Executive Summary for UK Traders

TradeSanta is a user-friendly, cloud-based platform that actively automates cryptocurrency trading strategies. It is particularly well-suited for beginner and intermediate UK traders because of its intuitive interface, helpful templates, and relatively affordable entry price points. Crucially, as with any crypto bot, it remains a high-risk tool not regulated by the UK’s Financial Consult Authority (FCA). Consequently, traders must actively account for all bot-generated profits, which are potentially subject to UK Capital Gains Tax (CGT).

⚡️ READY TO START?

Test your strategies risk-free today with TradeSanta’s Paper Trading Mode.

1. What is TradeSanta?

TradeSanta operates as a non-custodial software service, connecting to major global cryptocurrency exchanges (including Binance, Coinbase, and Kraken) via API keys. This connection allows users to set up and run automated trading bots 24/7 without needing constant market monitoring.

Importantly, TradeSanta simplifies the setup process for common algorithmic strategies, making advanced trading tools accessible even to those who might find competitors overly complex. Critically, because the platform is non-custodial, it only has permission to execute trades—it cannot withdraw funds from your connected exchange account.

2. Key Features and Bots

TradeSanta excels by straightforwardly implementing proven market strategies, often providing templates that expedite setup:

a) DCA (Dollar-Cost Averaging) Bots

These bots execute staggered buy or sell orders. This smooths out volatility and improves the average entry or exit price of an asset. Traders favour them for use in volatile or trending markets.

b) Grid Bots (Long and Short)

Grid Bots profit from sideways or ranging markets. They place a network of simultaneous buy and sell limit orders at incremental price levels. The bot automatically executes trades as the price moves up and down within the set range.

c) Martingale Strategy and Risk Management

TradeSanta includes a Martingale setting. This automatically increases the volume of ‘Extra Orders’ after a trade moves against the bot’s prediction. The aim is to recover losses and capture profit more quickly when the price reverses.

⚠️ Warning: This strategy dramatically increases risk and capital exposure. Since it is highly aggressive, beginners should approach it with extreme caution.

Martingale Safetly Tips:

- Multiplier: Use a lower position multiplier (e.g., 1.1x – 1.2x) instead of the maximum (2.0x).

- Stop Loss: Always use a hard stop loss with Martingale to prevent capital erosion during prolonged market crashes.

- Capital Allocation: Only allocate a small fraction of your portfolio to any Martingale bot.

d) Virtual Bots (Paper Trading)

An essential feature for UK beginners is Virtual Bots. These allow you to test and refine your trading strategies using simulated funds in real-time market conditions, providing a risk-free environment before deploying real capital.

e) TradingView Integration

The platform facilitates integration with TradingView. Specifically, users can receive signals directly from custom indicators or alerts and automatically trigger bot actions. This capability adds a layer of advanced customisation for experienced users.

3. Regulatory and Tax Considerations for the UK

UK users must prioritize compliance and risk management when utilising any external trading tool.

| Consideration | Detail for UK Residents |

|---|---|

| FCA Regulation | TradeSanta is NOT regulated by the FCA. It operates solely as a technology provider. Connecting funds to the service means the Financial Services Compensation Scheme (FSCS) does not protect them. |

| Risk Warning | Automated trading carries an extremely high risk. Bots, especially those utilising Martingale or high leverage, can quickly lose significant capital, particularly in fast-moving, unexpected market events. Only invest what you can afford to lose. |

| Capital Gains Tax (CGT) | Every single trade executed by a TradeSanta bot constitutes a taxable event (a disposal). Users must actively track all trades (entries, exits, and profits/losses) and report them annually to HMRC for CGT assessment. |

| Tax Simplification | Traders generating hundreds or thousands of trades should use specialized crypto tax software (e.g., Koinly, Accointing) to automate the complex CGT calculations required by HMRC. |

| Exchange Compliance | Always ensure that the specific crypto exchange connected to TradeSanta legally serves UK residents and meets all UK anti-money laundering (AML) requirements, even if the exchange itself is FCA-registered. |

4. User Experience and Pricing

Ease of Use

TradeSanta features an approachable and intuitive design. Because of this focus on simplicity, analysts often cite it as being more beginner-friendly than some competitors. The platform provides pre-set strategy templates and clear explanations, effectively making the initial learning curve shallower. However, running profitable bots still requires a solid understanding of market fundamentals and technical indicators.

