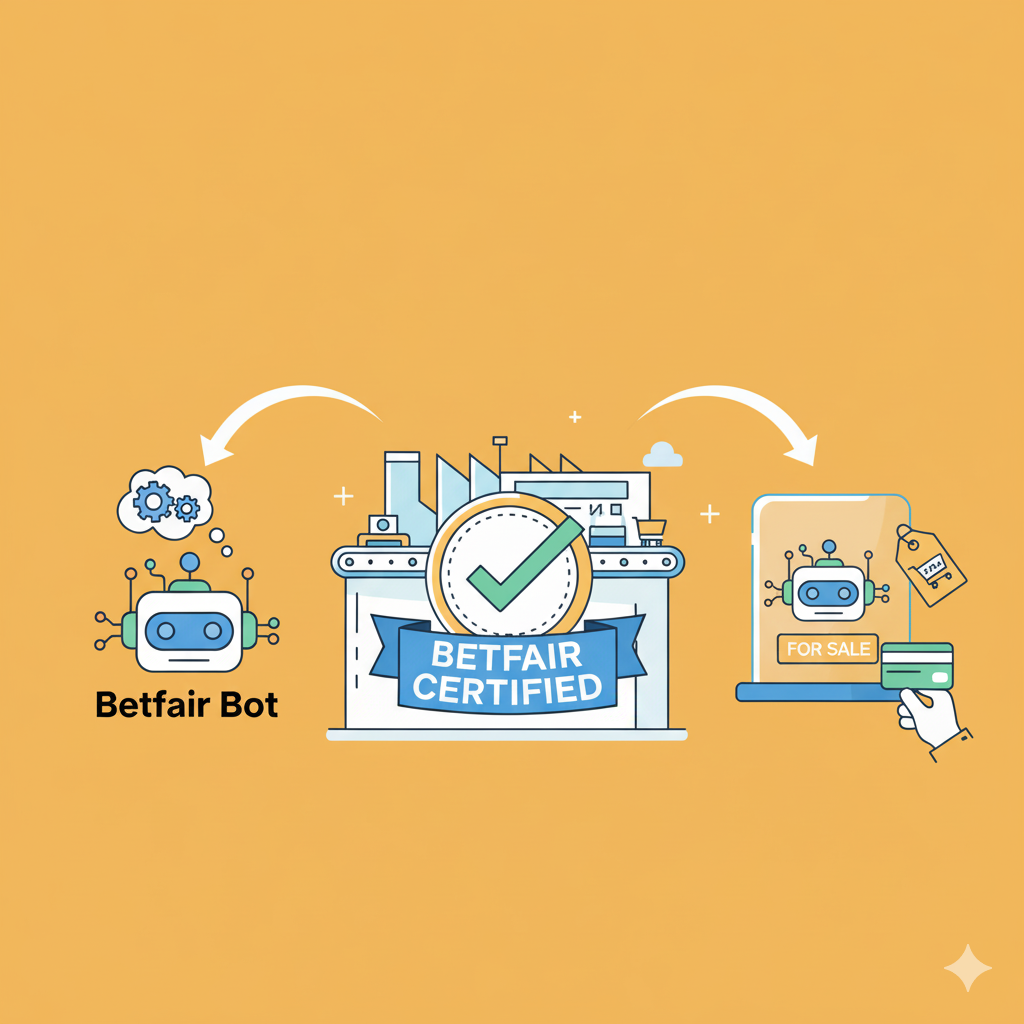

How to Get Your Betfair Bot Certified and Ready to Sell

So, you’ve done it. You’ve spent countless hours coding, testing, and perfecting a Betfair bot. It’s a powerful piece of…

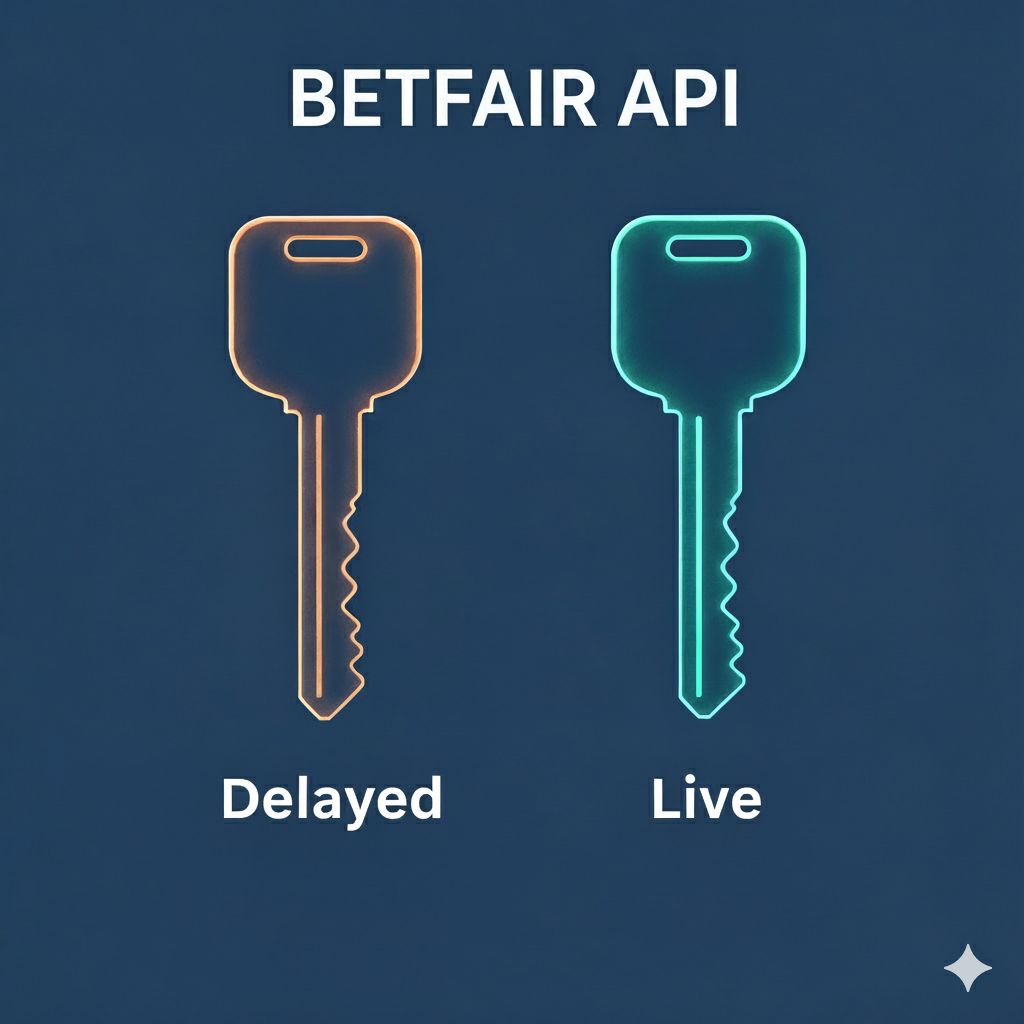

Betfair API Key: Delayed vs. Live Explained (The £299 Cost for Real-Time Trading)

Introduction: The Speed Barrier in Automated Betting If you’re developing a Betfair bot, you’re searching for an edge. That edge…