Pricing Structure

TradeSanta offers a competitive, tiered subscription structure, typically billed in USD:

- Free Trial: This is generally a 3- to 5-day trial providing full access to test features.

- Basic Plan: An affordable entry level plan, suitable for running a limited number of bots (often up to 49) and basic strategies.

- Advanced Plan: This offers more bot capacity and includes features like Trailing Stop Loss and potentially futures trading access.

- Maximum Plan: This plan provides unlimited bot capacity for high-volume or highly diversified traders.

4.5 API Key Security Best Practices

Since your API keys grant TradeSanta trading access to your funds, securing them is non-negotiable. Follow these steps:

- Restrict Permissions: When creating the API key on your exchange, NEVER enable the withdrawal permission. Only grant rights for reading account data and placing orders.

- IP Allowlist: After connecting to TradeSanta, the platform provides a list of secure IP addresses. Always copy and paste this list back into your exchange’s API settings to restrict access to trusted IPs only. This prevents unauthorized use if your key is leaked.

- Rotation: Treat your API keys like passwords. Change them periodically (every 60–90 days) to minimize risk.

- 2FA: Enable two-factor authentication (2FA) on both your TradeSanta account and your connected exchange account.

5. Comparative Analysis: TradeSanta vs. 3Commas

When UK traders evaluate automated solutions, TradeSanta and 3Commas consistently appear as top contenders. They appeal to different user needs based on complexity and customization.

| Feature | TradeSanta (TS) | 3Commas (3C) | Key Differentiator |

|---|---|---|---|

| Target User | Beginner / Budget-Conscious | Intermediate / Advanced | TS prioritises simplicity ✅. |

| Bot Variety | DCA, Grid, Smart Orders (Limited) | DCA, Grid, Options, HODL, Composite | 3C offers significantly more complex bot types. 📈 |

| Manual Trading Terminal | Basic Trading Interface | SmartTrade Terminal (Advanced SL/TP, Trailing) | 3C’s terminal offers professional-grade order management. 💻 |

| Strategy Validation | Paper Trading Only (❌ No Backtesting) | Comprehensive Backtesting Included (✅) | 3C allows users to test strategies on historical data. |

| Pricing | Lower entry price (starts ∼$14/month) | Higher starting price (starts ∼$22/month) | TS is typically more budget-friendly at entry level. 💰 |

| Exchange Support | Fewer exchanges supported (typically <10) | Wider exchange support (typically >20) | 3C offers better multi-exchange diversity. 🌐 |

6. Market and Media Sentiment (Pros & Cons)

Reputable press and experienced traders consistently position TradeSanta as an effective, low-barrier-to-entry tool, best suited for users who prioritise simplicity and affordability over extreme customization.

| Aspect | Pros (Strengths) | Cons (Weaknesses) |

|---|---|---|

| Accessibility | ✅ User-Friendly Interface for beginners. | ❌ Simplistic interface lacks advanced customization. |

| Cost | ✅ Very affordable and budget-conscious entry plans. | ❌ Mobile app experience is sometimes buggy. |

| Strategy | ✅ Excellent execution; removes emotional trading. | ❌ Lacks comprehensive built-in Backtesting. |

| Tools | ✅ Strong DCA and Grid bots. | ❌ Limited overall bot diversity compared to rivals. |

Mitigating Drawbacks: Strategy Testing and Mobile Access

TradeSanta’s biggest critical points revolve around the lack of built-in backtesting and reports of a sometimes-buggy mobile app. Prudent traders must plan around these limitations:

- Testing Workaround: Since the platform does not include built-in backtesting (the ability to test a strategy on historical price data), prudent traders must use the Virtual Bots (Paper Trading) for an extended period (e.g., 30-90 days) for forward testing. Alternatively, users can design and backtest strategies externally using tools like TradingView’s strategy tester, then manually apply those parameters to their live TradeSanta bots.

- Mobile Use: While the web interface is excellent, if you rely on constant mobile monitoring, always confirm the latest app version reviews for stability before committing to a paid plan.

- Focus on Simplicity: Analysts frequently highlight TradeSanta’s user-friendly interface and pre-configured bot templates as its biggest advantage. This focus makes it highly accessible to beginners or those transitioning from traditional finance.

- Quote: “TradeSanta is designed for those who want consistency without complications… Its automation tools help users manage risk efficiently, while the interface keeps the experience straightforward.” (Finextra)

- Quote: “The main reason why TradeSanta looks outstanding in the crypto market is the variety of automated trading options it offers… this platform makes the process simple, fast, and beginner-friendly.” (BitCourier)

- Budget-Friendly: Reviewers consistently rate TradeSanta as one of the most affordable bot platforms compared to rivals like 3Commas or Bitsgap, making it a popular choice for budget-conscious traders.

- Execution over Strategy: Expert reviews confirm that the platform excels at executing trades according to the user’s plan. Consequently, the bot effectively removes the emotional factor (fear and greed) that often hinders human traders.

- Quote: “What TradeSanta does well is execution—it sticks to your plan without hesitation, no emotions, no second-guessing. That’s where humans usually mess up.” (IEAGreen.co.uk)

Performance Snapshot

(Note: When publishing this article, consider adding a screenshot or simulated chart here showing a 30-day performance summary from a simple Grid Bot running on a volatile pair.)

7. Example Bot Strategies with Setup Guide

Traders commonly use these two strategies as starting points on the TradeSanta platform. Therefore, always test them using Virtual Bots (Paper Trading) before deploying real funds.

Strategy A: DCA Long Bot for Volatile Uplink (Beginner)

This bot buys a cryptocurrency, then places additional ‘Extra Orders’ (buys) on small dips to lower the average entry price. Ultimately, it aims for a single, overall profitable sale.

| Parameter | Recommended Setting | Rationale |

|---|---|---|

| Strategy Type | DCA Long | Best for assets you believe will trend upward long-term. |

| Indicator Signal | RSI below 40 | Waits for the asset to be slightly oversold for entry. |

| Initial Order (IO) | Market/Limit Buy | This opens the first position. |

| Take Profit (TP) | 1.5% – 2.5% | This sets the target profit margin on the total volume of accumulated coins. |

| Number of Extra Orders (EO) | 5 to 8 | This determines how many dips the bot will try to catch. |

| Step of Extra Order | 3.0%−4.0% | This is the percentage drop required after the previous order for a new EO to be placed. |

| Martingale | Disabled (or Low Factor) | Keep risk low while learning; Martingale dramatically increases exposure. |

| Stop Loss | Set at 15% – 20% | This provides a crucial safety net to prevent catastrophic losses if the asset crashes. |

Goal: If the price drops by 3% after the IO, the bot buys more, effectively lowering your average price. Once the price recovers and hits the overall 2% TP target, the bot sells all positions.

Strategy B: Grid Bot for Ranging Market (Intermediate)

This bot excels in sideways markets where the price oscillates between two defined boundaries. It profits by repeatedly buying at the bottom of the range and selling at the top.

| Parameter | Recommended Setting | Rationale |

|---|---|---|

| Strategy Type | Grid Bot (Long) | This optimises the bot for frequent, small gains within a price channel. |

| Indicator Signal | Bollinger Bands | Best used when the price is consistently moving between the upper and lower bands. |

| Take Profit (TP) | 0.8% – 1.2% | Set a small profit margin for high frequency of trades. |

| Grid Quantity | 10 to 20 | A higher quantity means tighter spacing and more trade opportunities. |

| Lower/Upper Limit | Define based on 7-day support/resistance | Set the boundaries of the price channel where you expect oscillation. |

| Stop Loss | Placed just outside the Lower Limit | If the price breaks support, the bot exits to protect capital. |

| Use Martingale | Disabled | Martingale can be volatile when combined with Grid strategies. |

Goal: The bot places a grid of buy and sell orders across the defined range. As the price bounces up and down, buy orders are filled at the lower levels, and corresponding sell orders are executed at the higher levels, locking in small, continuous profits.

8. Your Safety Checklist: Important UK Information

We want to empower you to trade responsibly. Before starting any automated trading, please treat the following information not as complex legal jargon, but as your essential safety checklist.

DISCLOSURE & ADVICE

This review is for educational and informational purposes only. It does not provide financial, investment, or tax advice. Always consult an independent, regulated professional regarding your personal financial situation and goals.

🇬🇧 UK Regulatory Status: What You Must Know

Automated crypto trading, including platforms like TradeSanta, operates outside the UK’s regulated financial framework.

- ❌ No FCA Regulation: The Financial Conduct Authority (FCA) does not regulate the bot platform itself.

- ❌ No Protection (FSCS): If the market crashes or something goes wrong, the Financial Services Compensation Scheme (FSCS) will not protect your invested capital.

- ❌ No Complaints Service (FOS): You cannot escalate complaints to the Financial Ombudsman Service (FOS) regarding bot performance or losses.

- ⚠️ High Risk Reminder: Crypto prices are extremely volatile. Be prepared for the possibility of losing all the money you allocate to automated trading.

🧾 UK Tax Responsibilities (HMRC)

You handle your profits, and you handle your tax reporting.

- Tax Responsibility: As a UK trader, you are personally and solely responsible for accurately calculating and paying all applicable UK taxes, including Capital Gains Tax (CGT), on profits generated by your bot.

- Record Keeping: Automated trading generates many transactions. Meticulous record-keeping for every single trade—entry, exit, profit, and loss—is mandatory for accurate HMRC reporting.

- Tax Automation Tip: Consider using specialized crypto tax software (e.g., Koinly, Accointing) that connects directly to your exchanges via API to automate the tracking and calculation of thousands of bot trades for your annual self-assessment.

9. Quick-Reference FAQ

| Question | Answer |

|---|---|

| What is the minimum investment for TradeSanta? | There is no platform-set minimum, but your connected exchange may impose minimum order sizes (usually around ∼$10 to ∼$20). |

| Does the bot hold my funds? | No. TradeSanta is non-custodial. Your funds always remain secure on your connected crypto exchange account. The bot only executes trades using API keys. |

| Can I use this on my phone? | Yes, TradeSanta offers both iOS and Android apps for monitoring. However, most complex bot setup is best done via the more stable web interface. |

| Does TradeSanta offer backtesting? | No. The platform only offers Virtual Bots (Paper Trading) for forward testing in real-time. It does not allow testing strategies against historical price data. |

10. Final Verdict

Verdict: TradeSanta is an excellent entry point for automated crypto trading.

For the UK trader seeking simplicity and ease of access to robust automation strategies (DCA and Grid), TradeSanta is a strong contender. Its intuitive design and paper trading feature make it a safer environment for new users to start testing.

However, users must fully appreciate the extreme market risks, the lack of UK regulatory oversight, and the ongoing obligation to manage and report every automated trade for UK tax purposes (CGT). Starting with the Virtual Bots is non-negotiable.

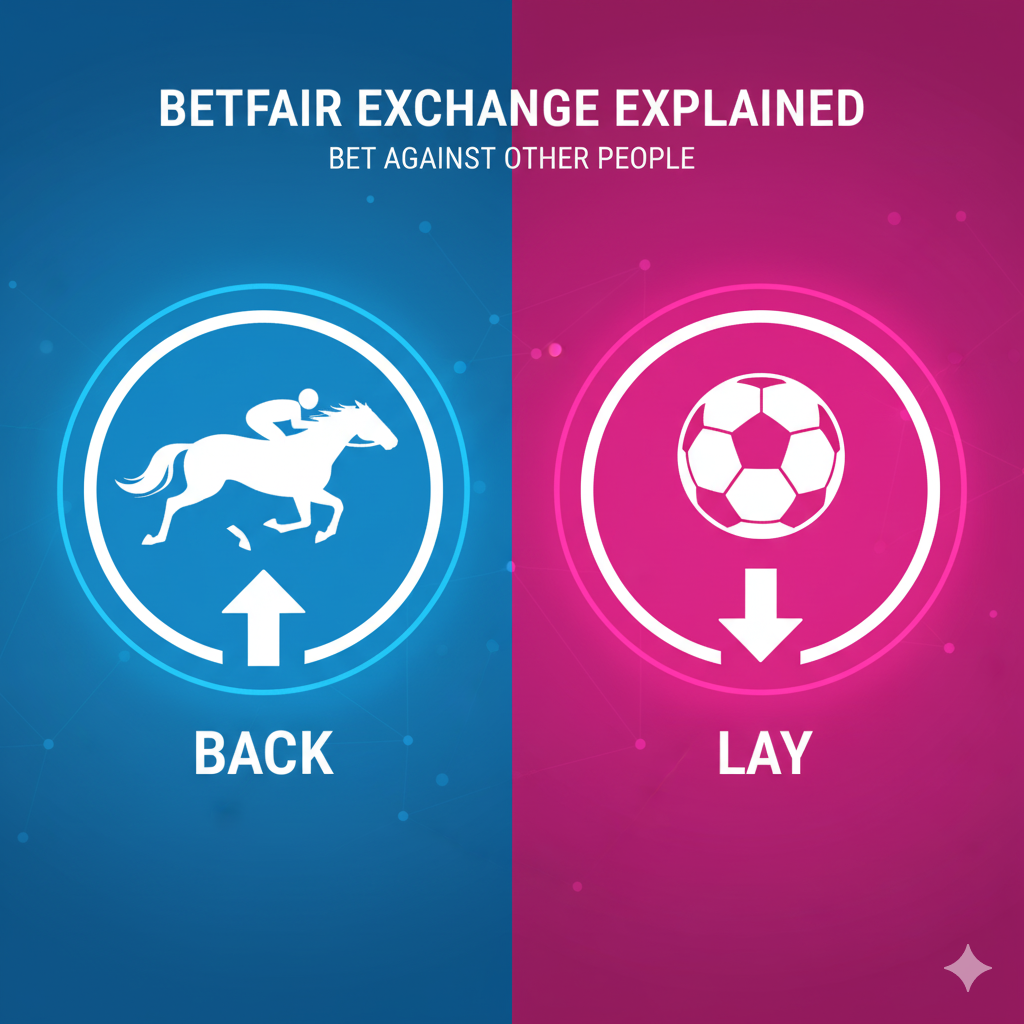

Betfair Bot Reviews: Which One Suits You Best?

Which Automated Betfair bot Trading Software is Right For You? Choosing the best Betfair bot in 2026 can be a…

Building a Betfair Bot with Python & AI: Why I Failed (Case Study)

For years, I have obsessed over the Betfair Exchange. I’ve spent countless hours staring at trading ladders on professional software…

The Ultimate Betfair Trading Guide: History, Strategies

Betfair trading is the secret that professional gamblers don’t want you to know. For decades, the game was rigged. You…

Backtesting Guides

Backtesting Guide — Principles & MarketBook Replay | BotBlog Backtesting guides Published: 2025-11-11 • BotBlog Backtesting Guide — Principles &…

Lesson 7 — Risk management & deployment

Skip to content Lesson 7 — Risk management, hedging & deployment Final crypto lesson: implement hedging/green‑up, enforce risk limits and…

Lesson 6 — Backtesting & simulation (Jupyter)

Skip to content Lesson 6 — Backtesting & simulation (Jupyter) Simulate strategies in Jupyter: load historical ticks/candles, replay data, simulate…

Lesson 5 — Webhooks & Pine alerts

Skip to content Lesson 5 — Webhooks & Pine alerts Build a secure webhook receiver for TradingView Pine alerts, validate…